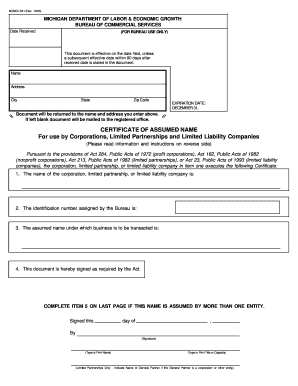

Bcscd 541 Form

What is the Bcscd 541 Form

The Bcscd 541 Form is a specific document used primarily for tax purposes in the United States. It is associated with the reporting of income and deductions for certain business entities, particularly those classified as partnerships or limited liability companies (LLCs). This form is essential for accurately reporting income to the Internal Revenue Service (IRS) and ensuring compliance with federal tax regulations.

How to use the Bcscd 541 Form

Using the Bcscd 541 Form involves several key steps. First, gather all necessary financial information related to the business entity, including income, expenses, and any applicable deductions. Next, fill out the form accurately, ensuring that all required fields are completed. It is crucial to review the form for accuracy before submission to avoid any potential issues with the IRS. Finally, submit the completed form by the designated deadline, either electronically or by mail, based on the preferred submission method.

Steps to complete the Bcscd 541 Form

Completing the Bcscd 541 Form requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents, including income statements and receipts for expenses.

- Access the Bcscd 541 Form through the appropriate channels, such as the IRS website or tax preparation software.

- Fill in the required information, ensuring that all figures are accurate and correspond to your financial records.

- Double-check the form for any errors or omissions.

- Submit the form by the deadline, keeping a copy for your records.

Legal use of the Bcscd 541 Form

The legal use of the Bcscd 541 Form is critical for ensuring compliance with U.S. tax laws. This form must be filled out accurately and submitted on time to avoid penalties. It serves as a formal declaration of income and deductions, which can be reviewed by the IRS for auditing purposes. Failure to use the form correctly can lead to legal consequences, including fines or additional scrutiny of the business's financial activities.

Filing Deadlines / Important Dates

Filing deadlines for the Bcscd 541 Form are crucial for compliance. Typically, the form must be submitted by the due date for the business tax return, which varies depending on the entity type. For partnerships, the deadline is usually March 15, while for LLCs, it may align with the individual tax return deadlines. It is important to stay informed about these dates to avoid late fees and penalties.

Who Issues the Form

The Bcscd 541 Form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines and instructions for completing the form, ensuring that taxpayers have the necessary resources to comply with tax regulations. It is essential to refer to the IRS for the most current version of the form and any updates regarding its use.

Quick guide on how to complete bcscd 541 form

Effortlessly Prepare Bcscd 541 Form on Any Device

Managing documents online has become increasingly popular among companies and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents swiftly without delays. Handle Bcscd 541 Form on any platform with the airSlate SignNow apps for Android or iOS, and enhance any document-focused operation today.

Effortlessly Edit and eSign Bcscd 541 Form

- Locate Bcscd 541 Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method for delivering your form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow satisfies all your document management needs in just a few clicks from any device of your choice. Edit and eSign Bcscd 541 Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bcscd 541 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Bcscd 541 Form?

The Bcscd 541 Form is a specific document that may be required in various administrative processes. It is designed to facilitate the collection of necessary information while ensuring compliance with regulations. Using airSlate SignNow, you can easily manage and electronically sign the Bcscd 541 Form for seamless processing.

-

How does airSlate SignNow help with the Bcscd 541 Form?

airSlate SignNow provides an intuitive platform for creating, sending, and eSigning the Bcscd 541 Form. Our solution simplifies the document workflow, allowing you to collect signatures quickly while maintaining security. This ensures that your Bcscd 541 Form is processed timely and efficiently.

-

What are the pricing options for using airSlate SignNow with the Bcscd 541 Form?

airSlate SignNow offers various pricing plans to accommodate different business needs when handling documents like the Bcscd 541 Form. Each plan includes access to essential features that streamline your eSigning process. Check our pricing page to find the most suitable option for your requirements.

-

Can I integrate airSlate SignNow with other applications for processing the Bcscd 541 Form?

Yes, airSlate SignNow seamlessly integrates with several applications, enhancing your workflow for the Bcscd 541 Form. You can connect it with platforms such as Google Drive, Dropbox, and Salesforce, making it easier to manage documents and signatures across different tools. This integration allows you to optimize your operations and save time.

-

What features does airSlate SignNow offer for the Bcscd 541 Form?

With airSlate SignNow, you get features like customizable templates, automated notifications, and secure digital storage specifically designed for the Bcscd 541 Form. Our platform is user-friendly, allowing your team to create and manage documents with ease. These features enhance productivity and ensure compliance in your signing processes.

-

Is it safe to sign the Bcscd 541 Form using airSlate SignNow?

Absolutely, signing the Bcscd 541 Form with airSlate SignNow is very secure. We utilize industry-leading encryption and authentication measures to protect your information. Our platform complies with legal standards, ensuring that your signed documents are both valid and secure.

-

What benefits can I expect from using airSlate SignNow for the Bcscd 541 Form?

Using airSlate SignNow for the Bcscd 541 Form offers numerous benefits, including time savings, increased workflow efficiency, and reduced paper usage. By digitizing the signing process, you can expedite approvals and track document status in real-time. This results in enhanced productivity for your business.

Get more for Bcscd 541 Form

Find out other Bcscd 541 Form

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe