Omb Form 3245 0407

What is the SBA Form 413?

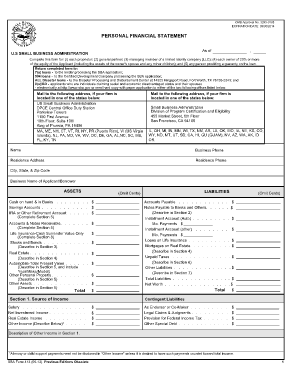

The SBA Form 413, also known as the Personal Financial Statement, is a crucial document used by the Small Business Administration (SBA) for evaluating the financial health of individuals applying for loans or grants. This form collects detailed information about an applicant's assets, liabilities, income, and expenses. It provides a comprehensive overview of an individual's financial situation, which helps lenders assess creditworthiness and determine eligibility for funding. Accurate completion of this form is essential, as it directly impacts the approval process for various SBA loan programs.

How to Use the SBA Form 413

Using the SBA Form 413 involves several steps to ensure that the information provided is accurate and complete. First, gather all necessary financial documents, including bank statements, investment records, and tax returns. Next, fill out the form by detailing your assets, such as cash, real estate, and personal property, along with your liabilities, including loans and credit card debts. It is important to provide truthful and precise figures to avoid complications during the loan approval process. Once completed, the form should be submitted alongside your loan application to the appropriate SBA lender.

Steps to Complete the SBA Form 413

Completing the SBA Form 413 requires a systematic approach to ensure all information is accurately reported. Follow these steps:

- Gather financial documents: Collect all relevant financial information, including income statements, tax returns, and asset documentation.

- List your assets: Clearly itemize all assets, including cash, real estate, and investments, along with their current values.

- Detail your liabilities: Include all outstanding debts, such as mortgages, loans, and credit card balances.

- Calculate net worth: Subtract total liabilities from total assets to determine your net worth.

- Review and verify: Double-check all entries for accuracy and completeness before submission.

Legal Use of the SBA Form 413

The SBA Form 413 is legally binding, meaning that the information provided must be truthful and accurate. Misrepresentation or omission of facts can lead to serious consequences, including denial of loan applications or legal action. This form is governed by federal regulations, and compliance with these regulations is essential for maintaining eligibility for SBA programs. It is advisable to consult with a financial advisor or legal expert if there are uncertainties about the information required on the form.

Key Elements of the SBA Form 413

Several key elements are essential when completing the SBA Form 413. These include:

- Personal Information: Basic details such as name, address, and Social Security number.

- Assets: A comprehensive list of all personal assets, including cash, investments, and real estate.

- Liabilities: Detailed information on all debts and obligations.

- Income: Monthly income from various sources, including employment and investments.

- Expenses: Regular monthly expenses that affect overall financial health.

Eligibility Criteria for the SBA Form 413

Eligibility for using the SBA Form 413 typically requires that the applicant is seeking financial assistance through an SBA loan program. This form is primarily used by individuals who are business owners or are applying for a loan as part of a business venture. Additionally, applicants must demonstrate a need for funding and the ability to repay the loan based on their financial statements. Meeting these criteria is essential for a successful application process.

Quick guide on how to complete omb form 3245 0407

Easily Prepare Omb Form 3245 0407 on Any Device

Digital document management has gained popularity among businesses and individuals. It offers a fantastic eco-friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly without complications. Handle Omb Form 3245 0407 on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Edit and eSign Omb Form 3245 0407 Effortlessly

- Obtain Omb Form 3245 0407 and click Get Form to begin.

- Employ the tools we offer to complete your document.

- Highlight important sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to missing or lost documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Omb Form 3245 0407 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the omb form 3245 0407

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 413 and how can it be used with airSlate SignNow?

Form 413 is a document commonly used for various administrative purposes. With airSlate SignNow, you can easily upload, edit, and eSign form 413 digitally, streamlining your document workflow and ensuring secure electronic signatures.

-

What features does airSlate SignNow offer for managing form 413?

airSlate SignNow provides a range of features for managing form 413, including templates, automated workflows, and collaboration tools. These features simplify the process of sending, receiving, and signing your form 413, making it more efficient for businesses.

-

Is there a cost associated with using airSlate SignNow for form 413?

Yes, airSlate SignNow offers flexible pricing plans that cater to different business needs. You can choose a plan that fits your budget while benefiting from all the essential features to manage form 413 effectively.

-

How does airSlate SignNow ensure the security of form 413?

airSlate SignNow employs advanced security measures, including encryption, to protect your form 413 and other documents. This ensures that your data remains confidential and secure while being transmitted and stored.

-

Can I integrate airSlate SignNow with other applications for managing form 413?

Absolutely! airSlate SignNow offers seamless integrations with various third-party applications, allowing you to manage form 413 alongside your other essential business tools. This integration capability enhances your overall workflow efficiency.

-

What are the benefits of using airSlate SignNow for form 413?

Using airSlate SignNow for form 413 provides numerous benefits, including time savings, increased productivity, and improved accuracy. By digitizing and automating the signing process, your team can focus more on core activities rather than administrative tasks.

-

Is airSlate SignNow easy to use for completing form 413?

Yes, airSlate SignNow is renowned for its user-friendly interface that simplifies the process of completing form 413. With intuitive navigation and step-by-step guidance, users can easily draft, send, and eSign their documents.

Get more for Omb Form 3245 0407

- Krec open listing agreement form

- Pest control service plan form

- Biblical counseling worksheets pdf form

- Lma5 form

- Mall fr kvalitetsgranskning av studier med kvalitativ forskningsmetodik patientupplevelser form

- Mother of christ registration form miami fl

- Forget about losing your job form

- One year church bulletin advertising contract diocesancom form

Find out other Omb Form 3245 0407

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer