California Form 3582 E File Payment

What is the California Form 3582 E File Payment

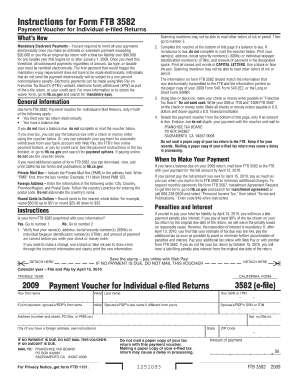

The California Form 3582 is a tax payment voucher used by individuals and businesses to make payments to the California Franchise Tax Board (FTB). This form is particularly relevant for those who owe taxes and need to submit payments electronically. The 3582 payment is part of the state's efforts to streamline tax collection and ensure compliance with tax obligations. By utilizing the e-file option, taxpayers can ensure that their payments are processed quickly and securely.

Steps to complete the California Form 3582 E File Payment

Completing the California Form 3582 for e-file payment involves several straightforward steps:

- Access the form through the official California Franchise Tax Board website or a trusted electronic filing service.

- Fill in your personal information, including your name, address, and Social Security number or taxpayer identification number.

- Indicate the payment amount and the tax year associated with the payment.

- Review the form for accuracy to avoid delays or issues with processing.

- Submit the form electronically, ensuring you receive confirmation of your submission.

Legal use of the California Form 3582 E File Payment

The California Form 3582 is legally valid when completed and submitted according to the guidelines set forth by the California Franchise Tax Board. To ensure compliance, it is crucial to follow the specific requirements for electronic signatures and data submission. Utilizing a reliable e-signature platform can enhance the legal standing of your submission by providing necessary authentication and compliance with eSignature laws.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the California Form 3582. Typically, payments are due on or before the tax return due date. For most individual taxpayers, this is April fifteenth of the following year. However, if the due date falls on a weekend or holiday, the deadline may be extended to the next business day. Keeping track of these dates helps avoid penalties and ensures timely compliance with tax obligations.

Form Submission Methods (Online / Mail / In-Person)

The California Form 3582 can be submitted through various methods, including:

- Online: The preferred method is e-filing, which allows for immediate processing and confirmation.

- Mail: Taxpayers can also print the completed form and mail it to the appropriate address provided by the FTB.

- In-Person: Payments can be made in person at designated FTB offices, though this method may require appointments and adherence to specific office hours.

Key elements of the California Form 3582 E File Payment

When completing the California Form 3582, several key elements must be included to ensure proper processing:

- Taxpayer Information: Accurate personal details are essential for identification and processing.

- Payment Amount: Clearly state the amount being paid to avoid discrepancies.

- Tax Year: Specify the tax year for which the payment is being made to ensure it is applied correctly.

- Signature: An electronic signature may be required to validate the submission.

Quick guide on how to complete california form 3582 e file payment

Easily Prepare California Form 3582 E File Payment on Any Device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly and without delays. Manage California Form 3582 E File Payment on any device using the airSlate SignNow apps for Android or iOS and enhance any document-based process today.

The Optimal Method to Edit and eSign California Form 3582 E File Payment Effortlessly

- Locate California Form 3582 E File Payment and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require new document copies to be printed. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and eSign California Form 3582 E File Payment to ensure effective communication at every stage of the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california form 3582 e file payment

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 3582 e file?

A 3582 e file is a specific electronic document format used for transferring data securely between parties. It is designed to streamline e-filing processes, making it easier for organizations to manage important forms. By using a 3582 e file, companies can enhance their operational efficiency and ensure compliance.

-

How does airSlate SignNow support 3582 e file processing?

airSlate SignNow enables users to create and manage 3582 e file documents seamlessly. The platform offers tools for easy document signing, sharing, and storage, giving businesses a comprehensive solution for their electronic filing needs. This allows for faster transactions and better record-keeping.

-

What features are included when using the 3582 e file with airSlate SignNow?

When utilizing the 3582 e file with airSlate SignNow, users access features such as customizable templates, real-time status tracking, and integrated compliance measures. These functionalities ensure that your electronic documents are efficient and legally binding. The ease of use also enhances user experience.

-

Is airSlate SignNow cost-effective for managing 3582 e files?

Yes, airSlate SignNow offers a range of pricing plans that are economical for businesses of all sizes needing to manage 3582 e files. With various features included in these plans, companies can effectively control their costs while enhancing their document management processes. This makes it a strategic investment for businesses.

-

Can I integrate airSlate SignNow with other software to handle 3582 e files?

Absolutely! airSlate SignNow supports integration with numerous applications and platforms, making it easier to manage your 3582 e file processes alongside existing systems. This flexibility allows businesses to streamline their workflow further and enhance productivity by connecting different software solutions.

-

What are the benefits of using airSlate SignNow for 3582 e files?

Using airSlate SignNow for your 3582 e files can signNowly improve efficiency and regulatory compliance. The platform simplifies document workflows, reduces processing time, and provides a secure environment for file handling. As a result, businesses can focus on their core operations instead of manual paperwork.

-

Is there a free trial available for airSlate SignNow to test 3582 e file capabilities?

Yes, airSlate SignNow offers a free trial that allows potential users to explore the functionalities related to managing 3582 e files. This provides an opportunity to experience the platform's features without any financial commitment. It's a great way to evaluate if it meets your business needs.

Get more for California Form 3582 E File Payment

- Sms banking application form

- Sketchup pro license key form

- Valet trash service proposal pdf form

- Djp form

- Csi spanish class checking alibis form

- Rebate form

- Political fervor crossword clue form

- Il 1065 x amended partnership replacement tax return il 1065 x amended partnership replacement tax return 636274152 form

Find out other California Form 3582 E File Payment

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney

- Sign Michigan Mechanic's Lien Easy

- How To Sign Texas Revocation of Power of Attorney

- Sign Virginia Revocation of Power of Attorney Easy

- Can I Sign North Carolina Mechanic's Lien

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple

- How To Sign Utah Mechanic's Lien

- How To Sign Washington Mechanic's Lien

- Help Me With Sign Washington Mechanic's Lien

- Sign Arizona Notice of Rescission Safe

- Sign Hawaii Notice of Rescission Later

- Sign Missouri Demand Note Online

- How To Sign New York Notice to Stop Credit Charge

- How Do I Sign North Dakota Notice to Stop Credit Charge

- How To Sign Oklahoma Notice of Rescission