University of Missouri Extension 1099 Forms

What is the University of Missouri Extension 1099 Forms

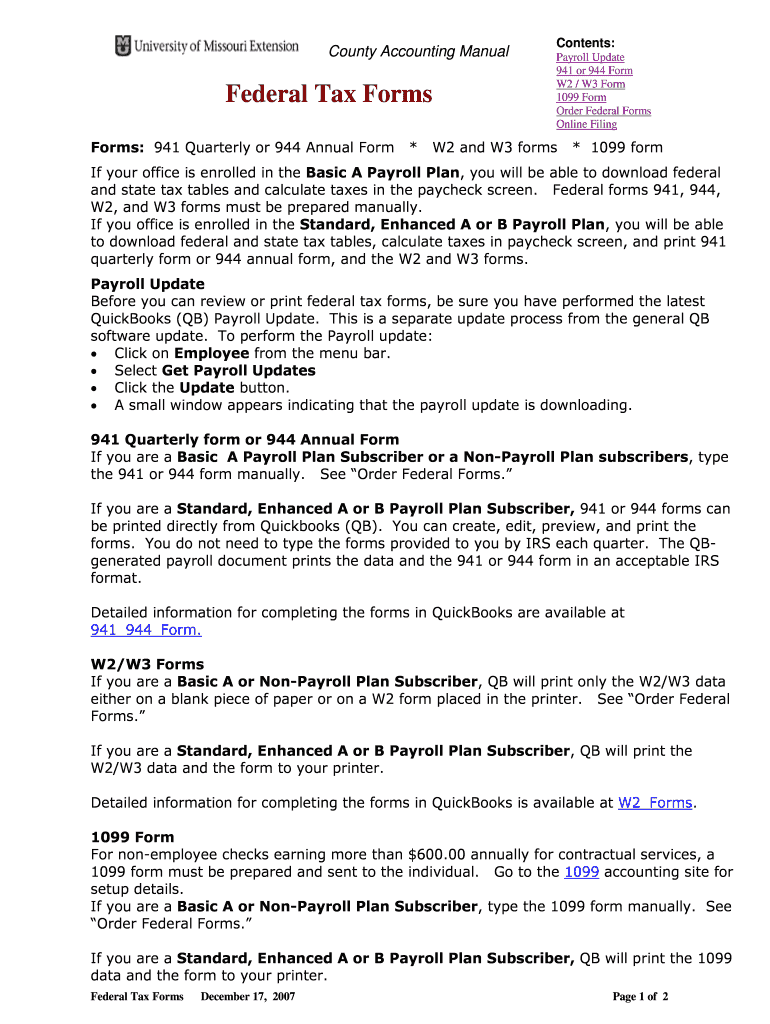

The University of Missouri Extension 1099 forms are essential documents used for reporting various types of income to the Internal Revenue Service (IRS). These forms are particularly relevant for individuals and businesses that have paid or received payments for services rendered, which may include freelance work, consulting, or other contractual agreements. The forms help ensure compliance with tax regulations by documenting income that may be subject to taxation.

How to use the University of Missouri Extension 1099 Forms

Using the University of Missouri Extension 1099 forms involves several steps. First, determine the type of 1099 form required based on the nature of the payment. Common types include the 1099-MISC for miscellaneous income and the 1099-NEC for non-employee compensation. After identifying the correct form, gather the necessary information, including the recipient's name, address, and taxpayer identification number. Finally, complete the form accurately and submit it to the IRS and the recipient by the established deadlines.

Steps to complete the University of Missouri Extension 1099 Forms

Completing the University of Missouri Extension 1099 forms requires careful attention to detail. Follow these steps:

- Gather all necessary information about the payee and the payments made.

- Select the appropriate 1099 form based on the type of income.

- Fill in the required fields, ensuring accuracy in names, addresses, and amounts.

- Review the completed form for any errors or omissions.

- Submit the form to the IRS and provide a copy to the payee by the deadline.

Legal use of the University of Missouri Extension 1099 Forms

The legal use of the University of Missouri Extension 1099 forms is crucial for compliance with federal tax laws. These forms must be filed accurately and on time to avoid penalties. Properly completed forms provide a legal record of income for both the payer and the payee, ensuring that all parties fulfill their tax obligations. It is essential to adhere to IRS guidelines regarding the issuance and filing of these forms to maintain legal standing.

Filing Deadlines / Important Dates

Filing deadlines for the University of Missouri Extension 1099 forms vary based on the specific form type. Generally, forms must be submitted to the IRS by January 31 of the following year for forms reporting non-employee compensation. For other types of 1099 forms, the deadline may be February 28 if filing by paper or March 31 if filing electronically. It is important to stay informed about these dates to ensure timely compliance.

Who Issues the Form

The University of Missouri Extension 1099 forms are typically issued by businesses or individuals who have made payments to contractors, freelancers, or other service providers. This includes various entities such as corporations, partnerships, and sole proprietorships. The responsibility to issue the form lies with the payer, who must ensure that the form is completed and submitted according to IRS requirements.

Quick guide on how to complete university of missouri extension 1099 forms

Easily Prepare University Of Missouri Extension 1099 Forms on Any Device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the resources required to create, edit, and electronically sign your documents swiftly and without hassle. Manage University Of Missouri Extension 1099 Forms on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related task today.

Steps to Edit and eSign University Of Missouri Extension 1099 Forms with Ease

- Find University Of Missouri Extension 1099 Forms and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Select important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Decide how you want to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searching, or mistakes that require printing new copies. airSlate SignNow fulfills your document management needs in a few clicks from any device you choose. Edit and eSign University Of Missouri Extension 1099 Forms and guarantee effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

Can I use broker statements to fill out form 8949 instead of a 1099-B?

Yes you can. Should you? Perhaps, but remember that the 1099 is what the IRS is going to receive. There could be differences.You may receive a 1099 which is missing basis information. You will indicate that, and use your records to fill in the missing information.My suggestion is to use the 1099, cross-referencing to your statements.

-

Do I have to fill out a 1099 tax form for my savings account interest?

No, the bank files a 1099 — not you. You’ll get a copy of the 1099-INT that they filed.

-

Is there an extension of time available to file the W-2 and 1099 forms?

I know about 1099 forms. It’s necessary to send the template to the IRS for the 2018 tax year before the end of January 2019.The same term is applicable for filing to your local tax department of state and payment receiver. It’s a general requirement for all information in the return documents to be sent to a governmental institution during the first month of any given year. It’s also important to file before the set deadlines.The IRS allows taxpayers to complete their tax forms electronically in order for them to be received and processed faster.Filing electronically also makes it easier to share one completed copy between persons and institutions you file to.This helps save time and better automates the tax management process.Info:http://bit.ly/2Nkf48f

-

Do you have to fill out form 1099 (for tax reporting) if you send over $600 in bitcoin to company for a product?

Among the numerous tax forms, the IRS will be expecting you to fill out a 1099-MISC form in two cases:you made payments to freelancers or independent contractors for business-related services totaling at least $600 within the year;or you paid minimum $10 in royalties or broker payments in lieu of dividends or tax-exempt interest.However, if you made any payments for personal or household services, there is no need to submit a 1099-MISC form.This site has a lot of information about it - http://bit.ly/2Nkf48f

-

What happens to all of the paper forms you fill out for immigration and customs?

Years ago I worked at document management company. There is cool software that can automate aspects of hand-written forms. We had an airport as a customer - they scanned plenty and (as I said before) this was several years ago...On your airport customs forms, the "boxes" that you 'need' to write on - are basically invisible to the scanner - but are used because then us humans will tend to write neater and clearer which make sit easier to recognize with a computer. Any characters with less than X% accuracy based on a recognition engine are flagged and shown as an image zoomed into the particular character so a human operator can then say "that is an "A". This way, you can rapidly go through most forms and output it to say - an SQL database, complete with link to original image of the form you filled in.If you see "black boxes" at three corners of the document - it is likely set up for scanning (they help to identify and orient the page digitally). If there is a unique barcode on the document somewhere I would theorize there is an even higher likelihood of it being scanned - the document is of enough value to be printed individually which costs more, which means it is likely going to be used on the capture side. (I've noticed in the past in Bahamas and some other Caribbean islands they use these sorts of capture mechanisms, but they have far fewer people entering than the US does everyday)The real answer is: it depends. Depending on each country and its policies and procedures. Generally I would be surprised if they scanned and held onto the paper. In the US, they proably file those for a set period of time then destroy them, perhaps mining them for some data about travellers. In the end, I suspect the "paper-to-data capture" likelihood of customs forms ranges somewhere on a spectrum like this:Third world Customs Guy has paper to show he did his job, paper gets thrown out at end of shift. ------> We keep all the papers! everything is scanned as you pass by customs and unique barcodes identify which flight/gate/area the form was handed out at, so we co-ordinate with cameras in the airport and have captured your image. We also know exactly how much vodka you brought into the country. :)

Create this form in 5 minutes!

How to create an eSignature for the university of missouri extension 1099 forms

How to create an electronic signature for the University Of Missouri Extension 1099 Forms online

How to create an eSignature for your University Of Missouri Extension 1099 Forms in Google Chrome

How to make an electronic signature for putting it on the University Of Missouri Extension 1099 Forms in Gmail

How to make an eSignature for the University Of Missouri Extension 1099 Forms right from your smartphone

How to generate an eSignature for the University Of Missouri Extension 1099 Forms on iOS

How to generate an electronic signature for the University Of Missouri Extension 1099 Forms on Android devices

People also ask

-

What is a Missouri extension form?

A Missouri extension form is a document that allows taxpayers to request additional time to file their state tax returns. By using this form, individuals can extend their filing deadline while ensuring compliance with Missouri tax regulations. This is particularly helpful for those who need more time to gather necessary documents.

-

How can I electronically submit my Missouri extension form?

You can electronically submit your Missouri extension form using airSlate SignNow, which allows for easy eSigning and submission of documents. With our platform, you can fill out, sign, and send your form securely in just a few clicks. This not only saves time but also reduces the chance of errors.

-

What features does airSlate SignNow offer for handling Missouri extension forms?

airSlate SignNow provides various features to streamline the handling of Missouri extension forms, including customizable templates, secure eSignature capabilities, and real-time tracking. These tools ensure that your extension form is completed accurately and submitted on time. Additionally, our intuitive interface makes it easy for users of all skill levels to navigate.

-

Are there any costs associated with using airSlate SignNow for Missouri extension forms?

Using airSlate SignNow for Missouri extension forms is cost-effective, with various pricing plans that cater to different business needs. Our plans are designed to provide value without compromising on features or support. You can choose the plan that best fits your needs and budget for a hassle-free experience.

-

How does airSlate SignNow enhance the filing process for Missouri extension forms?

airSlate SignNow enhances the filing process for Missouri extension forms by providing an efficient, user-friendly platform for document management. This minimizes the time spent on paperwork and accelerates the submission process. Users benefit from easy collaboration, ensuring that all parties can review and sign documents promptly.

-

Can I integrate airSlate SignNow with my existing software for Missouri extension forms?

Yes, airSlate SignNow seamlessly integrates with a variety of existing software platforms, allowing for a streamlined workflow when managing Missouri extension forms. Popular tools like CRM systems, cloud storage services, and accounting software can be connected to enhance productivity. This integration simplifies document management and keeps your processes organized.

-

Is airSlate SignNow secure for submitting sensitive Missouri extension forms?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption methods to safeguard your sensitive data when submitting Missouri extension forms. Our platform complies with industry standards to ensure that all documents are kept confidential and secure throughout the entire process.

Get more for University Of Missouri Extension 1099 Forms

Find out other University Of Missouri Extension 1099 Forms

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will