Form S 211

What is the Form S 211

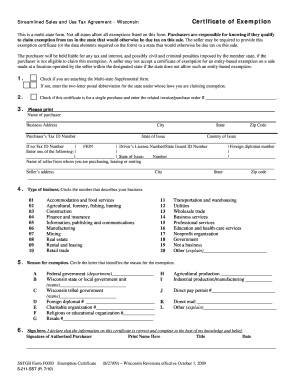

The Form S 211 is a specific document used in various administrative processes, often related to business or legal matters. It serves as a formal request or declaration, depending on the context in which it is utilized. Understanding the purpose of this form is crucial for ensuring compliance with relevant regulations and for facilitating smooth transactions or applications.

How to use the Form S 211

Using the Form S 211 involves several steps to ensure that all necessary information is accurately provided. First, gather all required information, including personal or business details relevant to the form's purpose. Next, fill out the form carefully, ensuring that all fields are completed as required. After completing the form, review it for accuracy before submission. Depending on the requirements, you may need to submit the form electronically or in paper format.

Steps to complete the Form S 211

Completing the Form S 211 requires attention to detail. Follow these steps:

- Read the instructions carefully to understand what information is needed.

- Gather all necessary documentation that supports your application or request.

- Fill out the form, ensuring clarity and accuracy in each section.

- Double-check the information for any errors or omissions.

- Submit the form as per the specified guidelines, either online or by mail.

Legal use of the Form S 211

The legal use of the Form S 211 is contingent upon meeting specific requirements set forth by governing bodies. For the form to be considered valid, it must be filled out correctly and submitted in accordance with established regulations. Utilizing a reliable eSignature platform can enhance the legal standing of the document, ensuring compliance with laws such as ESIGN and UETA.

Key elements of the Form S 211

Key elements of the Form S 211 include personal or business identification information, the purpose of the form, and any supporting documentation that may be required. Each section of the form is designed to capture essential details that facilitate the processing of your request or application. Ensuring that all key elements are accurately completed is vital for a successful submission.

Required Documents

When filling out the Form S 211, certain documents may be required to support your submission. Commonly required documents include:

- Proof of identity, such as a driver's license or passport.

- Business registration documents, if applicable.

- Any additional forms or certifications that relate to your specific request.

Having these documents ready will streamline the completion and submission process.

Form Submission Methods

The Form S 211 can typically be submitted through various methods, including:

- Online submission via a designated portal.

- Mailing a physical copy to the appropriate office.

- In-person submission at designated locations.

Choosing the right submission method can depend on your specific circumstances and the guidelines provided for the form.

Quick guide on how to complete form s 211

Complete Form S 211 effortlessly on any device

Digital document management has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents quickly and easily. Manage Form S 211 on any device with airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

How to edit and eSign Form S 211 effortlessly

- Locate Form S 211 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides for that specific purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you want to submit your form, by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or mislaid files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form S 211 and ensure smooth communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form s 211

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the s211 form and how can airSlate SignNow help?

The s211 form is a document often required for various business processes. With airSlate SignNow, you can easily upload, send, and eSign the s211 form securely, streamlining your workflow and reducing paperwork.

-

Is airSlate SignNow affordable for submitting the s211 form?

Yes, airSlate SignNow offers a cost-effective solution for businesses looking to manage the s211 form. Our competitive pricing plans ensure that you have access to all the features you need without breaking the bank.

-

What features does airSlate SignNow provide for the s211 form?

AirSlate SignNow provides a variety of features for managing the s211 form, including customizable templates, quick eSignature options, and secure cloud storage. These features enhance your efficiency and keep your documents organized.

-

How does airSlate SignNow ensure the security of my s211 form?

Security is a top priority at airSlate SignNow. We utilize encryption and secure cloud services to safeguard your s211 form and other documents, protecting sensitive information from unauthorized access.

-

Can I integrate airSlate SignNow with other tools for managing the s211 form?

Yes, airSlate SignNow offers integrations with various applications to enhance your document workflow. You can link our platform with CRM systems, cloud storage services, and project management tools for seamless management of the s211 form.

-

What are the benefits of using airSlate SignNow for the s211 form?

Using airSlate SignNow for your s211 form facilitates faster processing and accuracy in your documentation. With electronic signatures and efficient sharing options, you can save time and maintain compliance with legal standards.

-

How can I get support for issues related to the s211 form?

AirSlate SignNow provides excellent customer support to assist you with any issues concerning the s211 form. Our knowledgeable team is available via chat, email, or phone to ensure you have the help you need.

Get more for Form S 211

Find out other Form S 211

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT