Al Form Com 101

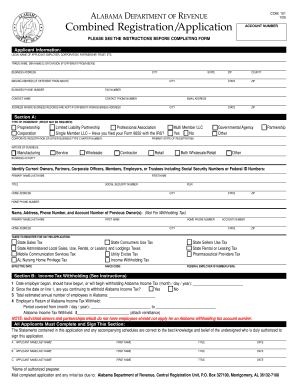

What is the Al Form Com 101

The Al Form Com 101 is a specific document used for various administrative and legal purposes, often required by government agencies or organizations. It is essential for individuals and businesses to understand the nature of this form, as it may pertain to tax obligations, compliance requirements, or other official processes. The form serves as a means to collect necessary information, ensuring that all parties involved can fulfill their legal and regulatory responsibilities.

How to use the Al Form Com 101

Using the Al Form Com 101 involves several straightforward steps. First, ensure you have the correct version of the form, as updates may occur. Next, carefully read the instructions provided with the form to understand what information is required. Fill out the form accurately, providing all necessary details. Once completed, review the form for any errors or omissions before submission. Depending on the requirements, you may need to submit it online, by mail, or in person.

Steps to complete the Al Form Com 101

Completing the Al Form Com 101 can be broken down into a series of clear steps:

- Gather all required information and documents needed to fill out the form.

- Access the form through the appropriate channel, ensuring you have the latest version.

- Fill in your personal or business details as requested.

- Double-check all entries for accuracy and completeness.

- Sign the form, if necessary, to validate your submission.

- Submit the form according to the specified guidelines.

Legal use of the Al Form Com 101

The legal use of the Al Form Com 101 is crucial for ensuring compliance with applicable laws and regulations. When filled out correctly, the form can serve as a legally binding document in various contexts. It is important to understand the legal implications of the information provided and to ensure that all signatures and certifications meet the necessary legal standards. Utilizing a trusted platform for electronic signatures can further enhance the form's legal validity.

Key elements of the Al Form Com 101

Several key elements must be included in the Al Form Com 101 to ensure its validity:

- Accurate identification information of the individual or entity submitting the form.

- Clear and concise details regarding the purpose of the form.

- Signature or electronic signature of the individual completing the form.

- Date of completion to establish the timeline of submission.

Required Documents

When preparing to complete the Al Form Com 101, certain documents may be required to support the information provided. These may include:

- Identification documents, such as a driver's license or Social Security card.

- Financial records or tax documents, if applicable.

- Any prior forms or correspondence related to the current submission.

Form Submission Methods

The Al Form Com 101 can typically be submitted through various methods, depending on the requirements set forth by the issuing authority. Common submission methods include:

- Online submission via a designated portal or website.

- Mailing the completed form to the appropriate address.

- In-person delivery to a designated office or agency.

Quick guide on how to complete al form com 101

Effortlessly Prepare Al Form Com 101 on Any Device

The management of online documents has gained signNow traction among businesses and individuals. It offers a seamless, eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the right format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Manage Al Form Com 101 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Edit and Electronically Sign Al Form Com 101 with Ease

- Locate Al Form Com 101 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional ink signature.

- Review all details and then click the Done button to save your modifications.

- Select how you wish to share your form—via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or disorganized files, tedious searches for forms, or errors that necessitate creating new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Al Form Com 101 to ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the al form com 101

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is al form com 101 and how does it relate to airSlate SignNow?

Al form com 101 is a guide to understanding advanced forms and document management. airSlate SignNow leverages this concept to provide businesses with the tools needed to create, manage, and eSign forms efficiently, enhancing workflow and productivity.

-

How does airSlate SignNow ensure the security of documents during eSigning?

airSlate SignNow employs robust security measures, including SSL encryption and secure access controls. Users can trust that their documents, including those related to al form com 101, are protected against unauthorized access or data bsignNowes.

-

What pricing plans are available for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate the needs of various businesses. Whether you're a small startup or a large enterprise, you can find a suitable option that aligns with the benefits provided by features related to al form com 101.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers seamless integrations with numerous third-party applications. This means you can easily connect your workflows to tools you already use, enhancing your document management processes related to al form com 101.

-

What are the key features of airSlate SignNow for document management?

Key features of airSlate SignNow include customizable templates, automated workflows, and real-time document tracking. These features make it easy to manage documents efficiently, especially when utilizing principles outlined in al form com 101.

-

How can airSlate SignNow improve my business efficiency?

By streamlining the document signing process, airSlate SignNow minimizes delays associated with traditional methods. This efficiency aligns with the concepts of al form com 101, allowing businesses to focus on core operations while ensuring timely document handling.

-

Is technical support available for airSlate SignNow users?

Absolutely! airSlate SignNow provides comprehensive support options, including tutorials and customer service assistance. Our team is ready to help users navigate features and benefits related to al form com 101, ensuring a smooth experience.

Get more for Al Form Com 101

Find out other Al Form Com 101

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy