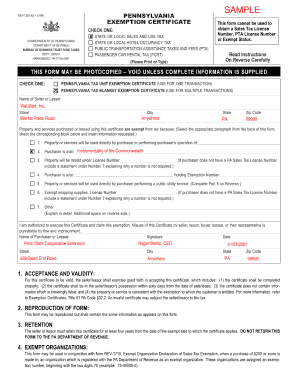

Example of Form 1220

What is the rev 1220 form?

The rev 1220 form, also known as the Pennsylvania Exemption Certificate, is a crucial document used by businesses and individuals in Pennsylvania to claim exemption from sales tax on specific purchases. This form is particularly relevant for entities that qualify under certain categories, such as non-profit organizations or government agencies. By submitting the rev 1220, taxpayers can avoid paying sales tax on items that are exempt under Pennsylvania law, thereby ensuring compliance with state regulations.

Steps to complete the rev 1220 form

Completing the rev 1220 form involves several straightforward steps. First, gather the necessary information, including your business details and the specific items for which you are claiming exemption. Next, accurately fill out the form, ensuring that all required fields are completed. It is essential to provide a valid reason for the exemption, as this will support your claim. After filling out the form, review it for accuracy and completeness before submitting it to the appropriate vendor or agency.

Legal use of the rev 1220 form

The rev 1220 form holds legal significance as it serves as a declaration of exemption from sales tax in Pennsylvania. For the form to be legally binding, it must be completed accurately and submitted to the appropriate parties. This includes ensuring that the form is signed by an authorized representative of the entity claiming the exemption. Compliance with state laws regarding the use of this form is crucial, as improper use can lead to penalties or legal issues.

Who issues the rev 1220 form?

The rev 1220 form is issued by the Pennsylvania Department of Revenue. This state agency is responsible for overseeing tax regulations and ensuring that businesses comply with sales tax laws. By issuing the rev 1220, the Department of Revenue provides a standardized method for taxpayers to claim their exemptions, thereby facilitating smoother transactions between vendors and exempt entities.

Form Submission Methods

The rev 1220 form can be submitted through various methods, depending on the vendor's preferences. Typically, businesses can present the completed form in person at the point of sale, or they may choose to submit it via mail or electronically, depending on the vendor's policies. It is essential to check with the specific vendor to understand their preferred submission method to ensure proper processing of the exemption claim.

Penalties for Non-Compliance

Failure to comply with the regulations surrounding the rev 1220 form can result in significant penalties. If an entity incorrectly claims an exemption or fails to provide the necessary documentation, they may be subject to back taxes, fines, or other legal repercussions. It is vital for businesses and individuals to understand the implications of non-compliance and to ensure that they accurately complete and submit the rev 1220 form to avoid any potential issues.

Quick guide on how to complete example of form 1220

Complete Example Of Form 1220 effortlessly on any device

Digital document management has become increasingly favored by companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed materials, allowing you to obtain the correct format and safely save it online. airSlate SignNow provides all the tools necessary for you to generate, modify, and electronically sign your documents quickly without delays. Manage Example Of Form 1220 on any device using airSlate SignNow apps for Android or iOS and simplify any document-related task today.

How to alter and eSign Example Of Form 1220 with ease

- Obtain Example Of Form 1220 and then click Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all details and then click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors necessitating reprints. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Example Of Form 1220 and ensure smooth communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the example of form 1220

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Pennsylvania exemption certificate?

A Pennsylvania exemption certificate is a document used to claim an exemption from sales tax when purchasing certain goods or services. It is essential for businesses and consumers who qualify for tax exemptions under Pennsylvania law. By using this certificate, you can save money on eligible purchases while remaining compliant with tax regulations.

-

How do I obtain a Pennsylvania exemption certificate?

To obtain a Pennsylvania exemption certificate, you can download the form from the Pennsylvania Department of Revenue's website. Fill out the necessary information and ensure that you meet the eligibility requirements. Once completed, the form can be submitted to the seller to claim your exemption.

-

What are the benefits of using airSlate SignNow for managing Pennsylvania exemption certificates?

Using airSlate SignNow for managing Pennsylvania exemption certificates allows for a streamlined process in sending and eSigning documents. The platform is user-friendly and cost-effective, making it easy to manage your exemption certificates efficiently. This can save you time and reduce errors associated with paperwork.

-

Is airSlate SignNow compliant with Pennsylvania exemption certificate regulations?

Yes, airSlate SignNow is designed to comply with regulations, including those surrounding the Pennsylvania exemption certificate. The platform ensures that all documents are managed securely and in accordance with legal standards. This compliance helps to protect your business from potential tax-related issues.

-

What features does airSlate SignNow offer for handling exemption certificates?

AirSlate SignNow offers features such as customizable templates, document tracking, and secure eSignature capabilities for managing exemption certificates. These features are designed to facilitate a smooth workflow for your business, ensuring that you can easily send, receive, and store your Pennsylvania exemption certificates. Additionally, the platform provides collaboration tools for teams.

-

How does pricing work for airSlate SignNow to manage Pennsylvania exemption certificates?

AirSlate SignNow offers various pricing plans to fit different business needs, making it cost-effective for managing Pennsylvania exemption certificates. You can choose from monthly or annual subscriptions, allowing you to scale as your business grows. Each plan provides access to essential features that enhance document management and signature processes.

-

Can I integrate airSlate SignNow with other software to manage Pennsylvania exemption certificates?

Yes, airSlate SignNow can be integrated with several software solutions, enhancing your ability to manage Pennsylvania exemption certificates seamlessly. Popular integrations include CRM systems and cloud storage services, which allow for better organization and access to documents. This connectivity helps optimize your workflow and increases efficiency.

Get more for Example Of Form 1220

- Emblemhealth transaction form for group accounts

- Donald goodman form

- Comb 98992 2009 form

- Instructions dhs 8027 0303 request for accounting of disclosures of health information purpose 1 med quest

- Sbar template sheet pdf type in form

- Narcotic patient agreement form

- Tricare other health insurance ohi questionnaire form

- Vaccine storage troubleshooting record check one form

Find out other Example Of Form 1220

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online