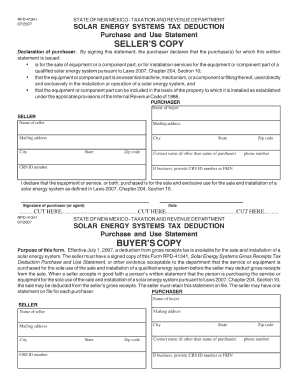

Rpd 41341 Form

What is the Rpd 41341 Form

The Rpd 41341 Form is a specific document used primarily in the context of tax reporting and compliance within the United States. This form is typically associated with certain financial disclosures or declarations that individuals or businesses must submit to the relevant tax authorities. Understanding the purpose and requirements of the Rpd 41341 Form is essential for ensuring compliance and avoiding potential penalties.

How to use the Rpd 41341 Form

Using the Rpd 41341 Form involves several key steps. First, ensure that you have the correct version of the form, as there may be updates or variations. Next, gather all necessary information and documentation required to complete the form accurately. This may include financial records, identification details, and any other relevant data. Once you have completed the form, review it for accuracy before submission to ensure that all information is correct and complete.

Steps to complete the Rpd 41341 Form

Completing the Rpd 41341 Form requires a systematic approach. Follow these steps:

- Obtain the latest version of the Rpd 41341 Form from the appropriate source.

- Read the instructions carefully to understand the requirements.

- Fill out the form with accurate information, ensuring that all fields are completed as required.

- Double-check your entries for any errors or omissions.

- Sign and date the form where indicated.

- Submit the form according to the specified submission methods.

Legal use of the Rpd 41341 Form

The Rpd 41341 Form is legally binding when filled out and submitted in accordance with established regulations. To ensure its legal validity, it is important to comply with all relevant laws governing the form's use. This includes adhering to any deadlines for submission and ensuring that the information provided is truthful and complete. Failure to comply with these legal requirements may result in penalties or other consequences.

Key elements of the Rpd 41341 Form

Several key elements are essential to the Rpd 41341 Form. These include:

- Identification Information: This section typically requires personal or business identification details.

- Financial Data: Accurate financial information is crucial for the form's purpose.

- Signature: The form must be signed to validate the information provided.

- Date of Submission: Including the date ensures compliance with submission timelines.

Who Issues the Form

The Rpd 41341 Form is typically issued by the relevant tax authority or government agency responsible for overseeing tax compliance and reporting. In the United States, this is often the Internal Revenue Service (IRS) or a state-level tax authority. It is important to obtain the form from the official source to ensure that you are using the correct version and following the appropriate guidelines.

Quick guide on how to complete rpd 41341 form

Complete Rpd 41341 Form effortlessly on any device

Digital document management has become increasingly favored by companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to find the correct form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage Rpd 41341 Form on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related task today.

How to modify and eSign Rpd 41341 Form with ease

- Obtain Rpd 41341 Form and click Get Form to begin.

- Make use of the tools we offer to finalize your document.

- Emphasize key sections of your documents or obscure sensitive information with features that airSlate SignNow provides specifically for this purpose.

- Generate your signature with the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your alterations.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or disorganized files, tedious form searching, or errors that require printing new document replicas. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Rpd 41341 Form and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rpd 41341 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Rpd 41341 Form and how is it used?

The Rpd 41341 Form is a document required for specific tax purposes within jurisdictions. It is commonly used by organizations to report income and expenses to tax authorities. Utilizing airSlate SignNow simplifies the process of filling out and submitting the Rpd 41341 Form electronically, ensuring accuracy and compliance.

-

How can airSlate SignNow help with the Rpd 41341 Form?

airSlate SignNow provides an easy-to-use platform for completing and eSigning the Rpd 41341 Form. Its intuitive interface allows users to fill out fields, store documents securely, and send them for signatures directly. This streamlines the filing process, making it efficient and hassle-free.

-

What are the pricing options for using airSlate SignNow for the Rpd 41341 Form?

airSlate SignNow offers various pricing plans that cater to different business needs. You can choose from individual, team, or enterprise plans, which provide access to features tailored for efficient handling of documents like the Rpd 41341 Form. Pricing is competitive, ensuring your business can efficiently manage its document signing needs.

-

Can I integrate airSlate SignNow with other applications for the Rpd 41341 Form?

Yes, airSlate SignNow supports integration with numerous applications including CRM, cloud storage, and productivity tools. This allows you to streamline your workflow for the Rpd 41341 Form by linking it with your existing software. Integrations enhance efficiency and reduce data entry errors.

-

What are the features of airSlate SignNow that assist with the Rpd 41341 Form?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure eSigning, all beneficial for managing the Rpd 41341 Form. These features ensure that your documents are filled accurately and securely, while providing a clear audit trail for your records. This makes compliance easier for your organization.

-

Is airSlate SignNow secure for storing and sending the Rpd 41341 Form?

Absolutely, airSlate SignNow prioritizes security and compliance, employing bank-level encryption to protect your documents, including the Rpd 41341 Form. Regular security audits and compliance with data protection regulations ensure that your information remains safe. You can confidently send and store sensitive documents with us.

-

What benefits does airSlate SignNow offer for businesses dealing with the Rpd 41341 Form?

Using airSlate SignNow for the Rpd 41341 Form provides several benefits such as time savings, improved accuracy, and enhanced collaboration. Teams can work together seamlessly to complete documents, reducing the risk of errors. Additionally, eSigning eliminates the need for printing and scanning, helping the environment and your bottom line.

Get more for Rpd 41341 Form

- Marina attestation letter form

- Life care planning packet form

- Cibc wire transfer form

- Form 24 smoke alarm

- Significant figures multiplication and division worksheet form

- Eviction notice for squatters pdf form

- Bond disposal department of commerce form

- Application for statement of marks and inspection of form

Find out other Rpd 41341 Form

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal