R 1201 Form

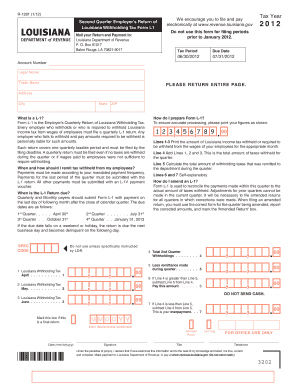

What is the R 1201

The R 1201 is a form issued by the Louisiana Department of Revenue, primarily used for reporting certain tax-related information. This form is essential for individuals and businesses to ensure compliance with state tax regulations. It is commonly utilized to report income and deductions, which are crucial for accurate tax assessments. Understanding the purpose of the R 1201 can help taxpayers navigate their obligations effectively.

Steps to complete the R 1201

Completing the R 1201 involves several key steps to ensure accuracy and compliance. Here is a straightforward guide to help you through the process:

- Gather necessary documents, including income statements and any relevant deductions.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Sign and date the form, as required for legal validation.

- Submit the completed form to the Louisiana Department of Revenue via the preferred method.

Legal use of the R 1201

The R 1201 is legally binding when completed and submitted according to the regulations set forth by the Louisiana Department of Revenue. To ensure its legal standing, all information provided must be truthful and accurate. Misrepresentation or errors can lead to penalties or legal repercussions. Utilizing a reliable eSignature solution can further enhance the form's validity by providing a secure and compliant signing process.

Form Submission Methods

There are several methods available for submitting the R 1201. Taxpayers can choose the option that best fits their needs:

- Online Submission: Many taxpayers prefer to submit the form electronically through the Louisiana Department of Revenue's online portal.

- Mail: The form can also be printed and mailed to the appropriate address provided by the department.

- In-Person: For those who prefer direct interaction, submitting the form in person at a local revenue office is an option.

Key elements of the R 1201

Understanding the key elements of the R 1201 is crucial for accurate completion. Essential components include:

- Taxpayer Information: Personal or business details must be clearly stated.

- Income Reporting: Accurate reporting of all income sources is required.

- Deductions: Any applicable deductions should be itemized to reduce taxable income.

- Signature: The form must be signed to validate the information provided.

How to obtain the R 1201

The R 1201 form can be obtained through the Louisiana Department of Revenue's official website. It is typically available as a downloadable PDF, which can be filled out electronically or printed for manual completion. Additionally, physical copies may be available at local revenue offices for those who prefer to obtain the form in person.

Quick guide on how to complete r 1201

Complete R 1201 seamlessly on any device

Managing documents online has gained traction among enterprises and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without any delays. Handle R 1201 on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest method to edit and electronically sign R 1201 effortlessly

- Locate R 1201 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your delivery method for the form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Edit and electronically sign R 1201 and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the r 1201

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the r 1201 feature in airSlate SignNow?

The r 1201 feature in airSlate SignNow allows users to streamline their document signing process. It simplifies the way businesses send and eSign documents, ensuring a secure and efficient workflow. With r 1201, you can quickly access templates and manage multiple signers with ease.

-

How does the pricing for airSlate SignNow with r 1201 work?

AirSlate SignNow offers flexible pricing plans that include access to the r 1201 feature. Depending on your business needs, you can choose from different tiers that provide various levels of access and functionality. This ensures that you select a plan that fits your budget while maximizing efficiency.

-

What benefits does r 1201 provide for my business?

The r 1201 functionality in airSlate SignNow enhances productivity by automating the document signing process. This reduces the time spent on managing paperwork and increases compliance by keeping all signatures secure and verifiable. Overall, r 1201 contributes to better workflow management and improved customer satisfaction.

-

Can r 1201 integrate with other software?

Yes, airSlate SignNow with r 1201 seamlessly integrates with a variety of software platforms. This includes CRM systems, project management tools, and more, enabling you to incorporate document signing into your existing workflows. Such integrations help maintain continuity and enhance overall efficiency.

-

Is r 1201 suitable for small businesses?

Absolutely! The r 1201 feature in airSlate SignNow is designed to be user-friendly and accessible for businesses of all sizes, including small enterprises. It provides a cost-effective solution that helps small business owners manage their documents without the need for extensive resources or technical expertise.

-

What types of documents can I eSign using r 1201?

With the r 1201 feature, you can eSign various types of documents including contracts, agreements, and invoices. This versatility ensures that regardless of your industry, airSlate SignNow can accommodate your document signing needs. The secure eSigning process ensures compliance and helps maintain integrity.

-

Does airSlate SignNow with r 1201 offer mobile access?

Yes, airSlate SignNow with r 1201 is accessible via mobile devices. This feature allows you to send and eSign documents on-the-go, providing flexibility and convenience. Whether in the office or traveling, you can manage your documents effortlessly from your smartphone or tablet.

Get more for R 1201

Find out other R 1201

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template