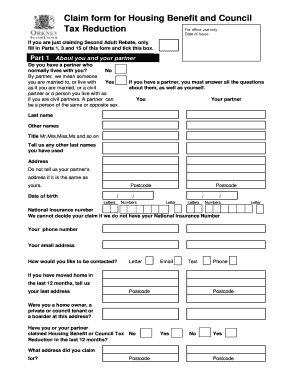

Council Tax Reduction Form

What is the Council Tax Reduction

The Council Tax Reduction is a financial assistance program designed to help eligible residents in the United States reduce their council tax bills. This form allows individuals to apply for a reduction based on their income, circumstances, and other qualifying factors. The program aims to alleviate the financial burden of council tax, making it more manageable for those who may be struggling financially.

Eligibility Criteria

To qualify for the Council Tax Reduction, applicants must meet specific criteria, which may vary by state or locality. Common eligibility factors include:

- Income level: Applicants typically must demonstrate that their income falls below a certain threshold.

- Household composition: The number of people living in the household can affect eligibility, particularly if there are dependents or individuals with disabilities.

- Property ownership: Eligibility may differ for homeowners versus renters.

- Age and status: Certain age groups, such as seniors or students, may have different requirements.

Steps to Complete the Council Tax Reduction

Filling out the Council Tax Reduction form involves several key steps to ensure accurate submission and processing:

- Gather necessary documents: Collect proof of income, residency, and any other required documentation.

- Fill out the form: Complete the tax reduction form with accurate information, ensuring all sections are addressed.

- Review and verify: Double-check the form for any errors or omissions before submission.

- Submit the form: Send the completed form through the designated method, whether online, by mail, or in person.

Required Documents

When applying for the Council Tax Reduction, certain documents are typically required to support the application. These may include:

- Proof of income: Pay stubs, tax returns, or benefit statements.

- Identification: A government-issued ID or social security number.

- Proof of residency: Utility bills or lease agreements that confirm your address.

- Additional documentation: Any other relevant paperwork that may support your claim.

Form Submission Methods

Applicants can submit the Council Tax Reduction form through various methods, depending on local regulations. Common submission options include:

- Online: Many jurisdictions offer a digital platform for submitting forms electronically.

- Mail: Completed forms can often be sent to the appropriate local government office via postal service.

- In-person: Some applicants may choose to deliver their forms directly to local offices for immediate processing.

Legal Use of the Council Tax Reduction

The Council Tax Reduction form is legally binding when completed and submitted according to local laws. It is essential to provide accurate information, as any discrepancies may lead to penalties or denial of the application. Understanding the legal implications of the form ensures compliance and protects the applicant's rights.

Quick guide on how to complete council tax reduction

Manage Council Tax Reduction effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly and without delays. Handle Council Tax Reduction on any platform using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

The easiest method to edit and eSign Council Tax Reduction with ease

- Obtain Council Tax Reduction and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose your preferred method to send your form, via email, SMS, or invitation link, or download it to your PC.

Eliminate issues of lost or mislaid files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks, from any device you select. Modify and eSign Council Tax Reduction and ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the council tax reduction

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax reduction form?

A tax reduction form is a document used to claim deductions and credits to reduce taxable income. With airSlate SignNow, you can easily create and eSign tax reduction forms to streamline your tax preparation process.

-

How can I use airSlate SignNow for my tax reduction form?

AirSlate SignNow allows you to customize and manage your tax reduction forms efficiently. You can complete, send, and get your tax reduction form signed digitally, ensuring a faster and more secure submission process.

-

Is there a cost associated with using airSlate SignNow for tax reduction forms?

Yes, airSlate SignNow offers various pricing plans to suit different needs. Depending on your requirements, you can choose a plan that provides features tailored to managing tax reduction forms at an affordable rate.

-

Are there any integrations available for tax reduction forms?

Absolutely! AirSlate SignNow integrates seamlessly with many popular applications, allowing you to link your tax reduction forms with tools you already use. This integration enhances efficiency and makes managing documents straightforward.

-

What security measures are in place for my tax reduction form?

AirSlate SignNow prioritizes the security of your documents. When you eSign a tax reduction form, data is encrypted and securely stored, providing you peace of mind that your sensitive information remains protected.

-

Can I track the status of my tax reduction form?

Yes, airSlate SignNow offers real-time tracking for all documents, including your tax reduction form. You’ll receive notifications on the status of your form, ensuring you’re always updated on its progress.

-

What benefits does digital signing offer for tax reduction forms?

Digital signing through airSlate SignNow speeds up the process of submitting tax reduction forms and eliminates paperwork. This convenience not only saves time but also enhances accuracy and compliance with regulations.

Get more for Council Tax Reduction

Find out other Council Tax Reduction

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation