Application for House Tax Form

What is the application for house tax?

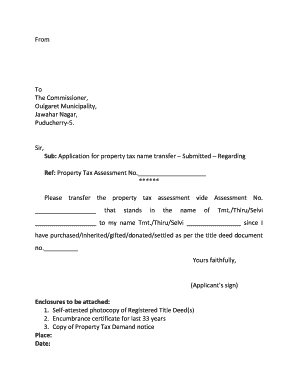

The application for house tax is a formal request submitted to local government authorities to assess or modify property taxes on a residential property. This application can be used for various purposes, including seeking exemptions, requesting a change in property assessment, or transferring property ownership. Understanding the specific requirements and processes involved in this application is essential for homeowners to ensure compliance and avoid potential penalties.

Steps to complete the application for house tax

Completing the application for house tax involves several key steps to ensure accuracy and compliance with local regulations. Begin by gathering necessary documents, such as proof of ownership, previous tax assessments, and any relevant identification. Next, fill out the application form carefully, ensuring all information is accurate and complete. After completing the form, review it for any errors before submitting it to the appropriate local tax authority. Depending on the jurisdiction, you may have the option to submit the application online, by mail, or in person.

Required documents

When applying for house tax, specific documents are typically required to support your application. Commonly needed documents include:

- Proof of property ownership, such as a deed or title.

- Previous property tax statements for reference.

- Identification documents, such as a driver’s license or state ID.

- Any supporting documents for exemptions or changes requested.

It is advisable to check with your local tax authority for any additional documentation that may be required based on your specific situation.

Form submission methods

Submitting the application for house tax can typically be done through various methods, depending on local regulations. The most common submission methods include:

- Online: Many jurisdictions offer online portals for submitting applications, making the process quicker and more efficient.

- Mail: You can print the completed application and send it via postal mail to the designated tax authority.

- In-person: Some applicants prefer to submit their forms in person at local government offices, where they can also ask questions or clarify any concerns.

Eligibility criteria

Eligibility criteria for the application for house tax can vary by state and local jurisdiction. Generally, homeowners must meet certain conditions to qualify for tax exemptions or adjustments. Common eligibility factors include:

- Ownership of the property being assessed.

- Residency status, such as being a primary residence.

- Specific circumstances, such as age, disability, or financial hardship, which may qualify for exemptions.

It is important to review the specific criteria set forth by local tax authorities to ensure compliance and maximize potential benefits.

Legal use of the application for house tax

The application for house tax must be completed and submitted in accordance with local laws and regulations to be considered legally binding. This includes adhering to deadlines and ensuring that all provided information is truthful and accurate. Failure to comply with legal requirements can result in penalties, including denial of the application or additional fines. Utilizing electronic tools for submission, such as e-signatures, can enhance the legal validity of the document, provided that all necessary legal frameworks are followed.

Quick guide on how to complete application for house tax

Complete Application For House Tax seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed materials, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Handle Application For House Tax on any platform using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to alter and eSign Application For House Tax without hassle

- Locate Application For House Tax and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Highlight important sections of the documents or conceal sensitive data using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Application For House Tax and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application for house tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a house tax request letter format in English?

A house tax request letter format in English is a structured document used to formally request information or adjustments regarding property taxes. These letters typically include details about the property owner, property address, and the specific request related to tax assessments. Having a proper format ensures clarity and professionalism in your communication with tax authorities.

-

How can airSlate SignNow help with house tax request letters?

airSlate SignNow simplifies the process of creating and sending house tax request letters by providing customizable templates. Users can easily enter relevant information into our user-friendly interface, ensuring their request adheres to the necessary format. This streamlines communication with tax authorities and helps avoid potential delays.

-

Is there a specific cost for using airSlate SignNow for a house tax request letter?

airSlate SignNow offers competitive pricing plans that accommodate businesses of all sizes, including plans designed specifically for sending house tax request letters. Each plan provides access to essential features that ensure efficient documentation and eSigning processes. Users can choose a plan that best fits their needs and budget.

-

Can I integrate airSlate SignNow with other software for managing house tax requests?

Yes, airSlate SignNow supports integrations with various applications, enabling streamlined workflows for managing house tax requests and other documents. By connecting with CRMs, project management tools, or accounting software, users can improve efficiency and maintain organization throughout the letter submission process.

-

What features does airSlate SignNow offer for creating a house tax request letter?

airSlate SignNow features a user-friendly editor that allows users to create house tax request letters quickly. It includes useful tools for signing documents, tracking status updates, and collaborating with multiple parties. These features enhance the overall effectiveness of managing your tax requests.

-

Is airSlate SignNow secure for sending sensitive house tax request information?

Absolutely! airSlate SignNow employs advanced security protocols to ensure that all documents, including house tax request letters, are securely transmitted and stored. With encryption and compliance with relevant regulations, users can trust that their sensitive information is protected throughout the entire process.

-

How long does it take to create a house tax request letter with airSlate SignNow?

Creating a house tax request letter with airSlate SignNow can be done in just a few minutes thanks to our intuitive templates and straightforward editing tools. Users can quickly input necessary information, ensuring compliance with the correct format. This efficiency translates into faster communication with tax authorities.

Get more for Application For House Tax

Find out other Application For House Tax

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation