1099 S Certification Exemption Form

What is the 1099 S Certification Exemption Form

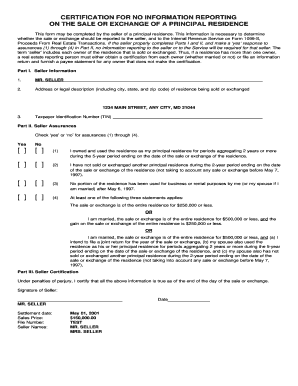

The 1099 S certification exemption form is a crucial document used in real estate transactions to report the sale or exchange of real property. This form is specifically designed to certify that the transaction is exempt from certain reporting requirements under Internal Revenue Service (IRS) regulations. The primary purpose of the 1099 S form is to ensure compliance with tax laws while protecting the privacy of the parties involved in the transaction. Understanding this form is essential for both buyers and sellers to navigate the complexities of real estate transactions effectively.

Eligibility Criteria for Exemption

Several criteria determine who is exempt from filing the 1099 S certification exemption form. Generally, individuals or entities that meet specific conditions can qualify for exemption. These conditions may include:

- Transactions involving a principal residence, where the seller has lived in the property for at least two of the last five years.

- Sales of real estate that do not result in a gain or loss, such as transfers between spouses or certain corporate reorganizations.

- Certain government entities or non-profit organizations that are exempt from federal income tax.

It is essential to review IRS guidelines to determine if your situation qualifies for exemption, as failing to meet the criteria may result in penalties or additional tax liabilities.

Steps to Complete the 1099 S Certification Exemption Form

Completing the 1099 S certification exemption form involves several key steps to ensure accuracy and compliance. Follow these steps for a successful submission:

- Gather necessary information, including the names and addresses of all parties involved in the transaction.

- Provide details about the property, including the address, sale price, and date of the transaction.

- Indicate the reason for exemption by selecting the appropriate box on the form.

- Sign and date the form to certify that the information provided is accurate and complete.

Once completed, the form should be submitted to the appropriate IRS office or retained for your records, depending on the specific requirements of the transaction.

IRS Guidelines for the 1099 S Certification Exemption Form

The IRS provides specific guidelines regarding the use of the 1099 S certification exemption form. It is important to adhere to these guidelines to avoid potential issues with tax compliance. Key points include:

- The form must be filed by the person responsible for closing the transaction, typically the closing agent or title company.

- All information must be accurate, as discrepancies can lead to audits or penalties.

- Filing deadlines are crucial; ensure that the form is submitted within the required timeframe to avoid late fees.

Consulting the IRS website or a tax professional can provide further clarity on the specific requirements and updates regarding the 1099 S certification exemption form.

Legal Use of the 1099 S Certification Exemption Form

Understanding the legal implications of the 1099 S certification exemption form is vital for all parties involved in a real estate transaction. This form serves as a legal declaration of the exemption status, which can protect individuals from unnecessary tax liabilities. Proper use of the form can prevent legal disputes and ensure that all parties comply with federal regulations. Failure to file the form when required can lead to significant penalties, including fines and interest on unpaid taxes.

Examples of Using the 1099 S Certification Exemption Form

Real-world scenarios illustrate the application of the 1099 S certification exemption form. For instance:

- A homeowner selling their primary residence for a profit may use the 1099 S certification exemption form to report the transaction, exempting them from certain tax liabilities.

- In a divorce settlement, one spouse may transfer ownership of the marital home to the other without triggering a tax event, utilizing the exemption form.

- A non-profit organization selling property as part of a charitable event may also qualify for exemption under specific IRS guidelines.

These examples highlight the importance of understanding when and how to use the 1099 S certification exemption form effectively.

Quick guide on how to complete 1099 s certification exemption form

Accomplish 1099 S Certification Exemption Form seamlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-conscious substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage 1099 S Certification Exemption Form on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign 1099 S Certification Exemption Form effortlessly

- Obtain 1099 S Certification Exemption Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Decide how you wish to send your form - by email, text (SMS), invitation link, or download it to your computer.

Leave behind lost or misplaced documents, tiring form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you select. Edit and eSign 1099 S Certification Exemption Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1099 s certification exemption form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Who is exempt from 1099 s requirements?

Generally, individuals and entities that do not meet specific income thresholds or those providing certain services are exempt from 1099 s. This includes corporations and tax-exempt organizations. Understanding who is exempt from 1099 s helps businesses avoid unnecessary paperwork and stay compliant.

-

How does airSlate SignNow streamline the 1099 s process?

airSlate SignNow simplifies the 1099 s process by enabling businesses to easily collect eSignatures and manage documents digitally. This reduces paper usage and ensures that your documents are securely stored and easily accessible. By streamlining this process, you can focus on understanding who is exempt from 1099 s rather than worrying about paperwork.

-

What features does airSlate SignNow offer for document management related to 1099 s?

airSlate SignNow offers features such as customizable templates, automated workflows, and real-time tracking for your documents. These tools assist in managing the complexities of 1099 s and keeping your compliance in check. Knowing who is exempt from 1099 s helps you utilize these features effectively.

-

Is airSlate SignNow cost-effective for small businesses dealing with 1099 s?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses, particularly when managing compliance like 1099 s. With affordable pricing plans tailored to different needs, you can efficiently handle your documentation while keeping your costs down. This is especially important when considering who is exempt from 1099 s.

-

Can airSlate SignNow integrate with accounting software for 1099 s?

Absolutely! airSlate SignNow easily integrates with major accounting software to streamline the 1099 s filing process. This integration allows you to manage your documents while also keeping track of who is exempt from 1099 s within your financial records.

-

What are the benefits of using airSlate SignNow for handling 1099 s?

The primary benefits of using airSlate SignNow for 1099 s include enhanced efficiency, reduced errors, and improved compliance. With easy tracking and eSign capabilities, businesses can save time and ensure they are aware of who is exempt from 1099 s regulations. This ultimately leads to better resource management.

-

How can airSlate SignNow help educate employees on 1099 s exemptions?

airSlate SignNow provides resources and templates that can be shared with employees to educate them about 1099 s exemptions. By providing clarity on who is exempt from 1099 s, you empower your team to make informed decisions. This educational approach fosters a better understanding of compliance within your organization.

Get more for 1099 S Certification Exemption Form

Find out other 1099 S Certification Exemption Form

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free