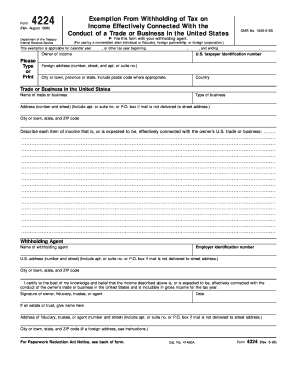

Form 4224 Irs

What is the IRS Form 4224?

The IRS Form 4224 is a document used by foreign individuals and entities to claim exemption from withholding on certain types of income. This form is specifically designed for non-resident aliens and foreign corporations that receive income from U.S. sources. By submitting Form 4224, taxpayers can assert their eligibility for reduced withholding rates or exemptions based on applicable tax treaties between their home country and the United States.

How to Use the IRS Form 4224

To effectively use the IRS Form 4224, individuals must first determine their eligibility for exemption from withholding. This involves understanding the types of income they receive and whether a tax treaty applies. Once eligibility is confirmed, the form must be completed accurately, providing necessary information such as the taxpayer's name, address, and the specific income type. After filling out the form, it should be submitted to the withholding agent or payer, who will then apply the appropriate withholding rate based on the information provided.

Steps to Complete the IRS Form 4224

Completing the IRS Form 4224 involves several key steps:

- Gather necessary information, including your tax identification number and details about the income you expect to receive.

- Fill out the form, ensuring all sections are completed accurately, including personal identification and income details.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the withholding agent or payer to ensure proper processing.

Legal Use of the IRS Form 4224

The legal use of the IRS Form 4224 hinges on its correct completion and submission. It is essential for taxpayers to ensure that they meet the eligibility criteria for exemption from withholding. Misuse of the form or providing inaccurate information can lead to penalties and increased withholding rates. Compliance with IRS regulations is crucial to maintain the legal standing of the form and to benefit from any applicable tax treaty provisions.

Eligibility Criteria for the IRS Form 4224

To qualify for the IRS Form 4224, taxpayers must meet specific eligibility criteria:

- Be a non-resident alien or a foreign corporation.

- Receive income from U.S. sources that is subject to withholding.

- Be eligible for a reduced withholding rate or exemption under a tax treaty.

Form Submission Methods

The IRS Form 4224 can be submitted through various methods, depending on the preferences of the taxpayer and the requirements of the withholding agent:

- Online submission, if the withholding agent accepts electronic forms.

- Mailing the completed form directly to the withholding agent.

- In-person delivery, if applicable, to ensure immediate processing.

Quick guide on how to complete form 4224 irs

Prepare Form 4224 Irs effortlessly on any device

Digital document management has become widespread among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly and without interruptions. Manage Form 4224 Irs on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign Form 4224 Irs seamlessly

- Obtain Form 4224 Irs and then click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere moments and carries the same legal validity as a traditional handwritten signature.

- Verify the information and then click on the Done button to save your modifications.

- Select how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, time-consuming form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from a device of your choice. Modify and eSign Form 4224 Irs and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4224 irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 4224 and how does it relate to airSlate SignNow?

IRS Form 4224 is a document used by foreign individuals to claim exemption from withholding on specific types of income. With airSlate SignNow, you can seamlessly eSign and send IRS Form 4224, ensuring compliance while also simplifying your document management process.

-

How does airSlate SignNow ensure the security of IRS Form 4224?

airSlate SignNow uses advanced encryption methods to protect your IRS Form 4224 and ensure that sensitive information remains confidential. With two-factor authentication and strict compliance protocols, you can trust that your eSigned forms are safe.

-

What are the pricing plans for using airSlate SignNow for IRS Form 4224?

airSlate SignNow offers several pricing plans that cater to different business needs, making it cost-effective for handling IRS Form 4224. You have the option to choose a plan based on the number of users and features required, ensuring you only pay for what you need.

-

Can I integrate airSlate SignNow with other tools for managing IRS Form 4224?

Yes, airSlate SignNow provides integrations with various applications such as CRM systems, document management platforms, and more, allowing for efficient handling of IRS Form 4224. This helps streamline your workflow and enhances productivity.

-

What features does airSlate SignNow offer for eSigning IRS Form 4224?

airSlate SignNow includes an easy-to-use interface for eSigning IRS Form 4224, along with features like text tagging, templates, and real-time tracking. These tools simplify the signing process and make it easier to manage important documents.

-

Is it possible to save templates for IRS Form 4224 in airSlate SignNow?

Absolutely! airSlate SignNow allows you to create and save templates for IRS Form 4224, which can be reused for future transactions. This feature saves time and ensures consistency across your documents.

-

What are the benefits of using airSlate SignNow for IRS Form 4224?

Using airSlate SignNow for IRS Form 4224 provides numerous benefits such as increased efficiency, reduced errors, and quick turnaround times. The platform simplifies document management and helps you maintain compliance with IRS regulations.

Get more for Form 4224 Irs

- Application form metedeconk river yacht club mryc metedeconkriveryc

- Waxing consent form

- Id badge request form upmc presbyterian staff of upmc presbyterian may use this form to request a replacement identification

- Bpi downloadable forms

- Fcc form 605

- Guardsman recruitment 2020 form

- High school dodgeball tournament registration form

- Afs travel form pdf fill up

Find out other Form 4224 Irs

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure