Software to Creat a Balance from Income Statement Form

Key elements of the business income statement

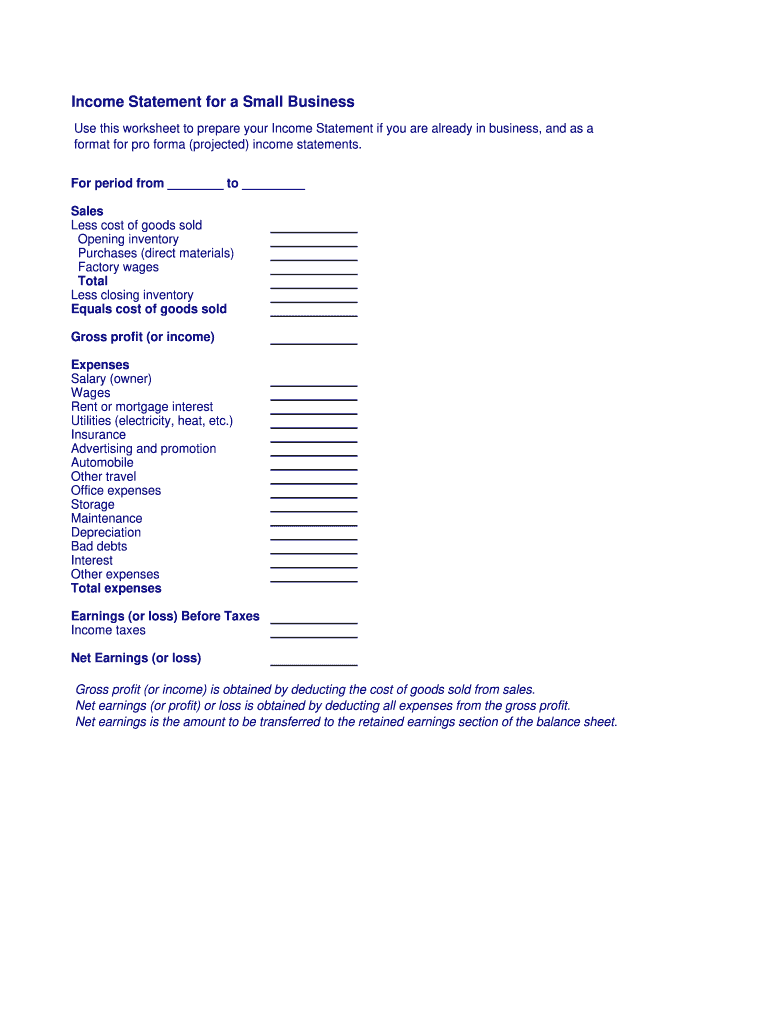

A business income statement, also known as a profit and loss statement, summarizes the revenues and expenses of a business over a specific period. Understanding its key elements is crucial for accurate financial reporting. The main components include:

- Revenue: This is the total income generated from sales of goods or services before any expenses are deducted.

- Cost of Goods Sold (COGS): This represents the direct costs attributable to the production of the goods sold by the business.

- Gross Profit: Calculated by subtracting COGS from revenue, this figure indicates the profitability of core business activities.

- Operating Expenses: These are the costs required to run the business that are not directly tied to the production of goods or services, such as rent, utilities, and salaries.

- Net Income: This is the final profit or loss after all revenues and expenses are accounted for, indicating the overall financial health of the business.

Steps to complete the business income statement

Completing a business income statement involves several systematic steps to ensure accuracy and compliance. Here’s a simple guide:

- Gather financial data: Collect all relevant financial documents, including sales records, expense receipts, and bank statements.

- Calculate total revenue: Sum all income generated from sales for the reporting period.

- Determine COGS: Identify and calculate all direct costs associated with producing the goods sold.

- Calculate gross profit: Subtract COGS from total revenue.

- List operating expenses: Itemize all operating expenses incurred during the period.

- Calculate net income: Subtract total operating expenses from gross profit to arrive at net income.

Legal use of the business income statement

Understanding the legal implications of the business income statement is essential for compliance and transparency. This document serves as a formal record of a company's financial performance and is often required for:

- Tax filings: The income statement is used to report earnings to the IRS and determine tax obligations.

- Loan applications: Lenders often request income statements to assess the financial stability of a business before granting loans.

- Investor relations: Potential investors may require access to income statements to evaluate the profitability and viability of a business.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines for preparing and submitting business income statements. Key points to consider include:

- Accrual vs. cash basis: Businesses must choose between these accounting methods, which affect how income and expenses are reported.

- Form 1065 or 1120: Depending on the business structure, different forms may need to be filed along with the income statement.

- Record retention: The IRS requires businesses to keep records supporting the figures reported in the income statement for a minimum of three years.

Examples of using the business income statement

Utilizing a business income statement can provide valuable insights into a company's financial performance. Here are some practical examples:

- Performance analysis: Business owners can compare income statements over multiple periods to identify trends in revenue and expenses.

- Budgeting: The income statement aids in setting future budgets by analyzing past performance and predicting future revenues and costs.

- Financial forecasting: By understanding historical performance, businesses can make informed predictions about future profitability and cash flow.

Form submission methods

Submitting a business income statement can be done through various methods, depending on the requirements of the IRS or other stakeholders. Common submission methods include:

- Online filing: Many businesses opt for electronic submission through tax software, which can streamline the process and reduce errors.

- Mail: Physical copies can be mailed to the IRS or relevant parties, ensuring that all required signatures and documentation are included.

- In-person submission: Some businesses may choose to submit documents directly at local IRS offices, especially when immediate assistance is needed.

Quick guide on how to complete business income statement template pdf form

The optimal method to obtain and sign Software To Creat A Balance From Income Statement

On a broader scale across your entire organization, ineffective workflows surrounding document authorization can take up signNow working hours. Signing documents such as Software To Creat A Balance From Income Statement is an inherent aspect of operations in any organization, which is why the effectiveness of each agreement’s lifecycle has such a considerable impact on the company’s overall productivity. With airSlate SignNow, signing your Software To Creat A Balance From Income Statement can be as effortless and quick as possible. This platform provides you with the latest version of nearly any form. Even better, you can sign it instantly without the need to install external software on your device or print anything as physical copies.

Steps to obtain and sign your Software To Creat A Balance From Income Statement

- Browse our library by category or use the search bar to find the document you require.

- Examine the form preview by clicking Learn more to verify it’s the correct one.

- Hit Get form to start editing immediately.

- Fill in your form and include any necessary information using the toolbar.

- Once finished, click the Sign tool to sign your Software To Creat A Balance From Income Statement.

- Choose the signature style that is most suitable for you: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to complete the editing process and proceed to document-sharing options as necessary.

With airSlate SignNow, you possess everything required to handle your documentation efficiently. You can discover, complete, modify, and even send your Software To Creat A Balance From Income Statement all in one tab with no complications. Simplify your workflows with a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How do I fill a form which is PDF?

You can try out Fill which had a free forever plan and requires no download. You simply upload your PDF and then fill it in within the browser:UploadFillDownloadIf the fields are live, as in the example above, simply fill them in. If the fields are not live you can drag on the fields to complete it quickly. Once you have completed the form click the download icon in the toolbar to download a copy of the finished PDF. Or send it for signing.Open a free account on Fill here

-

How can I electronically fill out a PDF form?

You’ll need a PDF editor to fill out forms. I recommend you PDF Expert, it’s a great solution for Mac.What forms it supports:Acro forms created in signNow or similar programs.Static XFA forms created in signNow LiveCycle.PDF Expert supports checkboxes and text fields. Just click them and type what you need.If your form is non-interactive, you can type on it using the ‘Text’ tool (go to the ‘Annotate’ tab > ‘Text’).For a non-interactive checkbox, you can use the ‘Stamp’ tool or just type ‘x’ on it.For a more detailed tutorial, check the article “How to fill out a PDF form on Mac”. And here are the guides on how to fill out different tax forms.Hopefully, this helps!

-

How do you fill out a form scanned as a PDF?

If you have Acrobat Reader or Foxit Phantom, you can add form to the PDF file you want to fill in. Refer to the screenshot here (Phantom). First click on Form, then you can pick option you want for your form (Text Field, Check box…) and draw it where you want to input your data. You can also change font and size of it to fit the existing text. When you are done adding the fields, you can just click on the hand icon, and you can now fill in your form and then save it as.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

What is the best way to fill out a PDF form?

If you are a user of Mac, iPhone or iPad, your tasks will be quickly and easily solved with the help of PDF Expert. Thanks to a simple and intuitive design, you don't have to dig into settings and endless options. PDF Expert also allows you to view, edit, reduce, merge, extract, annotate important parts of documents in a click. You have a special opportunity to try it on your Mac for free!

-

As a business owner, what online/offline templates would you benefit from having (e.g. a template to fill out and send invoices, business plan templates, etc.)?

One awesome highlight of ZipBooks’ invoice templates is that you can save default settings like your notes and payment terms for your invoices once you nail down the details of what exactly should be on your invoice. Using ZipBooks for your invoice means never sending off an invoice without your own company information on it (oops!). They actually score your invoice based on what information you include and so you'll be able to leverage the data we've collected from tens of thousands of invoices on what things are important to get you paid faster.Here are a couple tips on things that you will get you paid faster and should definitely be included on your invoice:Company logo: This is part of the invoice template that we provide for you. You'll save a company logo under company settings and you'll never have to think about whether your invoice template header looks good again.Notes: Thanking a customer for their business will always make you stand out in a crowd and leverages the psychological principle of reciprocity so that you get paid faster. Lots of studies show that including a thank you note gets you paid faster. I think that would especially be true when someone is getting a big bill for legal services.Invoice payment terms: Another great free feature of ZipBooks invoice templates for legal services (and anyone else who used our invoice templates for that matter) is that when you put terms into an invoice, we automatically detected it and set a due date for you. If you don't set terms, we assume that the invoice will be due in 14 days. This is the due date that we use to drive the late payment reminder and to display the number of days that a invoice has been outstanding in the AR aging report. If you don't want to set the invoice payment terms every time, you can set it up once under Account Preferences in the ZipBooks app. Pretty neat, right?Customer information: This one might seem pretty straightforward but it should always be on the list of "must haves" when thinking about what you should put on your invoice.Detailed description of bill: ZipBooks' invoice template lends itself to the ability to show a detailed account of everything that you have charged since you last sent an invoice. You can do that by manually entering the invoice details or you can use the time tracker to automatically pull in billable activity once you are ready to send the next invoice for your legal services.

-

Is it possible to display a PDF form on mobile web to fill out and get e-signed?

Of course, you can try a web called eSign+. This site let you upload PDF documents and do some edition eg. drag signature fields, add date and some informations. Then you can send to those, from whom you wanna get signatures.

Create this form in 5 minutes!

How to create an eSignature for the business income statement template pdf form

How to create an eSignature for the Business Income Statement Template Pdf Form online

How to make an eSignature for your Business Income Statement Template Pdf Form in Chrome

How to create an eSignature for putting it on the Business Income Statement Template Pdf Form in Gmail

How to make an electronic signature for the Business Income Statement Template Pdf Form straight from your smart phone

How to create an eSignature for the Business Income Statement Template Pdf Form on iOS

How to make an electronic signature for the Business Income Statement Template Pdf Form on Android devices

People also ask

-

What is a business income statement and why is it important?

A business income statement is a financial report that summarizes revenues, costs, and expenses incurred during a specific period. It provides crucial insights into profitability and helps stakeholders make informed decisions. Having a clear income statement can guide businesses in identifying trends and areas for improvement.

-

How does airSlate SignNow help in preparing a business income statement?

airSlate SignNow offers tools that facilitate document management, allowing you to gather financial data required for your business income statement efficiently. You can create, share, and eSign documents securely, ensuring that all financial figures are accurate and up-to-date. This streamlines the process of preparing crucial financial reports.

-

What are the pricing options for airSlate SignNow when handling business income statements?

airSlate SignNow provides flexible pricing plans that cater to various business sizes and needs. These plans ensure you have access to the features necessary for easily managing documents related to your business income statement. By choosing a plan that fits your budget, you can simplify financial reporting without compromising on functionality.

-

Can I integrate airSlate SignNow with accounting software to manage my business income statement?

Yes, airSlate SignNow allows seamless integrations with popular accounting software. This compatibility ensures that your financial documents, including your business income statement, are easily updated and maintained. Integrating these tools helps streamline your accounting processes and enhances overall productivity.

-

What are the key features of airSlate SignNow that assist with business income statements?

Key features of airSlate SignNow include document templates, electronic signatures, and audit trails. These tools ensure that your business income statement is accurately filled out, secured, and tracked throughout the signing process. With such features, creating and managing essential financial documents becomes a straightforward task.

-

How can I ensure the security of my business income statement using airSlate SignNow?

airSlate SignNow employs robust security measures such as encryption and secure data storage to protect your business income statement. You can also set permissions to control who has access to sensitive financial documents. This ensures that your financial data remains confidential and secure during the eSigning process.

-

Is airSlate SignNow user-friendly for creating a business income statement?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to create and manage a business income statement. The intuitive interface allows users to navigate through the document creation process quickly, reducing the learning curve and enabling efficient workflow.

Get more for Software To Creat A Balance From Income Statement

- Dartmouth coop questionnaire pdf form

- Wage statement template form

- Nurse practitioner job application form

- Worksheet 9 2 math 7 answer key form

- Qme notification form

- Retail water facility license application form

- Background check kings recruit form

- St aloysius catholic church youth ministry permission form saintaloysiuschurch

Find out other Software To Creat A Balance From Income Statement

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple