Sdr1 Form

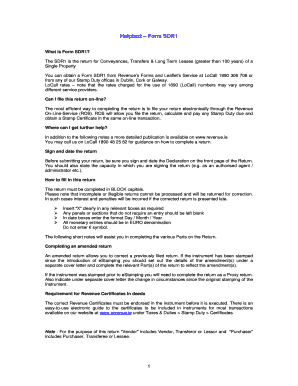

What is the sdr1?

The sdr1 form, also known as the sdr1 revenue form, is a critical document used in various financial and tax-related processes. It serves as a means for individuals and businesses to report specific revenue information to the relevant authorities. This form is particularly significant for compliance with state and federal regulations, ensuring that all reported income is accurately documented and accounted for. The sdr1 is essential for maintaining transparency in financial dealings and is often required during audits or financial reviews.

How to use the sdr1

Using the sdr1 form involves several straightforward steps. First, gather all necessary financial documents that pertain to your revenue for the reporting period. This may include income statements, invoices, and receipts. Next, accurately fill out the form with the required information, ensuring that all entries are correct and complete. It is crucial to double-check figures to avoid discrepancies. Once completed, the form can be submitted electronically or via traditional mail, depending on the requirements of the issuing authority.

Steps to complete the sdr1

Completing the sdr1 form involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather necessary documentation, including income records and previous tax filings.

- Fill in personal or business identification details as requested on the form.

- Report revenue figures accurately, ensuring all calculations are correct.

- Review the completed form for any errors or omissions.

- Submit the form according to the specified method, whether online or by mail.

Legal use of the sdr1

The legal use of the sdr1 form is governed by various state and federal regulations. To ensure that the form is legally binding, it must be completed accurately and submitted within the designated timeframes. Compliance with laws such as the Internal Revenue Code and state tax regulations is essential. Additionally, utilizing a reliable platform for electronic submission, such as airSlate SignNow, enhances the legal validity of the document by providing a secure and compliant method for eSigning.

Who issues the form?

The sdr1 form is typically issued by state revenue departments or tax authorities. These organizations are responsible for collecting and processing tax-related documents, including the sdr1. The specific issuing authority may vary depending on the state in which the taxpayer resides or operates a business. It is important to verify the correct issuing body to ensure compliance with local regulations and requirements.

Filing deadlines / Important dates

Filing deadlines for the sdr1 form can vary based on state regulations and the type of revenue being reported. Generally, it is advisable to submit the form by the end of the tax year or as specified by the issuing authority. Important dates to keep in mind include:

- Annual filing deadline for the sdr1 form.

- Quarterly reporting deadlines, if applicable.

- Any extensions granted by the state revenue department.

Examples of using the sdr1

There are various scenarios in which the sdr1 form may be utilized. For instance, a self-employed individual may use the form to report income from freelance work. Similarly, a small business may need to file the sdr1 to report revenue from sales and services. Each example underscores the form's role in ensuring accurate revenue reporting and compliance with tax obligations.

Quick guide on how to complete sdr1

Complete Sdr1 effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to generate, alter, and eSign your documents swiftly without delays. Handle Sdr1 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to alter and eSign Sdr1 with ease

- Obtain Sdr1 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or mask sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information carefully and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors necessitating the printing of new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Sdr1 to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sdr1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is sdr1 and how does it relate to airSlate SignNow?

sdr1 is a key feature of airSlate SignNow that enhances the document signing process. It allows users to streamline their workflows by automating repetitive tasks, providing a cost-effective solution for businesses looking to manage documents more efficiently.

-

How much does airSlate SignNow's sdr1 feature cost?

The pricing for using the sdr1 feature with airSlate SignNow is competitive and designed to fit various budgets. The platform offers flexible subscription plans that can accommodate the needs of small businesses to larger enterprises, making it a great value for efficient eSigning solutions.

-

What are the key features of sdr1 in airSlate SignNow?

The sdr1 feature in airSlate SignNow includes capabilities such as automated document routing, built-in templates, and comprehensive tracking of document statuses. These features enable users to facilitate the eSigning process, ensuring faster transaction times and improved productivity.

-

How can sdr1 benefit my business?

By utilizing the sdr1 feature in airSlate SignNow, businesses can signNowly reduce the time spent on document management. It fosters better collaboration among team members, improves turnaround times for agreements, and ultimately enhances customer satisfaction through faster service delivery.

-

Can airSlate SignNow's sdr1 integrate with other software and tools?

Yes, airSlate SignNow’s sdr1 feature is designed to integrate seamlessly with various third-party applications. This includes popular CRM systems and document management tools, allowing users to maintain a cohesive workflow without switching between different platforms.

-

Is there a free trial available for airSlate SignNow's sdr1 feature?

Absolutely! airSlate SignNow offers a free trial for users looking to explore the capabilities of the sdr1 feature. This trial period allows potential customers to test the platform, evaluate its functionality, and determine its fit for their document signing needs.

-

What types of businesses can benefit from using airSlate SignNow's sdr1?

Businesses of all sizes can benefit from airSlate SignNow's sdr1 feature, ranging from startups to large enterprises. The flexibility and ease of use cater to diverse industries, making it an attractive option for legal, real estate, and sales teams seeking efficient document handling solutions.

Get more for Sdr1

- Sers 131 request for purchase of service sers 131 pdf form

- Posadas sentinel application form

- The last black man in san francisco script form

- Ibm payslip form

- Pdf filler pest control form

- Suit affecting the parent child relationship texas form

- Amoeba sisters video recap food chains food webs and an introduction to biodiversity form

- Appendix kpreparati on guidelines for project repor t form

Find out other Sdr1

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter