Form 941n

What is the Form 941n

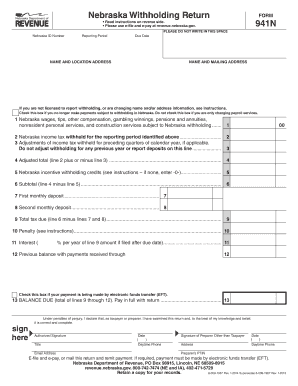

The Form 941n is a tax document used by employers in Nebraska to report wages, tips, and other compensation paid to employees, as well as to calculate and remit payroll taxes. This form is essential for compliance with federal tax regulations and helps ensure that employers meet their tax obligations. It is specifically designed for businesses that are required to file quarterly payroll tax returns. Understanding the purpose and requirements of the Form 941n is crucial for maintaining accurate financial records and avoiding potential penalties.

How to use the Form 941n

Using the Form 941n involves several steps to ensure accurate reporting of payroll information. First, employers must gather all necessary data, including employee wages and tax withholdings. Next, the form needs to be filled out carefully, ensuring that all sections are completed accurately. Employers can file the Form 941n electronically through a secure platform, which streamlines the submission process and ensures compliance with federal regulations. It is important to keep a copy of the submitted form for record-keeping purposes.

Steps to complete the Form 941n

Completing the Form 941n involves a systematic approach:

- Gather all relevant payroll records, including total wages paid and taxes withheld.

- Enter the employer identification number (EIN) and the quarter for which the form is being filed.

- Complete the sections detailing employee wages, tips, and other compensation.

- Calculate the total taxes owed based on the provided information.

- Review the completed form for accuracy before submission.

- Submit the form electronically or by mail, depending on your preferred method.

Legal use of the Form 941n

The legal use of the Form 941n is governed by federal tax laws, which dictate how employers must report payroll information. To ensure that the form is legally binding, it must be completed accurately and submitted on time. Employers should be aware of the legal implications of filing incorrect information, which can result in penalties or audits. Using a reliable electronic signature solution can help validate the submission and maintain compliance with legal requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Form 941n are crucial for employers to avoid penalties. Typically, the form must be submitted quarterly, with specific deadlines for each quarter:

- First quarter (January to March): Due by April 30

- Second quarter (April to June): Due by July 31

- Third quarter (July to September): Due by October 31

- Fourth quarter (October to December): Due by January 31 of the following year

Employers should mark these dates on their calendars to ensure timely filing and compliance with tax obligations.

Form Submission Methods (Online / Mail / In-Person)

Employers have several options for submitting the Form 941n. The most efficient method is electronic filing, which allows for quick processing and confirmation of receipt. Alternatively, employers can choose to mail the form to the appropriate IRS address, ensuring it is postmarked by the deadline. In-person submission is generally not recommended, as electronic and mail options are more secure and provide better tracking of the submission status. It is important to choose a method that aligns with your business practices and compliance needs.

Quick guide on how to complete form 941n

Effortlessly Prepare Form 941n on Any Device

Digital document management has become increasingly popular among organizations and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Form 941n on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

The simplest way to alter and eSign Form 941n with ease

- Locate Form 941n and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 941n and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 941n

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 941n online form and why is it important?

The 941n online form is used by employers to report income taxes withheld from employee wages, along with Social Security and Medicare taxes. It's crucial for compliance with IRS regulations, and using airSlate SignNow to eSign and submit this form simplifies the process, ensuring accuracy and timely submission.

-

How does airSlate SignNow help with eSigning the 941n online form?

airSlate SignNow offers an intuitive platform for eSigning documents, making it easy to complete the 941n online form quickly. With a user-friendly interface, you can sign, send, and manage your forms efficiently, ensuring that you meet all deadlines without hassle.

-

What are the pricing options for using airSlate SignNow for the 941n online form?

airSlate SignNow provides transparent pricing plans tailored to various needs, starting from a basic package to advanced features. Depending on your requirements for managing documents, you can choose the most cost-effective option, making it affordable to handle your 941n online form needs.

-

Are there any features specific to managing the 941n online form in airSlate SignNow?

Yes, airSlate SignNow includes features like templates for the 941n online form, automated reminders for deadlines, and secure storage for your signed documents. These features streamline your workflow, helping you stay organized and compliant.

-

Can I integrate airSlate SignNow with other applications for processing the 941n online form?

Absolutely! airSlate SignNow supports integrations with various applications, such as accounting software, which can facilitate easy data transfer for completing the 941n online form. This connectivity enhances your overall productivity and efficiency.

-

What security measures does airSlate SignNow implement for sensitive documents like the 941n online?

airSlate SignNow prioritizes your security with top-tier encryption protocols and secure user authentication processes. This ensures that your sensitive information related to the 941n online form is protected at all times during the signing and storage process.

-

How does airSlate SignNow improve the efficiency of submitting the 941n online form?

By utilizing airSlate SignNow for the 941n online form, you can expedite the entire signing process through easy collaboration and digital workflows. This reduces the time spent on paperwork, allowing you to focus on other important business tasks.

Get more for Form 941n

Find out other Form 941n

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy