Crs 1 Form

What is the CRS 1 Form

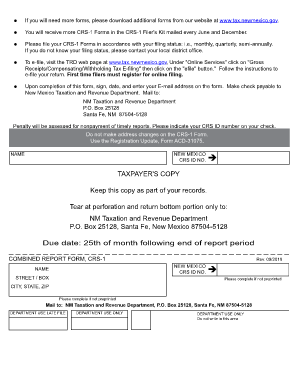

The CRS 1 form is a crucial document used in the context of tax reporting and compliance in the United States. It is primarily utilized by individuals and businesses to report certain financial information to the Internal Revenue Service (IRS). This form plays a significant role in ensuring that all relevant income and tax obligations are accurately documented and submitted. Understanding the purpose and requirements of the CRS 1 form is essential for maintaining compliance with federal tax laws.

How to Use the CRS 1 Form

Using the CRS 1 form involves several key steps. First, ensure that you have the most current version of the form, as tax regulations may change annually. Fill out the form with accurate financial information, including income details and any deductions or credits you may be eligible for. It is important to review the completed form for accuracy before submission. Once filled out, the CRS 1 form can be submitted electronically or via traditional mail, depending on your preference and the requirements set by the IRS.

Steps to Complete the CRS 1 Form

Completing the CRS 1 form requires careful attention to detail. Here are the essential steps:

- Gather all necessary financial documents, including income statements and previous tax returns.

- Download the CRS 1 form from the IRS website or access it through a reliable tax software.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income accurately, ensuring all sources are included.

- Claim any applicable deductions or credits to reduce your taxable income.

- Review the form for any errors or omissions before submission.

- Submit the form electronically or by mail, following the IRS guidelines for your chosen method.

Legal Use of the CRS 1 Form

The CRS 1 form is legally binding when filled out and submitted in accordance with IRS regulations. To ensure its legal validity, it is essential to provide accurate and truthful information. Any discrepancies or false information can lead to penalties, including fines or legal action. Utilizing a secure electronic signature solution, like airSlate SignNow, can further enhance the legal standing of the form by providing a verifiable audit trail and compliance with eSignature laws.

Filing Deadlines / Important Dates

Filing deadlines for the CRS 1 form are critical to avoid penalties. Typically, the form must be submitted by a specific date each tax year, often aligned with the general tax filing deadline of April 15. However, if you require an extension, it is essential to file the necessary paperwork to avoid late fees. Keeping track of these important dates ensures that you remain compliant and avoid any unnecessary complications with the IRS.

Required Documents

To complete the CRS 1 form accurately, several documents are required. These typically include:

- W-2 forms from employers, detailing annual income.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses, such as business-related costs.

- Previous year’s tax return for reference.

Having these documents organized and readily available will facilitate a smoother completion process for the CRS 1 form.

Quick guide on how to complete crs 1 form

Complete Crs 1 Form effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your paperwork promptly without delays. Handle Crs 1 Form on any device using airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to alter and eSign Crs 1 Form effortlessly

- Find Crs 1 Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight relevant portions of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as an ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of submitting your form, either by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing additional copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device. Alter and eSign Crs 1 Form and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the crs 1 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a CRS 1 form?

The CRS 1 form is a critical document used in various financial and legal transactions, facilitating the collection of essential information. Understanding its structure and requirement is vital for compliance and accuracy. airSlate SignNow supports the completion and e-signing of the CRS 1 form efficiently.

-

How can I use the airSlate SignNow for the CRS 1 form?

You can easily upload the CRS 1 form to airSlate SignNow and send it out for e-signature. Our platform enables seamless document management, allowing you to track the signing process in real-time. This ensures that you stay organized and that your CRS 1 form is completed promptly.

-

Is airSlate SignNow affordable for small businesses needing the CRS 1 form?

Yes, airSlate SignNow offers cost-effective pricing plans that cater to businesses of all sizes, including small businesses. The ability to manage documents like the CRS 1 form without breaking the bank makes it an attractive option. With various subscription tiers, you can choose the plan that best fits your budget and needs.

-

What features does airSlate SignNow offer for managing the CRS 1 form?

AirSlate SignNow provides a range of features such as customizable templates, secure e-signatures, and document tracking specifically tailored for forms like the CRS 1. Additionally, you can automate reminders to ensure that your recipients complete the CRS 1 form on time. These features optimize your workflow and enhance productivity.

-

Can I integrate airSlate SignNow with other tools for the CRS 1 form?

Absolutely! airSlate SignNow offers integrations with various popular business applications. Whether you use CRM, project management, or accounting software, you can link these tools to streamline the process of preparing and managing your CRS 1 form.

-

What are the benefits of using airSlate SignNow for the CRS 1 form?

Using airSlate SignNow for the CRS 1 form provides numerous benefits, including increased efficiency, cost savings, and improved security. The platform allows for fast e-signing without the hassle of printing and scanning, ensuring both speed and convenience. You can also rest assured that your documents are protected with top-notch security measures.

-

Is it easy to track the status of the CRS 1 form in airSlate SignNow?

Yes, airSlate SignNow allows you to easily track the status of your CRS 1 form. You can monitor when it's sent, viewed, signed, and completed, ensuring you stay informed throughout the process. This tracking feature helps you manage your documents effectively and prevents any delays.

Get more for Crs 1 Form

Find out other Crs 1 Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation