Where Do You Mail a Revenue Form K 4 to

What is the Revenue Form K-4?

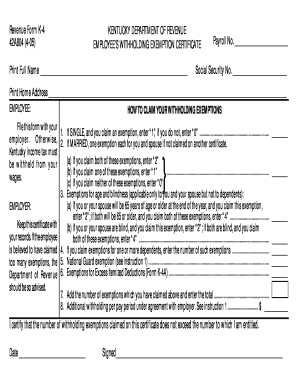

The Revenue Form K-4 is a tax document used in the United States, specifically for reporting income tax withholding for employees and certain payments. This form is essential for both employers and employees, as it helps ensure that the correct amount of state income tax is withheld from wages. The K-4 form provides information about the employee's residency status and any additional withholding allowances they may claim.

Steps to complete the Revenue Form K-4

Completing the Revenue Form K-4 involves several straightforward steps:

- Obtain the form from the appropriate state tax authority or download it from their website.

- Fill in personal information, including your name, address, and Social Security number.

- Indicate your residency status and any additional allowances you wish to claim.

- Review the completed form for accuracy.

- Sign and date the form to validate it.

How to obtain the Revenue Form K-4

The Revenue Form K-4 can be obtained through various methods:

- Visit the website of your state’s tax authority to download a digital copy.

- Request a physical copy by contacting your state tax office directly.

- Check with your employer, as they may provide the form during onboarding or tax season.

Form Submission Methods

You can submit the Revenue Form K-4 through several methods, depending on your state's guidelines:

- Mail the completed form to the address specified by your state tax authority.

- Submit the form electronically if your state offers online filing options.

- Deliver the form in person to your local tax office, if applicable.

IRS Guidelines

The Internal Revenue Service (IRS) provides guidelines for the use of the Revenue Form K-4, ensuring compliance with federal tax laws. While the K-4 is primarily a state form, it is essential to understand how it interacts with federal tax requirements. Taxpayers should ensure that the information reported on the K-4 aligns with their federal tax filings to avoid discrepancies.

Penalties for Non-Compliance

Failure to correctly complete and submit the Revenue Form K-4 may result in penalties imposed by the state tax authority. These penalties can include:

- Fines for late submission or incorrect information.

- Increased tax liability due to improper withholding.

- Potential audits or further scrutiny from tax authorities.

Quick guide on how to complete where do you mail a revenue form k 4 to

Effortlessly prepare Where Do You Mail A Revenue Form K 4 To on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without complications. Manage Where Do You Mail A Revenue Form K 4 To on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Where Do You Mail A Revenue Form K 4 To seamlessly

- Find Where Do You Mail A Revenue Form K 4 To and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize signNow sections of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Choose how you wish to send your form: via email, text message (SMS), invitation link, or download it to your PC.

Say goodbye to lost or misplaced documents, frustrating form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Modify and eSign Where Do You Mail A Revenue Form K 4 To and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the where do you mail a revenue form k 4 to

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Where do you mail a Revenue Form K 4 to for processing?

You should mail a Revenue Form K 4 to the designated address provided by your state's revenue department. It's essential to ensure that you have the correct mailing address to avoid any delays in processing. Check your local revenue department's website for the most accurate and updated information on where to mail a Revenue Form K 4.

-

What features does airSlate SignNow offer for handling Revenue Form K 4?

airSlate SignNow provides a straightforward platform for eSigning and sending various documents, including Revenue Form K 4. With features like document editing, audit trails, and guided workflows, you can easily manage your forms securely and efficiently. This streamlines the process and ensures your Revenue Form K 4 is completed accurately.

-

How can airSlate SignNow help with the eSigning of a Revenue Form K 4?

With airSlate SignNow, you can effortlessly eSign Revenue Form K 4, making the entire process faster and more efficient. The platform allows you to add signatures, dates, and initial fields seamlessly. This eliminates the need for physical mailing and reduces turnaround time for your important documents.

-

Is there a cost associated with using airSlate SignNow for Revenue Form K 4?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of businesses of all sizes. You can choose from a basic plan to more advanced options depending on the volume of documents you need to send and sign. Regardless of the plan, airSlate SignNow provides a cost-effective solution for managing your Revenue Form K 4 efficiently.

-

Are there integration options available with airSlate SignNow for handling Revenue Form K 4?

Absolutely! airSlate SignNow integrates with a wide range of applications such as Google Drive, Dropbox, and Zapier, enabling you to manage and send your Revenue Form K 4 effortlessly. These integrations enhance the functionality of airSlate SignNow, making it easier to work with your existing tools and workflows.

-

What are the benefits of using airSlate SignNow for Revenue Form K 4?

Using airSlate SignNow to manage your Revenue Form K 4 offers numerous benefits including time savings, enhanced security, and reduced costs. By eSigning and sending documents digitally, you minimize delays caused by physical mailing. Plus, the platform ensures that your sensitive information is protected with robust security measures.

-

Can I track the status of my Revenue Form K 4 sent via airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking of your documents. You will receive notifications about the status of your Revenue Form K 4, so you know exactly when it has been viewed and signed. This feature ensures transparency and helps in managing important deadlines.

Get more for Where Do You Mail A Revenue Form K 4 To

- 101 reasons to use legalshield form

- Publications forms link dpf 44s

- Box and whisker plot worksheet form

- Fl 306 form

- Heavy driver experience certificate format

- Drug incident report form alberta college of pharmacists

- Department of inspections licenses and permits form

- Seller information sheet template

Find out other Where Do You Mail A Revenue Form K 4 To

- Can I Electronic signature Florida Promissory Note Template

- How To Electronic signature Hawaii Promissory Note Template

- Electronic signature Indiana Promissory Note Template Now

- Electronic signature Kansas Promissory Note Template Online

- Can I Electronic signature Louisiana Promissory Note Template

- Electronic signature Rhode Island Promissory Note Template Safe

- How To Electronic signature Texas Promissory Note Template

- Electronic signature Wyoming Indemnity Agreement Template Free

- Electronic signature Iowa Bookkeeping Contract Safe

- Electronic signature New York Bookkeeping Contract Myself

- Electronic signature South Carolina Bookkeeping Contract Computer

- Electronic signature South Carolina Bookkeeping Contract Myself

- Electronic signature South Carolina Bookkeeping Contract Easy

- How To Electronic signature South Carolina Bookkeeping Contract

- How Do I eSignature Arkansas Medical Records Release

- How Do I eSignature Iowa Medical Records Release

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile