Property Supplement Form

What is the Property Supplement Form

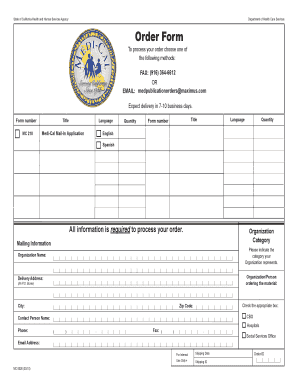

The Property Supplement Form, often referred to as the mc210ps, is a crucial document used in the context of Medi-Cal applications. This form allows applicants to report property ownership and other relevant assets, which are essential for determining eligibility for Medi-Cal benefits. Understanding the purpose of this form is vital for individuals seeking assistance, as it helps ensure that all necessary information is accurately conveyed to the relevant authorities.

How to Use the Property Supplement Form

Using the mc210ps involves several steps to ensure that all required information is provided correctly. First, gather all necessary documentation related to your property and assets. Next, fill out the form with accurate details, including property addresses, values, and ownership information. It is important to review the form for completeness before submission to avoid delays in processing. Once completed, the form can be submitted through the appropriate channels as outlined by the local Medi-Cal office.

Steps to Complete the Property Supplement Form

Completing the mc210ps requires careful attention to detail. Follow these steps for a smooth process:

- Gather necessary documents, such as property deeds and tax assessments.

- Fill in your personal information, including name, address, and contact details.

- List all properties owned, including their addresses and estimated values.

- Provide details about any mortgages or liens on the properties.

- Review the form for accuracy and completeness.

- Submit the form to your local Medi-Cal office via the designated method.

Legal Use of the Property Supplement Form

The mc210ps is legally recognized as a valid document for reporting property information in the context of Medi-Cal applications. To ensure its legal standing, it must be completed accurately and submitted in accordance with state regulations. Compliance with the guidelines set forth by the California Department of Health Care Services is essential for the form to be accepted without issues. This includes adhering to deadlines and providing truthful information to avoid penalties.

Eligibility Criteria

To utilize the mc210ps effectively, applicants must meet specific eligibility criteria set forth by Medi-Cal. Generally, these criteria include being a resident of California, meeting income limits, and having a qualifying medical need. Additionally, applicants must disclose all relevant property and asset information to determine their eligibility for benefits accurately. Understanding these criteria helps applicants prepare their documentation and increases the likelihood of a successful application.

Required Documents

When completing the mc210ps, several documents are necessary to support the information provided. These may include:

- Property deeds or titles for each property owned.

- Recent tax assessments or appraisals.

- Mortgage statements or documentation of any liens.

- Identification documents, such as a driver's license or Social Security card.

Having these documents ready will facilitate the completion of the form and help ensure that all required information is accurately reported.

Quick guide on how to complete property supplement form

Accomplish Property Supplement Form seamlessly on any device

Online document administration has gained traction among businesses and individuals. It offers an ideal eco-conscious alternative to traditional printed and signed paperwork, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without delays. Manage Property Supplement Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest method to modify and eSign Property Supplement Form with ease

- Obtain Property Supplement Form and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive data using tools specifically designed for that purpose by airSlate SignNow.

- Craft your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether through email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Alter and eSign Property Supplement Form to guarantee effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the property supplement form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is mc210ps and how does it benefit my business?

The mc210ps is a powerful feature of airSlate SignNow that simplifies electronic signing and document management. By using mc210ps, businesses can streamline workflows, save time, and reduce operational costs. This tool is designed to enhance productivity while ensuring the security of your documents.

-

How much does the mc210ps feature cost?

The mc210ps feature is included in airSlate SignNow's competitive pricing plans which cater to various business needs. Potential customers can find flexible pricing options that provide great value for the advanced functionalities offered by mc210ps. To get detailed pricing information, it’s best to visit the airSlate SignNow website directly.

-

What are the key features of mc210ps?

Key features of mc210ps include seamless electronic signatures, customizable templates, and robust analytics tools. This feature is designed to make document handling quick and efficient, allowing users to collaborate effortlessly. Additionally, mc210ps enhances compliance and security, keeping your data protected.

-

Is mc210ps easy to integrate with other software?

Yes, mc210ps is designed for easy integration with a variety of applications and software tools. Whether you use CRM systems, cloud storage, or project management tools, mc210ps can connect smoothly to enhance your existing workflows. This makes it a versatile choice for businesses of all sizes.

-

Can I use mc210ps for signing international documents?

Absolutely! The mc210ps feature from airSlate SignNow is compliant with international eSigning laws, enabling users to sign documents globally. This makes mc210ps a perfect solution for businesses that operate across borders, providing flexibility and compliance in your document signing process.

-

What are the benefits of using mc210ps over traditional signing methods?

Using mc210ps offers numerous benefits compared to traditional signing methods, such as speed, convenience, and cost savings. With mc210ps, you can avoid the hassles of printing and scanning, allowing for quick transaction completion. This not only saves time but also contributes to a more eco-friendly business practice.

-

Is there a free trial available for mc210ps?

Yes, airSlate SignNow offers a free trial period for users to explore the functionalities of mc210ps. This allows prospective customers to experience the benefits firsthand before committing to a paid plan. Take advantage of this opportunity to see how mc210ps can transform your document signing process.

Get more for Property Supplement Form

- 9 grammar vocabulary and pronunciation form

- Nuskin commission form uk

- Renunciation of executor form ontario

- Insurance questionnaire form 470 2826 iowa department of dhs state ia

- Pdf form test

- Dvbnachcs form

- Universal precautions quiz form

- Pdf eraser erase and delete pdf text or images official site form

Find out other Property Supplement Form

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement