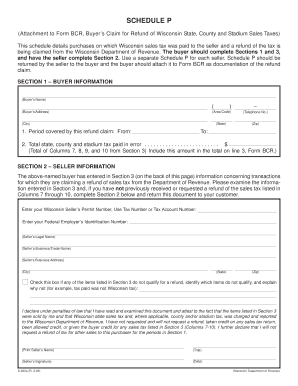

Bcr Claim Schedule P Form

What is the BCR Claim Schedule P

The BCR Claim Schedule P is a specific form used in the state of Wisconsin for claiming certain tax credits or deductions related to business taxes. This form is essential for businesses looking to accurately report their tax obligations and ensure compliance with state regulations. It is particularly relevant for those who may be eligible for benefits under the Wisconsin Department of Revenue guidelines.

How to use the BCR Claim Schedule P

Using the BCR Claim Schedule P involves several steps to ensure accurate completion. First, gather all necessary financial documents that support your claim. This includes income statements, expense reports, and any other relevant financial records. Next, fill out the form carefully, ensuring all information is accurate and complete. Pay close attention to any specific instructions provided by the Wisconsin Department of Revenue to avoid errors that could delay processing.

Steps to complete the BCR Claim Schedule P

Completing the BCR Claim Schedule P requires a systematic approach:

- Start by downloading the form from the Wisconsin Department of Revenue website or accessing it through a digital platform.

- Fill in your business information, including the legal name, address, and tax identification number.

- Detail your income and any deductions you are claiming, ensuring that you have supporting documentation for each entry.

- Review the completed form for accuracy, checking for any missed fields or calculations.

- Submit the form either electronically or via mail, following the submission guidelines provided by the Department of Revenue.

Legal use of the BCR Claim Schedule P

The BCR Claim Schedule P is legally binding when completed and submitted in accordance with state laws. It is crucial to ensure that all claims made on the form are truthful and supported by appropriate documentation. Misrepresentation or fraudulent claims can lead to penalties, including fines or legal action. Therefore, understanding the legal implications of the information provided on this form is essential for compliance.

Required Documents

To successfully complete the BCR Claim Schedule P, several documents are typically required:

- Income statements that reflect your business earnings.

- Expense records that substantiate any deductions claimed.

- Previous tax returns, if applicable, to provide context for your current claim.

- Any additional documentation required by the Wisconsin Department of Revenue specific to your claim.

Filing Deadlines / Important Dates

Filing deadlines for the BCR Claim Schedule P are critical to ensure timely processing of your claim. Generally, forms must be submitted by the end of the tax year, but specific dates may vary based on changes in tax legislation or state guidelines. It is advisable to check the Wisconsin Department of Revenue website for the most current deadlines to avoid penalties or delays in processing.

Quick guide on how to complete bcr claim schedule p

Complete Bcr Claim Schedule P seamlessly on any device

Online document management has gained traction with businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to locate the necessary form and securely archive it online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents promptly without delays. Handle Bcr Claim Schedule P on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign Bcr Claim Schedule P effortlessly

- Locate Bcr Claim Schedule P and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight important parts of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Generate your eSignature using the Sign tool, which only takes seconds and has the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select your preferred method for submitting your form—via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Bcr Claim Schedule P while ensuring effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bcr claim schedule p

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the bcr claim schedule p in airSlate SignNow?

The bcr claim schedule p is a specific section within the airSlate SignNow platform that outlines the claims process for your business. It helps streamline how you handle claims, making it easier to track and manage documents involved in the claim workflow more effectively.

-

How does airSlate SignNow facilitate the bcr claim schedule p?

airSlate SignNow provides a user-friendly interface to manage the bcr claim schedule p, allowing users to create, send, and sign documents with ease. With our eSignature capabilities, you can ensure that all necessary documents are securely signed and accessible at any time.

-

What are the pricing options for using airSlate SignNow for bcr claim schedule p?

airSlate SignNow offers multiple pricing plans that can cater to your needs when it comes to managing the bcr claim schedule p. Whether you’re a small business or an enterprise, we have cost-effective solutions designed to fit your budget while maximizing efficiency.

-

What features does airSlate SignNow offer for bcr claim schedule p management?

For managing the bcr claim schedule p, airSlate SignNow includes features like customizable templates, automatic reminders, and status tracking. These tools are designed to enhance document management and help you remain organized throughout the claims process.

-

Can I integrate airSlate SignNow with other tools for bcr claim schedule p?

Yes, airSlate SignNow offers seamless integrations with a variety of applications, enhancing your workflow for the bcr claim schedule p. You can connect it with CRM systems, document management tools, and more, allowing for a streamlined experience across platforms.

-

What benefits does airSlate SignNow provide for handling bcr claim schedule p?

Using airSlate SignNow for your bcr claim schedule p benefits your organization by reducing processing time and eliminating paper documents. This leads to increased efficiency, lower operational costs, and improved compliance with legal requirements in claims management.

-

Is airSlate SignNow secure for managing bcr claim schedule p documents?

Absolutely, airSlate SignNow prioritizes security, especially for sensitive documents related to the bcr claim schedule p. With bank-level encryption and secure access controls, you can trust that your documents are protected throughout the entire signing process.

Get more for Bcr Claim Schedule P

Find out other Bcr Claim Schedule P

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation