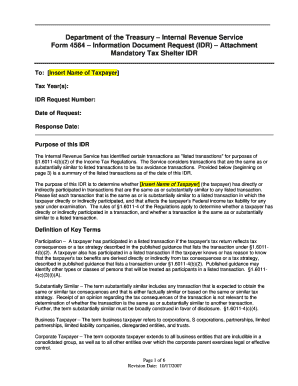

Tax Shelter Idr Form

What is the Tax Shelter IDR

The Tax Shelter IDR is a specific form utilized by taxpayers to report and manage their participation in tax shelter arrangements. It serves as a tool for documenting the details of the tax shelter, including its structure, participants, and the expected tax benefits. This form is essential for ensuring compliance with IRS regulations and for providing transparency regarding tax strategies employed by individuals or businesses.

How to Use the Tax Shelter IDR

Using the Tax Shelter IDR involves several steps to ensure accurate completion and submission. First, gather all necessary information regarding the tax shelter, including its name, type, and the parties involved. Next, fill out the form with precise details, ensuring that all sections are completed to avoid delays. Once completed, review the form for accuracy before submitting it to the appropriate tax authority. Utilizing electronic tools can streamline this process and enhance efficiency.

Steps to Complete the Tax Shelter IDR

Completing the Tax Shelter IDR requires careful attention to detail. Follow these steps for successful completion:

- Gather all relevant documentation related to the tax shelter.

- Fill in your personal information and the details of the tax shelter.

- Provide accurate descriptions of the tax benefits expected from the shelter.

- Review the form for any errors or omissions.

- Submit the form electronically or via mail, as per the guidelines.

Legal Use of the Tax Shelter IDR

The legal use of the Tax Shelter IDR is governed by IRS regulations. It is crucial to ensure that the information provided is truthful and complete, as inaccuracies can lead to penalties or audits. The form must be filed within the specified deadlines to maintain compliance. Understanding the legal implications of tax shelters and their reporting is essential for taxpayers to avoid potential legal issues.

IRS Guidelines

The IRS provides specific guidelines regarding the use and submission of the Tax Shelter IDR. These guidelines outline the requirements for reporting tax shelters, including the necessary documentation and deadlines for submission. Familiarizing oneself with these guidelines is important for ensuring compliance and avoiding penalties. Taxpayers should regularly check for updates to IRS regulations that may affect their reporting obligations.

Required Documents

To complete the Tax Shelter IDR, several documents may be required. These typically include:

- Documentation of the tax shelter arrangement.

- Records of any financial transactions related to the shelter.

- Statements from all parties involved in the tax shelter.

- Any previous correspondence with the IRS regarding the tax shelter.

Ensuring that all required documents are gathered before starting the form will facilitate a smoother completion process.

Quick guide on how to complete tax shelter idr

Effortlessly Prepare Tax Shelter Idr on Any Device

Digital document management has gained traction among companies and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with everything you need to produce, edit, and electronically sign your documents quickly and efficiently. Manage Tax Shelter Idr seamlessly on any platform using the airSlate SignNow Android or iOS applications, and streamline your document-related processes today.

The Easiest Way to Modify and Electronically Sign Tax Shelter Idr

- Find Tax Shelter Idr and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of the documents or obscure sensitive details with the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Tax Shelter Idr and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax shelter idr

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax shelter IDR?

A tax shelter IDR refers to an Individual Development Account specifically designed to provide tax benefits while encouraging savings. By utilizing a tax shelter IDR, individuals can strategically grow their resources for retirement or education. Understanding how a tax shelter IDR works can aid in effective financial planning.

-

How does airSlate SignNow support tax shelter IDR documentation?

airSlate SignNow offers an efficient platform for managing all your tax shelter IDR documents with ease. You can quickly create, edit, and eSign necessary documentation directly through our user-friendly interface. This streamlines the process, ensuring your tax shelter IDR paperwork is always accurate and secure.

-

What features does airSlate SignNow provide for managing tax shelter IDR forms?

With airSlate SignNow, you can access features like customizable templates, secure eSigning, and real-time document tracking specifically for your tax shelter IDR forms. These features enhance the efficiency of your workflow and minimize errors. Users can also get notifications whenever a document is viewed or signed, providing peace of mind.

-

Are there any costs associated with using airSlate SignNow for tax shelter IDR?

Yes, there are various pricing plans available for airSlate SignNow that cater to different needs for managing tax shelter IDR documents. Our plans are designed to be cost-effective and provide high value with features that simplify document handling. You can choose a plan that best fits your requirements without overspending.

-

Can airSlate SignNow integrate with other financial management tools for my tax shelter IDR?

Absolutely! airSlate SignNow seamlessly integrates with various financial management tools, allowing for comprehensive management of your tax shelter IDR. This integration helps you pull necessary data, manage documents, and streamline your financial strategies effortlessly. Your workflow will be enhanced signNowly with these integrations.

-

What benefits can I expect from using airSlate SignNow for tax shelter IDR processes?

Using airSlate SignNow for your tax shelter IDR processes provides enhanced security, reduced turnaround time, and increased accuracy in document handling. The platform is designed to ensure that you can manage your documents easily, allowing you to focus on maximizing your tax benefits. Plus, the ease of eSigning simplifies collaboration with all stakeholders.

-

Is airSlate SignNow secure for handling sensitive tax shelter IDR information?

Yes, airSlate SignNow prioritizes the security of sensitive information, including that related to your tax shelter IDR. We implement strong encryption protocols and offer advanced authentication options to protect your data. You can trust that your documents are safe and secure while using our platform.

Get more for Tax Shelter Idr

- This market stall lease this agreement is made as of form

- Agreement to lease subject to certain conditions precedent form

- Farmers market vendor application baltimore city health form

- Exhibit 61 motion to dismiss complaint state of form

- Agreement to manage painting repairs and plumbing of a building form

- Enclosed herewith please find a copy of the proposed order granting motion for leave to form

- Part 42 contract administration and audit services form

- Contract for part time assistance from independent contractor form

Find out other Tax Shelter Idr

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free