Monthly Payroll Report 2015-2026

What is the Monthly Payroll Report

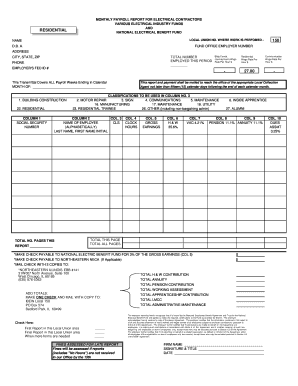

The monthly payroll report is a comprehensive document that summarizes all payroll-related activities for a specific month. This report typically includes details such as employee wages, deductions, bonuses, and taxes withheld. It serves as a crucial tool for businesses to track their payroll expenses and ensure compliance with federal and state regulations. Understanding the structure and contents of a monthly payroll report is essential for accurate financial reporting and effective payroll management.

Key Elements of the Monthly Payroll Report

A well-structured monthly payroll report includes several key elements that provide a complete overview of payroll activities. These elements often consist of:

- Employee Information: Names, identification numbers, and job titles of all employees.

- Gross Pay: Total earnings before any deductions.

- Deductions: Details on taxes withheld, retirement contributions, and other deductions.

- Net Pay: The amount employees take home after deductions.

- Employer Contributions: Contributions made by the employer for benefits such as health insurance and retirement plans.

Steps to Complete the Monthly Payroll Report

Completing a monthly payroll report involves several steps to ensure accuracy and compliance. Here is a streamlined process to follow:

- Gather employee data, including hours worked and any changes in pay rates.

- Calculate gross pay for each employee based on their hours and pay rates.

- Determine deductions, including federal and state taxes, Social Security, and Medicare.

- Calculate net pay by subtracting total deductions from gross pay.

- Compile all data into the payroll report format, ensuring all required elements are included.

- Review the report for accuracy before submission.

Legal Use of the Monthly Payroll Report

Using the monthly payroll report legally requires adherence to various regulations. The report must comply with federal laws, such as the Fair Labor Standards Act (FLSA), and state-specific employment laws. Accurate reporting ensures that businesses meet their tax obligations and avoid penalties. Additionally, maintaining records of payroll reports is vital for audits and compliance checks.

How to Obtain the Monthly Payroll Report

Businesses can obtain a monthly payroll report through their payroll processing system or accounting software. Many platforms offer templates that can be customized to meet specific reporting needs. Additionally, companies may choose to create their own reports using spreadsheet software, ensuring all necessary elements are included. It is crucial to ensure that the report format aligns with legal requirements and organizational standards.

Examples of Using the Monthly Payroll Report

The monthly payroll report can be utilized in various ways to enhance business operations. Some common examples include:

- Analyzing payroll expenses to identify trends and areas for cost savings.

- Preparing for tax filings by ensuring all payroll data is accurate and complete.

- Providing necessary documentation for audits or financial reviews.

- Facilitating discussions regarding employee compensation and benefits.

Quick guide on how to complete monthly payroll report

Complete Monthly Payroll Report with ease on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Handle Monthly Payroll Report on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to edit and electronically sign Monthly Payroll Report effortlessly

- Locate Monthly Payroll Report and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to store your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Edit and electronically sign Monthly Payroll Report to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the monthly payroll report

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a payroll reports sample?

A payroll reports sample is a template that outlines how payroll data is structured and presented. It typically includes employee details, earnings, deductions, and taxes. By using a payroll reports sample, businesses can better understand their payroll processing needs and ensure compliance with regulations.

-

How can airSlate SignNow help with payroll reports?

airSlate SignNow offers a streamlined solution for managing payroll documents, including payroll reports sample templates. Businesses can easily create, send, and eSign these reports, eliminating the need for paper workflows. This helps ensure that payroll data is accurate and securely stored.

-

What features does airSlate SignNow provide for payroll report management?

airSlate SignNow provides an easy-to-use interface for creating and eSigning payroll reports sample. Key features include customizable templates, automated reminders for approvals, and robust security measures to protect sensitive data. These features enhance efficiency and reduce the risk of errors in payroll processing.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows you to explore its features, including payroll reports sample templates. During the trial, you can test the software's capabilities without commitment, making it easier to see how it can meet your business’s payroll management needs.

-

How does airSlate SignNow integrate with other payroll systems?

airSlate SignNow seamlessly integrates with various payroll systems, making it easy to incorporate payroll reports sample into your existing workflows. This integration ensures that all your payroll data remains synchronized and accessible. It simplifies the process of preparing and sharing payroll reports.

-

What are the benefits of using airSlate SignNow for payroll reporting?

Using airSlate SignNow for payroll reporting offers numerous benefits including increased efficiency, reduced paperwork, and enhanced security. With payroll reports sample available for easy access and signature, you can streamline your payroll processes. This leads to timely reporting and better compliance with regulations.

-

Can I customize payroll reports sample in airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize payroll reports sample based on specific business requirements. You can adjust fields, add company branding, and ensure that the format meets your team's needs. This flexibility helps create more meaningful payroll documentation.

Get more for Monthly Payroll Report

- Da form 1256 feb fillable

- Court of honor script template form

- Boresha sacco loan form

- Vspdat form

- Mined land reclamation idaho department of lands form

- Idaho department of lands application for reclamation plan form

- How to strengthen your nonprofits internal controls form

- Form 1718 michigan unemployment jobs ecityworks

Find out other Monthly Payroll Report

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online