IRS Form 1040 Form 1040 Tax Return

What is the IRS Form 1040

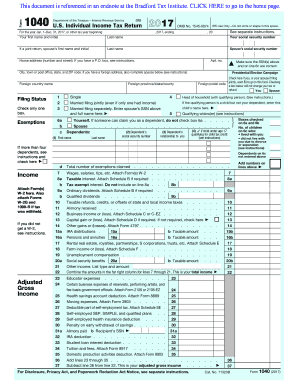

The IRS Form 1040 is a standard federal income tax form used by individuals to report their annual income to the Internal Revenue Service (IRS). This form is essential for calculating the amount of tax owed or the refund due based on the taxpayer's income, deductions, and credits. The 1040 form is designed to accommodate various income types, including wages, dividends, and capital gains, making it versatile for different taxpayers.

The form includes sections for personal information, income, adjustments to income, and tax calculations. It is important for taxpayers to accurately complete the form to ensure compliance with U.S. tax laws and to avoid potential penalties.

Steps to Complete the IRS Form 1040

Completing the IRS Form 1040 involves several key steps:

- Gather Financial Documents: Collect all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill Out Personal Information: Enter your name, address, and Social Security number at the top of the form.

- Report Income: List all sources of income in the appropriate sections, ensuring accuracy to avoid discrepancies.

- Claim Deductions and Credits: Determine if you qualify for standard or itemized deductions and apply any tax credits for which you are eligible.

- Calculate Tax Liability: Use the provided tax tables or tax software to calculate your total tax liability based on your reported income and deductions.

- Sign and Date the Form: Ensure that you sign and date the form before submission, as an unsigned form is considered invalid.

How to Obtain the IRS Form 1040

The IRS Form 1040 can be obtained through several methods:

- Online: Download the form directly from the IRS website in PDF format.

- Tax Preparation Software: Many tax software programs include the 1040 form as part of their services, allowing for easy completion and filing.

- Local IRS Office: Visit a local IRS office to request a physical copy of the form.

- Public Libraries: Some public libraries offer copies of tax forms during the tax season.

Legal Use of the IRS Form 1040

The IRS Form 1040 must be filled out and submitted in compliance with federal tax laws. It serves as a legal document that reports income and tax liability. To ensure its legal validity, taxpayers must:

- Provide accurate information and complete all required sections.

- Sign the form, confirming that the information is true and correct to the best of their knowledge.

- File the form by the designated deadline to avoid penalties.

Using a reliable eSignature tool can enhance the legal standing of the form when filed electronically, ensuring compliance with eSignature laws.

Key Elements of the IRS Form 1040

The IRS Form 1040 consists of several key elements that taxpayers must understand:

- Filing Status: Indicates whether you are single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Income Section: Details all sources of income, including wages, interest, dividends, and capital gains.

- Deductions: Allows taxpayers to claim either standard or itemized deductions to reduce taxable income.

- Tax Credits: Provides opportunities to reduce tax liability through various credits available to taxpayers.

- Signature Line: Requires the taxpayer's signature and date, affirming the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 1040 are crucial for compliance:

- April 15: Typically, this is the deadline for filing the form for the previous tax year.

- Extensions: Taxpayers may file for an extension, but any taxes owed must still be paid by April 15 to avoid penalties.

It is important to stay informed about any changes in deadlines that may occur due to legislation or IRS announcements.

Quick guide on how to complete irs form 1040 form 1040 tax return

Complete IRS Form 1040 Form 1040 Tax Return effortlessly on any device

The management of online documents has gained immense traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without any holdups. Manage IRS Form 1040 Form 1040 Tax Return on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and eSign IRS Form 1040 Form 1040 Tax Return with ease

- Acquire IRS Form 1040 Form 1040 Tax Return and then click Get Form to begin.

- Make use of the tools available to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes just a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information carefully and then click the Done button to finalize your changes.

- Choose your preferred method to share your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the worry of misplaced or lost documents, the hassle of searching for forms, or errors that necessitate reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign IRS Form 1040 Form 1040 Tax Return to ensure outstanding communication at any stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 1040 form 1040 tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 1040 form and why is it important?

A 1040 form is the standard IRS form used by individuals to file their annual income tax returns. Understanding what is a 1040 form is crucial as it determines your tax obligations and helps calculate any refund or amount owed to the government.

-

How can airSlate SignNow help with filling out a 1040 form?

airSlate SignNow offers an easy-to-use eSigning solution, allowing you to send and securely sign documents, including tax forms. By utilizing our platform, users can streamline the process of collecting signatures on their completed 1040 forms and ensure quick submissions.

-

What features does airSlate SignNow offer that relate to tax form management?

airSlate SignNow provides features like customizable templates, document storage, and audit trails, making it easy to manage your tax documents. Understanding what is a 1040 form and utilizing our features can enhance your productivity during tax season.

-

Is airSlate SignNow a cost-effective solution for handling 1040 forms?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. When considering what is a 1040 form, our competitive pricing plans help businesses save on administrative costs associated with tax form management.

-

Can I integrate airSlate SignNow with accounting software for 1040 forms?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software that may include tools for handling what is a 1040 form. This integration allows for efficient data transfer and collaboration, simplifying your tax preparation process.

-

What are the benefits of using airSlate SignNow for eSigning 1040 forms?

Using airSlate SignNow for eSigning 1040 forms enhances efficiency and speeds up the filing process. With features such as reusable templates and mobile access, you can manage what is a 1040 form from anywhere, ensuring that your documents are signed and submitted quickly.

-

Is it safe to use airSlate SignNow for signing 1040 forms?

Yes, airSlate SignNow employs top-notch security measures to protect your documents, including what is a 1040 form. Our platform uses encryption and complies with industry standards to ensure that your sensitive tax information remains secure.

Get more for IRS Form 1040 Form 1040 Tax Return

Find out other IRS Form 1040 Form 1040 Tax Return

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now