Life Estate Tables Irs Form

What are the IRS Life Estate Tables?

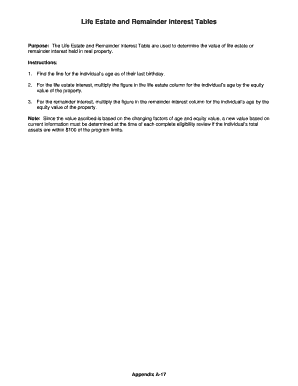

The IRS life estate tables are a set of actuarial tables used to determine the value of a life estate interest in property. These tables provide a standardized method for calculating the present value of a life interest based on the age of the individual holding the life estate. This is particularly important for tax purposes, as it helps in determining the fair market value of the property when it is transferred or when calculating estate taxes. The tables are updated periodically to reflect changes in life expectancy and other relevant factors.

How to Use the IRS Life Estate Tables

Using the IRS life estate tables involves a few straightforward steps. First, identify the age of the individual who holds the life estate. Next, locate the corresponding value factor from the appropriate table based on the individual's age. Multiply the value factor by the fair market value of the property to determine the present value of the life estate. This calculated value can then be used for tax reporting or estate planning purposes. It is essential to ensure that the correct table version is used, as these can vary by year.

Steps to Complete the IRS Life Estate Tables

Completing the IRS life estate tables requires careful attention to detail. Start by gathering necessary information, including the age of the life tenant and the fair market value of the property. Follow these steps:

- Determine the age of the life tenant at the time of valuation.

- Access the appropriate IRS life estate table for the relevant year.

- Find the corresponding value factor for the life tenant's age.

- Multiply the value factor by the fair market value of the property.

- Document the calculations for your records and for any required tax filings.

Legal Use of the IRS Life Estate Tables

The legal use of the IRS life estate tables is crucial in estate planning and tax compliance. These tables are recognized by the IRS as a valid method for valuing life estates, which can impact gift taxes, estate taxes, and property transfers. Using the tables ensures that valuations are consistent and defensible in case of an audit or legal scrutiny. It is advisable to consult with a tax professional or attorney to ensure compliance with all applicable laws and regulations when using these tables.

Examples of Using the IRS Life Estate Tables

Understanding how to apply the IRS life estate tables can be clarified through examples. For instance, if a 70-year-old individual has a life estate in a property valued at $200,000, the corresponding value factor from the life estate table might be 0.5. Multiplying $200,000 by 0.5 gives a present value of $100,000 for the life estate. This value would be reported for tax purposes. Another example could involve a 60-year-old with the same property, where the value factor might be 0.6, leading to a present value of $120,000. These examples illustrate how the tables can significantly affect the valuation process.

IRS Guidelines for Life Estate Tables

The IRS provides specific guidelines regarding the use of life estate tables, which include instructions on how to apply the tables for different tax scenarios. It is essential to refer to the latest IRS publications or guidance documents to ensure that you are using the most current tables and following the correct procedures. These guidelines help clarify how to report the value of life estates on tax returns and ensure compliance with federal tax laws.

Quick guide on how to complete life estate tables irs

Effortlessly complete Life Estate Tables Irs on any device

Electronic document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources you require to create, adjust, and eSign your documents rapidly and without interruptions. Handle Life Estate Tables Irs on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The simplest way to adjust and eSign Life Estate Tables Irs effortlessly

- Locate Life Estate Tables Irs and click on Get Form to begin.

- Utilize the tools we provide to send your document.

- Emphasize signNow sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign tool, which takes just moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors that necessitate the printing of new document copies. airSlate SignNow meets your document management requirements with just a few clicks from any device you choose. Modify and eSign Life Estate Tables Irs to ensure top-notch communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the life estate tables irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are life estate tables and how do they work?

Life estate tables are specialized tools that help individuals understand the value and implications of life estates in property ownership. These tables provide a clear structure for determining how long someone may enjoy and control a property before it reverts to another party. Utilizing life estate tables simplifies the process of estate planning and ensures informed decisions regarding property management.

-

How can airSlate SignNow help with life estate tables?

airSlate SignNow offers a streamlined approach to managing life estate tables through eSigning and document preparation. With our platform, users can easily create, send, and sign important documents related to life estates, ensuring that all agreements are legally binding and securely stored. This efficiency saves time and reduces the complexity of managing life estate transactions.

-

What features should I look for in life estate tables?

When evaluating life estate tables, look for features that include user-friendly design, easy customization options, and compatibility with legal requirements. Additionally, consider tables that provide detailed calculations regarding life tenancy and remainderman rights. These features enhance clarity and ensure users can fully understand their rights and obligations.

-

Are life estate tables included in the pricing of airSlate SignNow?

Yes, life estate tables are considered part of the comprehensive services offered by airSlate SignNow. Our subscription plans include access to template libraries where you can find fully developed life estate tables tailored to various situations. Pricing is competitive and designed to deliver maximum value for your document management needs.

-

How can I integrate life estate tables into my existing document workflow?

Integrating life estate tables into your document workflow is easy with airSlate SignNow. Our platform supports various integrations with popular productivity tools and CRMs, allowing you to seamlessly incorporate life estate tables into your current systems. This ensures that all your documents stay organized and easily accessible.

-

What are the benefits of using life estate tables for estate planning?

Using life estate tables for estate planning offers numerous benefits, including clarity in ownership rights, potential tax advantages, and simplified transfer processes. They help individuals visualize the timeline of property rights and the eventual transfer to heirs, thereby reducing conflicts and misunderstandings in future generations. This proactive approach to estate management can save families time and money.

-

Can I customize life estate tables on airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize life estate tables to meet specific needs and requirements. You can modify details such as property values, tenancy periods, and beneficiary information to create a personalized document that accurately reflects your situation. This flexibility ensures that your life estate table aligns perfectly with your estate planning goals.

Get more for Life Estate Tables Irs

Find out other Life Estate Tables Irs

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online