Bdo Loan Application Form

What is the BDO Loan Application?

The BDO loan application is a formal process that individuals must complete to request a salary loan from BDO Unibank, a leading financial institution in the Philippines. This application serves as a means for borrowers to provide essential information about their financial status, employment, and the purpose of the loan. Understanding the specifics of this application is crucial for ensuring a smooth borrowing experience.

Steps to Complete the BDO Loan Application

Completing the BDO loan application involves several key steps that help streamline the process. Here are the essential steps:

- Gather necessary documents, including proof of income, identification, and employment verification.

- Fill out the BDO loan application form accurately, ensuring all information is complete and truthful.

- Submit the application form along with the required documents, either online or in person at a BDO branch.

- Await confirmation and processing of your application from BDO.

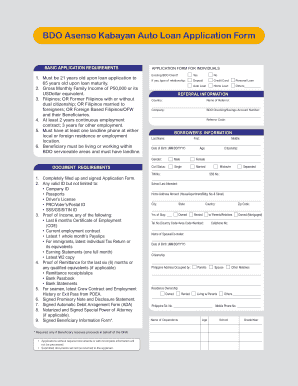

Required Documents for the BDO Loan Application

To successfully apply for a BDO salary loan, applicants must provide specific documentation. Commonly required documents include:

- Valid government-issued ID

- Proof of income, such as payslips or tax returns

- Employment certificate or contract

- Completed BDO loan application form

Eligibility Criteria for the BDO Loan Application

Eligibility for a BDO salary loan typically depends on several factors, including:

- Employment status: Applicants must be employed and have a stable income.

- Credit history: A good credit score may be required to qualify.

- Age: Applicants usually need to be at least eighteen years old.

Application Process & Approval Time

The application process for a BDO salary loan generally involves submitting the required documents and completing the application form. Once submitted, BDO will review the application, which may take a few days to process. Approval times can vary based on the completeness of the application and the applicant's financial profile.

Legal Use of the BDO Loan Application

The BDO loan application must be completed in compliance with relevant financial regulations. This includes providing truthful information and adhering to privacy laws regarding personal data. Ensuring legal compliance protects both the borrower and the lender during the loan process.

Quick guide on how to complete bdo loan application

Effortlessly Prepare Bdo Loan Application on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Handle Bdo Loan Application on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Easiest Way to Edit and eSign Bdo Loan Application Without Stress

- Obtain Bdo Loan Application and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Bdo Loan Application to guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bdo loan application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the basic BDO salary loan requirements?

To qualify for a BDO salary loan, applicants must be a permanent employee of a company with at least one year of service and earn a minimum monthly salary. Additionally, applicants need to submit valid identification, proof of income, and employement verification. Understanding these BDO salary loan requirements ensures a smoother application process.

-

How long does it take to process a BDO salary loan application?

The processing time for a BDO salary loan application typically ranges from three to five business days. This duration may vary based on the completeness of the submitted documents and any additional checks needed. Meeting the BDO salary loan requirements is crucial for timely approval.

-

What are the interest rates associated with BDO salary loans?

BDO salary loans offer competitive interest rates, which may vary depending on the borrower's profile and the loan amount. It's important to review the specific terms and conditions provided by BDO to understand the exact rates. Knowing the rates helps applicants evaluate their financial commitments based on the BDO salary loan requirements.

-

Can self-employed individuals apply for a BDO salary loan?

Unfortunately, BDO salary loans are primarily designed for salaried employees, so self-employed individuals do not typically qualify under standard BDO salary loan requirements. Self-employed applicants may need to explore other loan options provided by BDO tailored for their needs. It's advisable to consult with BDO representatives for more details.

-

What documents are required when applying for a BDO salary loan?

Applicants must prepare several important documents, including valid IDs, a certificate of employment, and proof of income, such as payslips. Ensuring that all documentation meets the BDO salary loan requirements can expedite the application process. It's recommended to double-check your paperwork before submission.

-

Is it possible to apply for a BDO salary loan online?

Yes, BDO offers an online application for salary loans, allowing applicants to submit the necessary documents digitally. This feature enhances convenience and accessibility, just as long as all outlined BDO salary loan requirements are met. Visit the official BDO website to start the online application process.

-

What are the benefits of choosing a BDO salary loan?

A BDO salary loan provides several advantages, including lower interest rates compared to other types of loans and flexible repayment terms. Furthermore, qualifying is easier for those who meet the BDO salary loan requirements, making it an appealing option for employees. These benefits support financial needs effectively.

Get more for Bdo Loan Application

Find out other Bdo Loan Application

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement