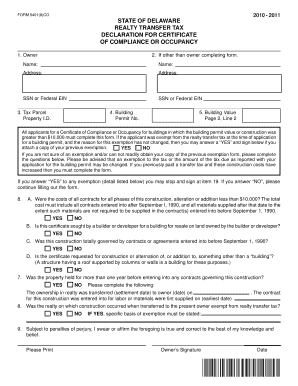

Delaware Form 5401

What is the Delaware Form 5401

The Delaware Form 5401 is a crucial document used for tax purposes in the state of Delaware. It serves as a request for a sales tax exemption certificate, allowing businesses to purchase goods without paying sales tax. This form is particularly important for entities that qualify for tax exemptions, such as non-profit organizations or resellers. Understanding the specific uses and requirements of the Form 5401 is essential for maintaining compliance with Delaware tax laws.

How to use the Delaware Form 5401

To effectively use the Delaware Form 5401, businesses must first determine their eligibility for a sales tax exemption. Once eligibility is established, the form must be filled out accurately, providing necessary details such as the business name, address, and the nature of the exemption being claimed. After completing the form, it should be submitted to the vendor from whom goods are being purchased. The vendor will then retain the form for their records, ensuring compliance with state regulations.

Steps to complete the Delaware Form 5401

Completing the Delaware Form 5401 involves several key steps:

- Gather necessary information about your business, including legal name, address, and tax identification number.

- Clearly state the reason for the exemption, ensuring it aligns with Delaware tax regulations.

- Review the form for accuracy and completeness before submission.

- Submit the completed form to the vendor at the time of purchase.

Following these steps helps ensure that the form is processed correctly and that the exemption is honored.

Legal use of the Delaware Form 5401

The Delaware Form 5401 is legally binding when filled out and submitted according to state guidelines. It is essential for businesses to understand that improper use of the form can lead to penalties. The form must only be used for valid exemptions as outlined by Delaware law. Misrepresentation or fraudulent claims can result in legal consequences, including fines or audits.

Filing Deadlines / Important Dates

While the Delaware Form 5401 does not have a specific filing deadline like tax returns, it is important to submit the form at the time of purchase to ensure that the sales tax exemption is applied correctly. Businesses should keep track of any changes in tax laws or regulations that may affect the use of the form. Staying informed about deadlines related to tax filings and renewals of exemption status is also crucial for compliance.

Required Documents

To complete the Delaware Form 5401, certain documents may be required to support the exemption claim. These may include:

- A valid tax identification number.

- Proof of eligibility for the exemption, such as non-profit status documentation.

- Any additional forms or certificates that may be relevant to the specific exemption being claimed.

Having these documents on hand can streamline the completion process and ensure compliance with state requirements.

Quick guide on how to complete delaware form 5401

Complete Delaware Form 5401 effortlessly on any device

Online document management has become increasingly popular with businesses and individuals alike. It offers a perfect eco-friendly substitute to traditional printed and signed papers, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and electronically sign your documents quickly and without interruptions. Manage Delaware Form 5401 on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to edit and electronically sign Delaware Form 5401 with ease

- Locate Delaware Form 5401 and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or conceal sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal standing as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and electronically sign Delaware Form 5401 and guarantee effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the delaware form 5401

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 5401 settlement?

A 5401 settlement refers to a specific type of financial agreement or transaction related to legal matters. It is essential for businesses to understand the implications of a 5401 settlement, as it can affect their financial and operational strategies.

-

How can airSlate SignNow assist with 5401 settlements?

airSlate SignNow provides a seamless platform for managing documents related to 5401 settlements. With its eSigning capabilities, businesses can quickly send, sign, and store important settlement documents, ensuring compliance and security.

-

What are the pricing plans for airSlate SignNow in relation to 5401 settlements?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. By choosing a plan, users can effectively manage 5401 settlements without the burden of hidden fees, making it a cost-efficient solution.

-

What features does airSlate SignNow offer for handling 5401 settlements?

Key features of airSlate SignNow include customizable templates, document tracking, and automated reminders, all beneficial for managing 5401 settlements. These functionalities help streamline the entire process, reducing time and effort.

-

Are there integrations available with airSlate SignNow for managing 5401 settlements?

Yes, airSlate SignNow integrates seamlessly with various third-party applications, allowing users to manage their 5401 settlements more efficiently. This includes popular tools like CRM systems, which can enhance productivity.

-

How secure is airSlate SignNow for handling sensitive 5401 settlement documents?

airSlate SignNow takes security seriously, employing bank-level encryption and robust authentication mechanisms for documents related to 5401 settlements. This ensures that all sensitive information remains protected throughout the signing process.

-

Can I automate the process of sending 5401 settlement documents with airSlate SignNow?

Absolutely! airSlate SignNow allows users to automate the document workflow for 5401 settlements. This includes setting up automated emails and reminders, ensuring timely responses and increasing efficiency.

Get more for Delaware Form 5401

Find out other Delaware Form 5401

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple