New York General Business Franchise Tax Return Fillable Form

What is the New York General Business Franchise Tax Return Fillable Form

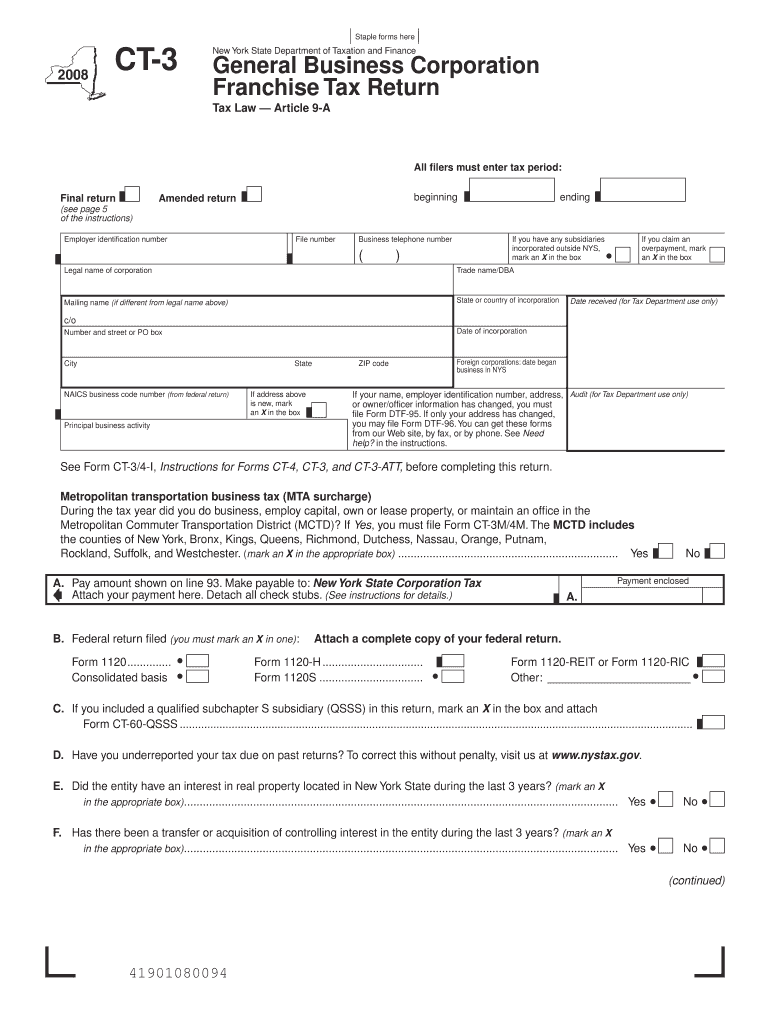

The New York General Business Corporation Franchise Tax Return, commonly referred to as the New York Form CT-3, is a crucial document for corporations operating in New York. This form is used to report the corporation's income, calculate its franchise tax liability, and ensure compliance with state tax regulations. Corporations must file this return annually, detailing their financial activities and tax obligations to the state. The form is designed for various types of business entities, including corporations, limited liability companies (LLCs), and partnerships, making it essential for businesses of all sizes.

Steps to complete the New York General Business Franchise Tax Return Fillable Form

Completing the New York General Business Franchise Tax Return involves several key steps:

- Gather Financial Information: Collect all necessary financial documents, including income statements, balance sheets, and prior tax returns.

- Fill Out the Form: Enter all required information accurately in the designated fields of the form. Ensure that you report all income and deductions.

- Calculate Tax Liability: Use the appropriate tax rates and calculations to determine your franchise tax liability based on your business income.

- Review for Accuracy: Double-check all entries for errors or omissions. Accurate reporting is essential to avoid penalties.

- Submit the Form: Choose your preferred submission method, whether online, by mail, or in person, and ensure it is sent by the filing deadline.

Legal use of the New York General Business Franchise Tax Return Fillable Form

The New York General Business Franchise Tax Return is legally binding when filled out and submitted according to state regulations. To ensure its validity, the form must be signed by an authorized representative of the corporation. Additionally, electronic submissions must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). These laws establish that eSignatures are legally recognized, provided that the signer intends to sign and that the process meets specific requirements.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for the New York General Business Franchise Tax Return. Generally, the return is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For most corporations operating on a calendar year, this means the return is due by April 15. However, if the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is essential to stay informed about any changes in deadlines or requirements to avoid late fees and penalties.

Required Documents

To complete the New York General Business Franchise Tax Return, several documents are necessary:

- Income statements and balance sheets for the reporting year

- Prior year tax returns for reference

- Documentation of any deductions or credits claimed

- Records of any estimated tax payments made during the year

- Any additional forms required for specific tax situations

Form Submission Methods (Online / Mail / In-Person)

Businesses have multiple options for submitting the New York General Business Franchise Tax Return. The form can be filed electronically through the New York State Department of Taxation and Finance website, which is often the quickest method. Alternatively, corporations may choose to mail the completed form to the appropriate address provided by the state. For those preferring in-person submissions, visiting a local tax office is also an option. Regardless of the method chosen, it is important to retain proof of submission for record-keeping purposes.

Quick guide on how to complete new york general business franchise tax return fillable 2008 form

Effortlessly Prepare New York General Business Franchise Tax Return Fillable Form on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, edit, and eSign your documents promptly without delays. Manage New York General Business Franchise Tax Return Fillable Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-based process today.

How to Edit and eSign New York General Business Franchise Tax Return Fillable Form with Ease

- Obtain New York General Business Franchise Tax Return Fillable Form and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important parts of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal standing as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to distribute your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Edit and eSign New York General Business Franchise Tax Return Fillable Form and ensure outstanding communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

A Startup CEO take a sales prospect out to a New York Knicks game and spends $500 on the tickets. How much of the $500 spent is Tax Deductible for the business?

Beginning in 2018, after the TCJA reforms, none of it.Only 50% of business meals are deductible.

Create this form in 5 minutes!

How to create an eSignature for the new york general business franchise tax return fillable 2008 form

How to create an eSignature for the New York General Business Franchise Tax Return Fillable 2008 Form online

How to make an electronic signature for your New York General Business Franchise Tax Return Fillable 2008 Form in Google Chrome

How to generate an eSignature for signing the New York General Business Franchise Tax Return Fillable 2008 Form in Gmail

How to make an electronic signature for the New York General Business Franchise Tax Return Fillable 2008 Form from your smart phone

How to make an eSignature for the New York General Business Franchise Tax Return Fillable 2008 Form on iOS

How to create an electronic signature for the New York General Business Franchise Tax Return Fillable 2008 Form on Android devices

People also ask

-

What is the New York General Business Franchise Tax Return Fillable Form?

The New York General Business Franchise Tax Return Fillable Form is a digital document that businesses can use to report their franchise taxes in New York. This fillable form simplifies the tax filing process, allowing users to enter information directly into the form fields, ensuring accuracy and efficiency.

-

How can I access the New York General Business Franchise Tax Return Fillable Form?

You can easily access the New York General Business Franchise Tax Return Fillable Form through airSlate SignNow's platform. Our user-friendly interface allows you to find and complete the form online, streamlining your tax preparation and ensuring compliance with New York state regulations.

-

Is the New York General Business Franchise Tax Return Fillable Form free to use?

While the New York General Business Franchise Tax Return Fillable Form can be accessed through airSlate SignNow, there may be associated fees for using premium features. However, our platform offers competitive pricing that provides great value and convenience for businesses looking to manage their tax documents effectively.

-

What features does the New York General Business Franchise Tax Return Fillable Form offer?

The New York General Business Franchise Tax Return Fillable Form includes features such as auto-calculation of taxes, easy-to-use fields for entering business information, and the ability to save and share forms securely. These features enhance the user experience and help ensure that your tax filings are accurate and compliant.

-

Can I eSign the New York General Business Franchise Tax Return Fillable Form?

Yes, airSlate SignNow allows you to eSign the New York General Business Franchise Tax Return Fillable Form conveniently. After filling out the form, you can add your electronic signature directly, making it easy to submit your tax return without needing to print or scan documents.

-

How does airSlate SignNow ensure the security of my New York General Business Franchise Tax Return Fillable Form?

At airSlate SignNow, we prioritize the security of your documents, including the New York General Business Franchise Tax Return Fillable Form. Our platform employs advanced encryption and compliance measures to protect your sensitive information and ensure that your tax data remains confidential.

-

Can I integrate the New York General Business Franchise Tax Return Fillable Form with other software?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to seamlessly incorporate the New York General Business Franchise Tax Return Fillable Form into your existing workflows. This connectivity makes it easier to manage your business documents and streamline processes.

Get more for New York General Business Franchise Tax Return Fillable Form

- Form a application for process maintenance aspri

- Composers monthly the newsletter for student musicians form

- Junior high speech meet passages form

- S041 form

- Circle check template ontario form

- Texas writ of attachment child form

- Deed of trust to secure assumption for real form

- Form order admitting will to probate as a muniment of title

Find out other New York General Business Franchise Tax Return Fillable Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile