8812 Worksheet Form

What is the 8812 Worksheet

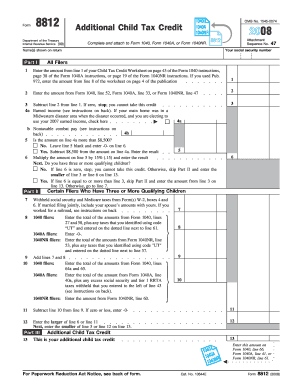

The 8812 Worksheet, also known as the Additional Child Tax Credit Worksheet, is a form used by taxpayers in the United States to determine eligibility for the Additional Child Tax Credit. This credit is designed to provide financial relief to families with qualifying children. The worksheet guides users through the calculations necessary to claim this credit, ensuring that they accurately report their income and the number of dependents. Understanding the purpose and structure of the 8812 Worksheet is essential for maximizing tax benefits.

How to use the 8812 Worksheet

Using the 8812 Worksheet involves a series of steps to ensure accurate completion. First, gather all necessary documents, including your tax return and information about your dependents. Next, follow the instructions on the worksheet carefully, filling in your income details and the number of qualifying children. It is important to double-check your calculations to avoid errors that could affect your tax refund. Once completed, the worksheet should be submitted along with your tax return to the IRS.

Steps to complete the 8812 Worksheet

Completing the 8812 Worksheet requires attention to detail. Here are the steps to follow:

- Gather your tax documents, including your Form 1040.

- Identify your qualifying children based on IRS criteria.

- Fill in your adjusted gross income (AGI) and other required financial information.

- Calculate the total credit based on the number of qualifying children.

- Review your entries for accuracy before submitting.

Legal use of the 8812 Worksheet

The 8812 Worksheet must be completed in accordance with IRS regulations to ensure its legal validity. This includes using accurate information regarding your income and dependents. The IRS requires that all claims for the Additional Child Tax Credit be substantiated with appropriate documentation. By following the guidelines set forth by the IRS, taxpayers can ensure that their use of the 8812 Worksheet is compliant with tax laws.

IRS Guidelines

The IRS provides specific guidelines for completing the 8812 Worksheet. These guidelines outline eligibility criteria, documentation requirements, and filing procedures. Taxpayers should refer to the latest IRS publications and instructions to stay informed about any changes in tax law that may affect their ability to claim the Additional Child Tax Credit. Adhering to these guidelines is crucial for a successful filing process.

Filing Deadlines / Important Dates

Filing deadlines for submitting the 8812 Worksheet are aligned with the annual tax return deadlines. Typically, individual tax returns are due on April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to deadlines and to file your tax return, including the 8812 Worksheet, on time to avoid penalties.

Quick guide on how to complete 8812 worksheet

Effortlessly Prepare 8812 Worksheet on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers a perfect eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the instruments necessary to create, edit, and electronically sign your documents swiftly, without any hold-ups. Manage 8812 Worksheet on any device using the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

Edit and eSign 8812 Worksheet with Ease

- Find 8812 Worksheet and click Get Form to begin.

- Make use of the tools available to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional ink signature.

- Review all information and click on the Done button to apply your changes.

- Select your preferred method for submitting the form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Edit and eSign 8812 Worksheet to guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 8812 worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is schedule 8812 and how can it benefit my business?

Schedule 8812 is an essential tax form used to claim the Recovery Rebate Credit and the Child Tax Credit. By utilizing airSlate SignNow for signing and sending this document, businesses can streamline their tax filing process. This can result in quicker reimbursements and a more organized way to manage financial paperwork.

-

How does airSlate SignNow facilitate the process of completing schedule 8812?

airSlate SignNow simplifies the completion of schedule 8812 by allowing users to fill in and eSign the document online. The platform features user-friendly tools for editing and organizing documents, ensuring accurate submissions. By reducing the manual effort required, businesses can save time and minimize errors.

-

Is airSlate SignNow a cost-effective solution for managing schedule 8812?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses needing to manage schedule 8812 and other documents. With flexible pricing plans, it provides an affordable way to handle eSigning tasks without compromising on features or security. This helps businesses keep their operational costs low while maintaining compliance.

-

What key features does airSlate SignNow offer for schedule 8812?

airSlate SignNow offers several key features for schedule 8812, including customizable templates, automated workflows, and secure eSignature options. These features enable users to quickly prepare documents and route them for signatures with ease. Moreover, real-time tracking ensures that you can monitor the progress of your submissions.

-

Can I integrate airSlate SignNow with other software for managing schedule 8812?

Absolutely! airSlate SignNow offers seamless integrations with various software platforms, including CRM and accounting tools. This allows you to streamline document management processes related to schedule 8812, ensuring that all your business operations work in harmony for efficiency.

-

Are there any security features when using airSlate SignNow for schedule 8812?

Yes, airSlate SignNow prioritizes security when handling schedule 8812 and other sensitive documents. The platform implements advanced encryption, secure user authentication, and compliance with industry standards. This ensures that your financial information is safe throughout the signing process.

-

How can airSlate SignNow help with compliance when filling out schedule 8812?

airSlate SignNow assists with compliance by ensuring that your schedule 8812 is completed accurately and in accordance with IRS regulations. The platform provides guidance and templates specifically designed for tax forms, helping to mitigate risks associated with errors or omissions. This allows businesses to confidently submit their forms on time.

Get more for 8812 Worksheet

- Affidavit of non ownership colorado form

- Database battery sds msi laptop form

- Non reliance letter template form

- Use this bladder diary to keep track of what you drink how much you drink and when you have an incontinent moment form

- Maseno university application form pdf

- Quest diagnostics scholarship form

- Mw 508a annual employer withholding reconciliation return mw 508a annual employer withholding reconciliation return form

- Application for homestead tax credit eligibility form

Find out other 8812 Worksheet

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple