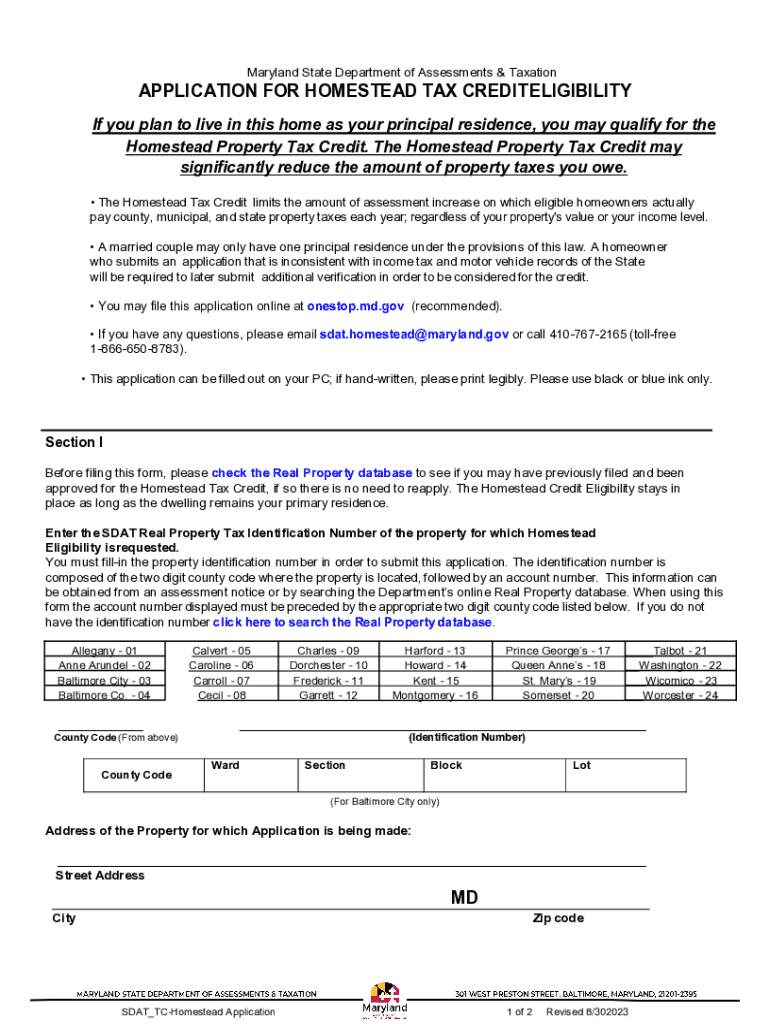

APPLICATION for HOMESTEAD TAX CREDIT ELIGIBILITY Form

What is the application for homestead tax credit eligibility?

The application for homestead tax credit eligibility in Maryland is a form that homeowners use to apply for a reduction in property taxes. This credit is designed to provide financial relief for eligible homeowners by lowering the taxable assessment of their primary residence. To qualify, the property must be owner-occupied, and the homeowner must meet specific eligibility criteria set by the state. Understanding the details of this application is crucial for homeowners seeking to benefit from tax savings.

Eligibility criteria for the homestead tax credit

To qualify for the Maryland homestead tax credit, several criteria must be met:

- The property must be the homeowner's principal residence.

- The homeowner must be an individual, not a business entity.

- The homeowner must have owned the property for at least six months prior to applying.

- There should be no significant changes in ownership or use of the property.

Meeting these criteria is essential for successful application and approval of the homestead tax credit.

Steps to complete the application for homestead tax credit eligibility

Completing the application for homestead tax credit eligibility involves several key steps:

- Obtain the application form from the Maryland State Department of Assessments and Taxation.

- Fill out the required information, including property details and ownership status.

- Provide any necessary supporting documentation to verify eligibility.

- Submit the completed application form by the specified deadline.

Following these steps carefully can help ensure a smooth application process.

Required documents for the application

When applying for the homestead tax credit, homeowners must prepare specific documents to support their application. These may include:

- Proof of ownership, such as a deed or title.

- Identification documents, like a driver's license or state ID.

- Any additional documents that demonstrate the property is the primary residence.

Gathering these documents in advance can facilitate a more efficient application process.

Form submission methods

The application for homestead tax credit eligibility can be submitted through various methods:

- Online submission via the Maryland State Department of Assessments and Taxation website.

- Mailing the completed form to the appropriate local assessment office.

- In-person submission at local assessment offices.

Choosing the right submission method can help ensure timely processing of the application.

Application process and approval time

The application process for the homestead tax credit typically involves the following stages:

- Submission of the application form and supporting documents.

- Review by the local assessment office to verify eligibility.

- Notification of approval or denial sent to the applicant.

Approval times can vary, but applicants should expect to receive a decision within a few weeks after submission. Staying informed about the status of the application can help homeowners plan accordingly.

Quick guide on how to complete application for homestead tax credit eligibility

Prepare APPLICATION FOR HOMESTEAD TAX CREDIT ELIGIBILITY seamlessly on any device

Digital document management has gained traction with organizations and individuals alike. It offers a superb environmentally friendly substitute for traditional printed and signed documents, as you can easily access the right form and securely archive it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents swiftly and without interruptions. Manage APPLICATION FOR HOMESTEAD TAX CREDIT ELIGIBILITY on any device using the airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The easiest way to modify and electronically sign APPLICATION FOR HOMESTEAD TAX CREDIT ELIGIBILITY effortlessly

- Find APPLICATION FOR HOMESTEAD TAX CREDIT ELIGIBILITY and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or mask sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow manages all your needs in document organization in just a few clicks from the device of your choice. Modify and electronically sign APPLICATION FOR HOMESTEAD TAX CREDIT ELIGIBILITY to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application for homestead tax credit eligibility

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the homestead tax credit Maryland?

The homestead tax credit Maryland is a program designed to provide property tax relief to homeowners by limiting the amount of assessment increases on their primary residence. This credit helps reduce the financial burden on homeowners, making it easier to manage property taxes.

-

How do I apply for the homestead tax credit Maryland?

To apply for the homestead tax credit Maryland, you need to complete an application form available on the Maryland State Department of Assessments and Taxation website. Ensure you provide all necessary documentation to support your application, as this will expedite the approval process.

-

What are the eligibility requirements for the homestead tax credit Maryland?

Eligibility for the homestead tax credit Maryland typically requires that the property is your primary residence and that you have owned the property for at least 12 months. Additionally, you must not have received the credit on any other property during the same time period.

-

How much can I save with the homestead tax credit Maryland?

The savings from the homestead tax credit Maryland can vary based on the assessed value of your property and the local tax rate. Generally, this credit can signNowly reduce your property tax bill, providing substantial savings for eligible homeowners.

-

Can I use airSlate SignNow to manage my homestead tax credit Maryland documents?

Yes, airSlate SignNow is an excellent tool for managing your homestead tax credit Maryland documents. With its easy-to-use eSigning features, you can quickly send, sign, and store all necessary paperwork securely, streamlining the application process.

-

What features does airSlate SignNow offer for document management related to homestead tax credit Maryland?

airSlate SignNow offers features such as customizable templates, secure cloud storage, and real-time tracking for document status. These features make it easier to manage your homestead tax credit Maryland applications and ensure that all documents are processed efficiently.

-

Is airSlate SignNow cost-effective for managing homestead tax credit Maryland applications?

Absolutely! airSlate SignNow provides a cost-effective solution for managing your homestead tax credit Maryland applications. With various pricing plans, you can choose one that fits your budget while still benefiting from powerful document management tools.

Get more for APPLICATION FOR HOMESTEAD TAX CREDIT ELIGIBILITY

- Court eviction texas form

- Texas expungement form

- Real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential house 497327761 form

- Texas annual minutes form

- Notices resolutions simple stock ledger and certificate texas form

- Minutes for organizational meeting texas texas form

- Texas secretary state office form

- Lead based paint disclosure for sales transaction texas form

Find out other APPLICATION FOR HOMESTEAD TAX CREDIT ELIGIBILITY

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation