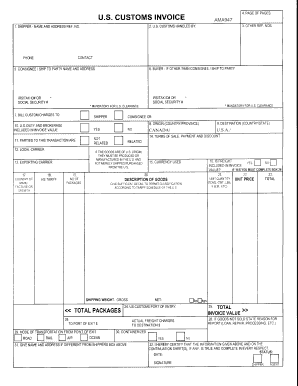

Us Customs Invoice Form

What is the U.S. Customs Invoice?

The U.S. Customs Invoice is a crucial document used in international shipping to declare the value and nature of goods being imported or exported. This invoice provides customs officials with essential information to assess duties and taxes. It typically includes details such as the seller and buyer's information, a description of the goods, their value, and the country of origin. The U.S. Customs Invoice is essential for compliance with customs regulations and facilitates the smooth processing of shipments across borders.

Key Elements of the U.S. Customs Invoice

When filling out the U.S. Customs Invoice, several key elements must be included to ensure accuracy and compliance. These elements typically consist of:

- Seller and Buyer Information: Names, addresses, and contact details of both parties.

- Description of Goods: A detailed description of each item, including quantity and unit value.

- Country of Origin: The country where the goods were manufactured or produced.

- Total Invoice Value: The total value of the goods being shipped, which is critical for duty assessment.

- Payment Terms: Information regarding payment methods and terms agreed upon by the seller and buyer.

Steps to Complete the U.S. Customs Invoice

Completing the U.S. Customs Invoice involves several straightforward steps to ensure all necessary information is accurately captured:

- Gather Information: Collect all relevant details about the shipment, including seller and buyer information, item descriptions, and values.

- Fill Out the Invoice: Use a blank customs invoice template to enter the gathered information clearly and legibly.

- Review for Accuracy: Double-check all entries for correctness, ensuring that all required fields are completed.

- Sign and Date: Ensure that the invoice is signed and dated by the appropriate party to validate the document.

- Submit to Customs: Include the completed invoice with your shipment and submit it to the relevant customs authority.

Legal Use of the U.S. Customs Invoice

The U.S. Customs Invoice holds legal significance as it serves as a binding document for customs declarations. To be considered legally valid, it must meet specific requirements set forth by customs authorities. This includes accurate and truthful representation of the goods, compliance with U.S. customs regulations, and proper signatures. Failure to adhere to these legal standards may result in penalties or delays in processing shipments.

How to Obtain the U.S. Customs Invoice

Obtaining a U.S. Customs Invoice is a straightforward process. Businesses can access a blank customs invoice template through various sources, including government websites or shipping companies. Many online platforms, such as signNow, offer customizable templates that can be filled out digitally. This allows for easy completion and storage of the invoice, ensuring that businesses can maintain accurate records for their shipments.

Digital vs. Paper Version of the U.S. Customs Invoice

Both digital and paper versions of the U.S. Customs Invoice are acceptable for customs processing. The digital version, often filled out using eSignature solutions, offers advantages such as ease of completion, storage, and sharing. It also allows for quick updates and modifications. On the other hand, a paper version may be preferred in certain situations, particularly when dealing with traditional shipping methods. Regardless of the format, it is essential that all required information is accurately presented to comply with customs regulations.

Quick guide on how to complete us customs invoice van kam freightways

Complete Us Customs Invoice effortlessly on any device

Managing documents online has become increasingly favored by both businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the required form and securely retain it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without interruption. Manage Us Customs Invoice on any device with airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

The simplest method to modify and electronically sign Us Customs Invoice effortlessly

- Locate Us Customs Invoice and click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight key sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document versions. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choice. Modify and electronically sign Us Customs Invoice and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How to fill the apple U.S tax form (W8BEN iTunes Connect) for indie developers?

This article was most helpful: Itunes Connect Tax Information

-

How do I mail a regular letter to Venezuela? Do I need to fill out a customs form for a regular letter or do I just need to add an international mail stamp and send it?

You do not need to fill out a customs form for a regular letter sent from the US to any other country. Postage for an international letter under 1 ounce is currently $1.15. You may apply any stamp - or combination of stamps - which equals that amount.

-

Is it normal nowadays for U.S. physicians to charge $100+ to fill out a 2-page form for a patient?

Medicaid patients would never be expected to pay their own bills. That defeats the purpose of providing this program as a resource to the aid of those who are below the poverty level. Legally, if you signed paperwork to the effect that you agree to pay whatever your insurance won't, there may be an issue.The larger question aside, technically, the professionally can set his fees at whatever level the market will allow. His time spent to complete your form would have been otherwise spent productively. The fact that he is the gatekeeper to your disability benefits should amount to some value with which you are able to accept rewarding him (or her).The doctor’s office needs to find a billable reason to submit (or re-submit) the claim as part of your medical treatment to Medicaid. It is absolutely a normal responsibility of their billing office to find a way to get insurance to reimburse. The failure is theirs, and turning the bill over to you would be ridiculous.If they accept Medicaid to begin with, they have to deal with the government’s complex processes to get paid. Generally, when a claim is denied a new reason to justify the doctor patient interaction will be necessary. I would guess “encounter for administrative reason” was sent. It is often too vague to justify payment. They may need to include the diagnosis behind your medical disability. If they have seen you before, and medical claims have bern accepted on those visits, then a resubmission for timely follow-up on those conditions could be justifued as reason for payment. The fact is, Medicaid is in a huge free-fall and payments are coming much more slowly since the new year. $800 billion is planned to be cut and possibly $600 billion on top of that. When we call their phone line for assistance, wait times are over two hours, if any one even answers. Expect less offices to accept new Medicaid, and many will be dismissing their Medicaid clients. If the office closes due to poor financial decisions, they can be of no service to anyone.Sister, things are rough all over.

-

Does a NAFTA TN Management consultant in the U.S. still need to fill out an i-9 form even though they are an independent contractor?

Yes.You must still prove work authorization even though you are a contractor. You will fill out the I9 and indicate that you are an alien authorized to work, and provide the relevant details of your TN visa in support of your application.Hope this helps.

-

For the new 2016 W8-BEN-E form to be filled out by companies doing business as a seller on the Amazon USA website, do I fill out a U.S. TIN, a GIIN, or a foreign TIN?

You will need to obtain an EIN for the BC corporation; however, I would imagine a W8-BEN is not appropriate for you, if you are selling through Amazon FBA. The FBA program generally makes Amazon your agent in the US, which means any of your US source income, ie anything sold to a US customer is taxable in the US. W8-BEN is asserting that you either have no US sourced income or that income is exempt under the US/Canadian tax treaty. Based on the limited knowledge I have of your situation, but if you are selling through the FBA program, I would say you don’t qualify to file a W8-BEN, but rather should be completing a W8-ECI and your BC corporation should be filing an 1120F to report your US effectively connected income.

Create this form in 5 minutes!

How to create an eSignature for the us customs invoice van kam freightways

How to create an electronic signature for the Us Customs Invoice Van Kam Freightways in the online mode

How to create an eSignature for the Us Customs Invoice Van Kam Freightways in Google Chrome

How to create an eSignature for putting it on the Us Customs Invoice Van Kam Freightways in Gmail

How to create an electronic signature for the Us Customs Invoice Van Kam Freightways from your smartphone

How to generate an electronic signature for the Us Customs Invoice Van Kam Freightways on iOS devices

How to create an eSignature for the Us Customs Invoice Van Kam Freightways on Android devices

People also ask

-

What is a US Customs Invoice and why do I need it?

A US Customs Invoice is a crucial document used for international shipments, detailing the contents of the package for customs clearance. It helps customs officials assess duties and taxes, ensuring your shipment complies with US regulations. By using airSlate SignNow, you can easily create and eSign your US Customs Invoice, streamlining your shipping process.

-

How does airSlate SignNow simplify the creation of a US Customs Invoice?

airSlate SignNow offers intuitive templates that make it easy to create a US Customs Invoice quickly and accurately. You can fill in the required information, add necessary details about the shipment, and eSign the document—all in one seamless platform. This simplifies compliance and saves you time during the shipping process.

-

Can I integrate airSlate SignNow with my existing shipping software for US Customs Invoices?

Yes, airSlate SignNow integrates seamlessly with various shipping and logistics platforms, allowing you to generate and manage your US Customs Invoices efficiently. This integration helps ensure that your documents are automatically populated with shipment details, reducing errors and improving workflow. Check our integrations page for more details.

-

Is there a cost associated with using airSlate SignNow for US Customs Invoices?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Depending on your needs, you can choose a plan that includes features for creating and eSigning US Customs Invoices at a cost-effective rate. Explore our pricing page to find the best option for your business.

-

What features does airSlate SignNow offer for managing US Customs Invoices?

airSlate SignNow provides a range of features to manage your US Customs Invoices, including customizable templates, electronic signatures, and document storage. You can also track the status of your invoices in real-time, ensuring you stay informed throughout the shipping process. These features simplify compliance and enhance efficiency.

-

How secure are my US Customs Invoices when using airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure data storage protocols to protect your US Customs Invoices and sensitive information. This ensures that your documents remain confidential and secure throughout the eSigning process.

-

Can I access my US Customs Invoices from any device using airSlate SignNow?

Absolutely! airSlate SignNow is designed to be accessible from any device, whether you're using a computer, tablet, or smartphone. This flexibility allows you to create, edit, and eSign your US Customs Invoices on the go, making it convenient for busy professionals.

Get more for Us Customs Invoice

- Lone wolf character sheet pdf form

- Icmje form for disclosure of potential conflicts of interest

- Waiver of liability and hold harmless agreement form

- American psycho book pdf form

- Senior project independent study time log vernon regional adult form

- Alcohol and the brain worksheet form

- Gestational surrogate application form the center for egg options

- Chapelgate counseling form

Find out other Us Customs Invoice

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors