593 Form

What is the 593 Form

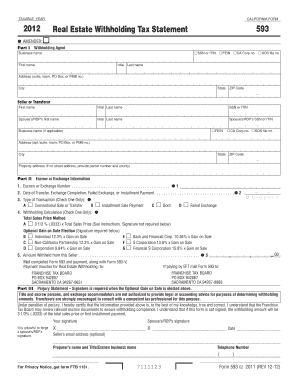

The 593 form is a tax document used in the United States primarily for reporting the sale of real estate. It is essential for both buyers and sellers to understand this form, as it outlines the withholding requirements for the sale of property by non-resident sellers. The form ensures that the appropriate amount of tax is withheld from the proceeds of the sale, facilitating compliance with federal tax regulations.

How to use the 593 Form

Using the 593 form involves several steps to ensure accurate reporting and compliance. First, the seller must complete the form with their personal information, including name, address, and taxpayer identification number. Next, details about the property being sold, including the sale price and date of sale, must be provided. Finally, the form must be signed and submitted to the appropriate tax authority, typically alongside the seller's tax return.

Steps to complete the 593 Form

Completing the 593 form requires careful attention to detail. Follow these steps:

- Gather necessary information, including the seller's identification and property details.

- Fill out the form accurately, ensuring all fields are completed.

- Review the form for any errors or omissions.

- Sign the form to validate it.

- Submit the completed form to the relevant tax authority, either electronically or by mail.

Legal use of the 593 Form

The legal use of the 593 form is crucial for ensuring compliance with tax laws. This form serves as a declaration of the seller's tax obligations related to the sale of real estate. Failure to properly complete and submit the form may result in penalties, including fines or additional tax liabilities. It is important for both buyers and sellers to understand their responsibilities under U.S. tax law when using this form.

Filing Deadlines / Important Dates

Filing deadlines for the 593 form are critical for compliance. Typically, the form must be submitted at the time of the property sale or with the seller's tax return for the year in which the sale occurred. It is advisable to check specific deadlines each tax year, as they may vary. Missing these deadlines can lead to penalties or complications in the tax filing process.

Required Documents

To complete the 593 form, certain documents are required. These may include:

- Proof of identity, such as a Social Security number or Individual Taxpayer Identification Number.

- Details of the property being sold, including the sale agreement.

- Any previous tax documents related to the property, if applicable.

Form Submission Methods (Online / Mail / In-Person)

The 593 form can be submitted through various methods, depending on the preferences of the seller and the requirements of the tax authority. Options typically include:

- Online submission through the tax authority's website.

- Mailing a physical copy of the completed form.

- In-person submission at designated tax offices, if available.

Quick guide on how to complete 593 form

Complete 593 Form seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Handle 593 Form on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and eSign 593 Form effortlessly

- Obtain 593 Form and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred delivery method for your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form navigation, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Edit and eSign 593 Form to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 593 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 593 form, and why is it important?

The 593 form is a crucial document used in the state of California to report withholding on payments made to foreign individuals. Understanding the 593 form is important for businesses to ensure compliance with tax regulations and avoid penalties. By utilizing airSlate SignNow, you can easily eSign and send the 593 form securely.

-

How can airSlate SignNow help with the 593 form?

airSlate SignNow offers features that streamline the process of signing and sending the 593 form. With its easy-to-use interface, you can quickly fill out, eSign, and send the 593 form from any device. This simplifies your workflow and ensures that all documents are signed promptly.

-

What are the pricing options for using airSlate SignNow for the 593 form?

airSlate SignNow provides flexible pricing plans that cater to different business needs for handling documents like the 593 form. You can choose from various tiers depending on the volume of documents and features required. Each plan allows for efficient management of the 593 form without compromising on quality.

-

Are there any integrations available with airSlate SignNow for the 593 form?

Yes, airSlate SignNow integrates seamlessly with various platforms to facilitate easy handling of the 593 form. You can connect it with your CRM, cloud storage, and other productivity tools, ensuring a smoother process for document management. These integrations enable you to incorporate the 593 form into your existing workflows effortlessly.

-

What are the key features of airSlate SignNow that assist with the 593 form?

airSlate SignNow boasts several key features that enhance the usability of the 593 form, including customizable templates, real-time tracking, and audit trails. These features ensure that your documents are processed efficiently and securely. Moreover, eSigning the 593 form becomes a streamlined task with such helpful tools.

-

How secure is airSlate SignNow when handling the 593 form?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive documents like the 593 form. The platform utilizes advanced encryption and complies with various security regulations to protect your data. This ensures that your 593 form remains confidential and secure during the signing process.

-

Can multiple users collaborate on the 593 form using airSlate SignNow?

Absolutely! airSlate SignNow allows multiple users to collaborate on the 593 form, making it easy for teams to work together. Users can share the document, add comments, and make edits in real-time, enhancing team collaboration. This feature is especially beneficial when dealing with crucial forms such as the 593 form.

Get more for 593 Form

Find out other 593 Form

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast

- Electronic signature Louisiana Land lease agreement Fast

- How Do I eSignature Arizona Attorney Approval

- How Can I eSignature North Carolina Retainer Agreement Template

- Electronic signature New York Land lease agreement Secure

- eSignature Ohio Attorney Approval Now

- eSignature Pennsylvania Retainer Agreement Template Secure

- Electronic signature Texas Land lease agreement Free

- Electronic signature Kentucky Landlord lease agreement Later

- Electronic signature Wisconsin Land lease agreement Myself

- Electronic signature Maryland Landlord lease agreement Secure

- How To Electronic signature Utah Landlord lease agreement

- Electronic signature Wyoming Landlord lease agreement Safe

- Electronic signature Illinois Landlord tenant lease agreement Mobile

- Electronic signature Hawaii lease agreement Mobile