NORTH DAKOTA BUSINESS or FARMING LIMITED LIABILITY Form

What is the North Dakota business or farming limited liability?

The North Dakota business or farming limited liability is a legal structure designed to protect the personal assets of its owners from business debts and liabilities. This form of organization combines the flexibility of a partnership with the liability protection of a corporation. It is particularly beneficial for entrepreneurs and farmers in North Dakota, allowing them to operate their businesses while minimizing personal financial risk.

How to obtain the North Dakota business or farming limited liability

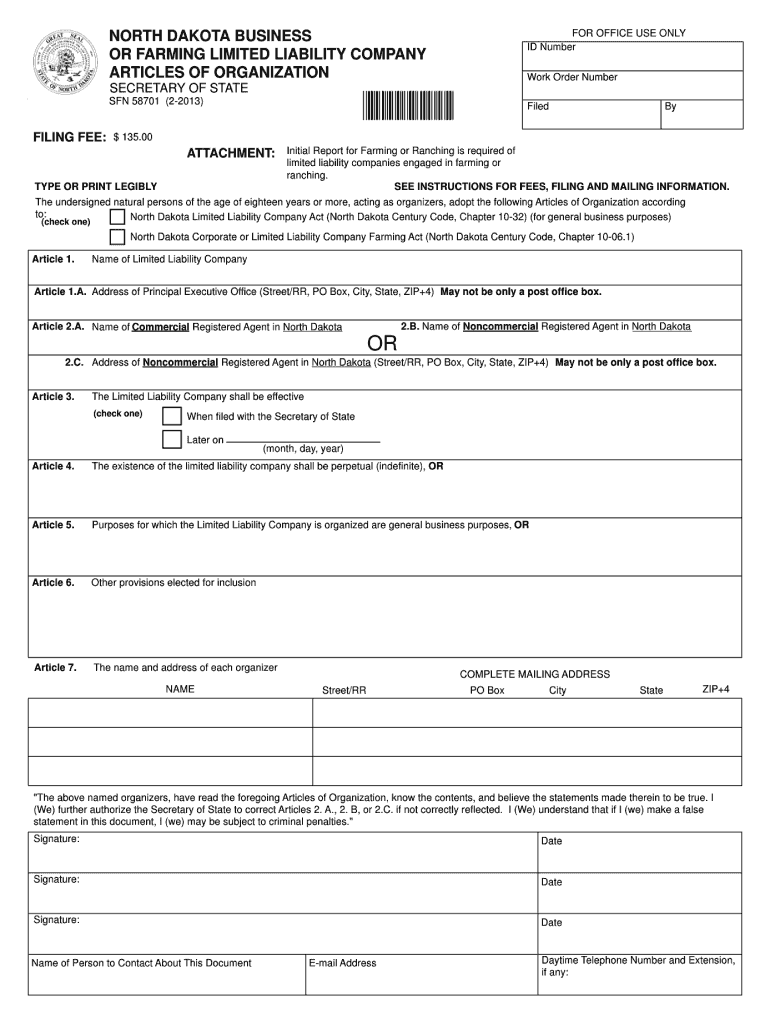

To obtain the North Dakota business or farming limited liability, you need to follow a series of steps. First, choose a unique name for your LLC that complies with state regulations. Next, file the Articles of Organization with the North Dakota Secretary of State. This document includes essential information about your LLC, such as its name, address, and the names of its members. Additionally, you may need to pay a filing fee, which varies depending on the type of LLC you are forming.

Steps to complete the North Dakota business or farming limited liability

Completing the North Dakota business or farming limited liability involves several key steps:

- Choose a name for your LLC that meets state requirements.

- Designate a registered agent who will receive legal documents on behalf of the LLC.

- File the Articles of Organization with the North Dakota Secretary of State.

- Create an operating agreement that outlines the management structure and operating procedures of the LLC.

- Obtain any necessary licenses or permits required for your specific business activities.

Key elements of the North Dakota business or farming limited liability

Key elements of the North Dakota business or farming limited liability include:

- Limited liability protection: Owners are not personally liable for the debts and obligations of the LLC.

- Pass-through taxation: Income is taxed at the individual level, avoiding double taxation.

- Flexible management structure: Members can choose how to manage the LLC, whether by themselves or by appointing managers.

- Compliance with state regulations: Adherence to North Dakota laws is necessary to maintain the LLC's status.

Required documents for forming an LLC in North Dakota

When forming an LLC in North Dakota, several documents are required. The primary document is the Articles of Organization, which must be filed with the Secretary of State. Additionally, an operating agreement is recommended, although not required by law. This agreement outlines the management and operational procedures of the LLC. Depending on the nature of your business, you may also need to obtain specific licenses or permits.

Eligibility criteria for forming an LLC in North Dakota

To form an LLC in North Dakota, you must meet certain eligibility criteria. The members of the LLC can be individuals or other business entities. There is no limit to the number of members, and they can be residents of any state. However, the chosen name for the LLC must be unique and not already in use by another business entity in North Dakota. Additionally, the LLC must have a registered agent with a physical address in the state.

Quick guide on how to complete north dakota business or farming limited liability

Prepare NORTH DAKOTA BUSINESS OR FARMING LIMITED LIABILITY effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, edit, and eSign your documents swiftly without delays. Manage NORTH DAKOTA BUSINESS OR FARMING LIMITED LIABILITY on any device with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to edit and eSign NORTH DAKOTA BUSINESS OR FARMING LIMITED LIABILITY with ease

- Find NORTH DAKOTA BUSINESS OR FARMING LIMITED LIABILITY and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal significance as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign NORTH DAKOTA BUSINESS OR FARMING LIMITED LIABILITY and guarantee seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Why Indians don't prefer to come under organised form of business like one person company or limited liability partnership (LLP)?

The first LLP was registered on the 2nd of April, 2009As of 3rd June, 2017 a Total of 96020 LLP’s have been registered in India.

-

I received my late husband's W-9 form to fill out for what I believe were our stocks. How am I supposed to fill this out or am I even supposed to?

You do not sound as a person who handles intricasies of finances on daily basis, this is why you should redirect the qustion to your family’s tax professional who does hte filings for you.The form itself, W-9 form, is a form created and approved by the IRS, if that’s your only inquiry.Whether the form applies to you or to your husband’s estate - that’s something only a person familiar with the situation would tell you about; there is no generic answer to this.

-

For the new 2016 W8-BEN-E form to be filled out by companies doing business as a seller on the Amazon USA website, do I fill out a U.S. TIN, a GIIN, or a foreign TIN?

You will need to obtain an EIN for the BC corporation; however, I would imagine a W8-BEN is not appropriate for you, if you are selling through Amazon FBA. The FBA program generally makes Amazon your agent in the US, which means any of your US source income, ie anything sold to a US customer is taxable in the US. W8-BEN is asserting that you either have no US sourced income or that income is exempt under the US/Canadian tax treaty. Based on the limited knowledge I have of your situation, but if you are selling through the FBA program, I would say you don’t qualify to file a W8-BEN, but rather should be completing a W8-ECI and your BC corporation should be filing an 1120F to report your US effectively connected income.

-

Are health clubs, gyms and other public businesses that require customers and clients to fill out health and/or medical forms or releases required to protect that information under HIPAA?

This does not fall under HIPAA. Under the HIPAA regulations, the entities that must comply with the rules are defined as "covered entities" which are: health care plans, health care providers, and health care clearinghouses. So health clubs or gyms do not meet this definition and are therefore not subject to HIPAA. However, depending on your state, there may be laws which protect the sharing of this type of information.

Create this form in 5 minutes!

How to create an eSignature for the north dakota business or farming limited liability

How to make an eSignature for your North Dakota Business Or Farming Limited Liability in the online mode

How to create an electronic signature for your North Dakota Business Or Farming Limited Liability in Chrome

How to generate an eSignature for putting it on the North Dakota Business Or Farming Limited Liability in Gmail

How to make an eSignature for the North Dakota Business Or Farming Limited Liability from your smartphone

How to make an eSignature for the North Dakota Business Or Farming Limited Liability on iOS devices

How to make an eSignature for the North Dakota Business Or Farming Limited Liability on Android OS

People also ask

-

What is a NORTH DAKOTA BUSINESS OR FARMING LIMITED LIABILITY company?

A NORTH DAKOTA BUSINESS OR FARMING LIMITED LIABILITY company (LLC) is a legal structure that protects owners from personal liability for business debts while allowing for flexible management and tax options. This structure is particularly beneficial for farmers and businesses in North Dakota looking to minimize risk and enhance operational flexibility.

-

How can airSlate SignNow help with my NORTH DAKOTA BUSINESS OR FARMING LIMITED LIABILITY paperwork?

airSlate SignNow simplifies the process of managing your NORTH DAKOTA BUSINESS OR FARMING LIMITED LIABILITY paperwork by allowing you to easily create, send, and eSign documents online. Our platform streamlines document workflows, making it easier for business owners and farmers to stay organized and compliant with state regulations.

-

What are the benefits of forming a NORTH DAKOTA BUSINESS OR FARMING LIMITED LIABILITY?

Forming a NORTH DAKOTA BUSINESS OR FARMING LIMITED LIABILITY offers several advantages, including personal liability protection, tax flexibility, and enhanced credibility with customers. It allows you to separate your personal assets from your business liabilities, which is particularly important in the farming industry where risks can be signNow.

-

Is airSlate SignNow affordable for managing my NORTH DAKOTA BUSINESS OR FARMING LIMITED LIABILITY?

Yes, airSlate SignNow is a cost-effective solution for managing your NORTH DAKOTA BUSINESS OR FARMING LIMITED LIABILITY needs. We offer various pricing plans that cater to different business sizes and budgets, ensuring you can find an option that fits your financial requirements while accessing essential eSigning features.

-

What features does airSlate SignNow offer for NORTH DAKOTA BUSINESS OR FARMING LIMITED LIABILITY users?

airSlate SignNow provides a range of features tailored for NORTH DAKOTA BUSINESS OR FARMING LIMITED LIABILITY users, including customizable templates, secure document storage, and real-time collaboration tools. These features help streamline your document management process and enhance productivity for your business operations.

-

Can I integrate airSlate SignNow with other tools for my NORTH DAKOTA BUSINESS OR FARMING LIMITED LIABILITY?

Absolutely! airSlate SignNow offers seamless integrations with popular business applications that can benefit your NORTH DAKOTA BUSINESS OR FARMING LIMITED LIABILITY, such as CRM systems, cloud storage services, and more. This flexibility allows you to create a comprehensive digital environment that meets all your business needs.

-

How does eSigning work for a NORTH DAKOTA BUSINESS OR FARMING LIMITED LIABILITY?

eSigning with airSlate SignNow for your NORTH DAKOTA BUSINESS OR FARMING LIMITED LIABILITY is simple and secure. You can upload documents, add signers, and send them for eSignature in just a few clicks, ensuring you can finalize agreements quickly and efficiently while maintaining compliance with legal standards.

Get more for NORTH DAKOTA BUSINESS OR FARMING LIMITED LIABILITY

Find out other NORTH DAKOTA BUSINESS OR FARMING LIMITED LIABILITY

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free