Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser Residential Land Contract, Executory Contract Form

What is the Texas Contract For Deed Seller's Annual Accounting Statement To Purchaser Residential Land Contract, Executory Contract

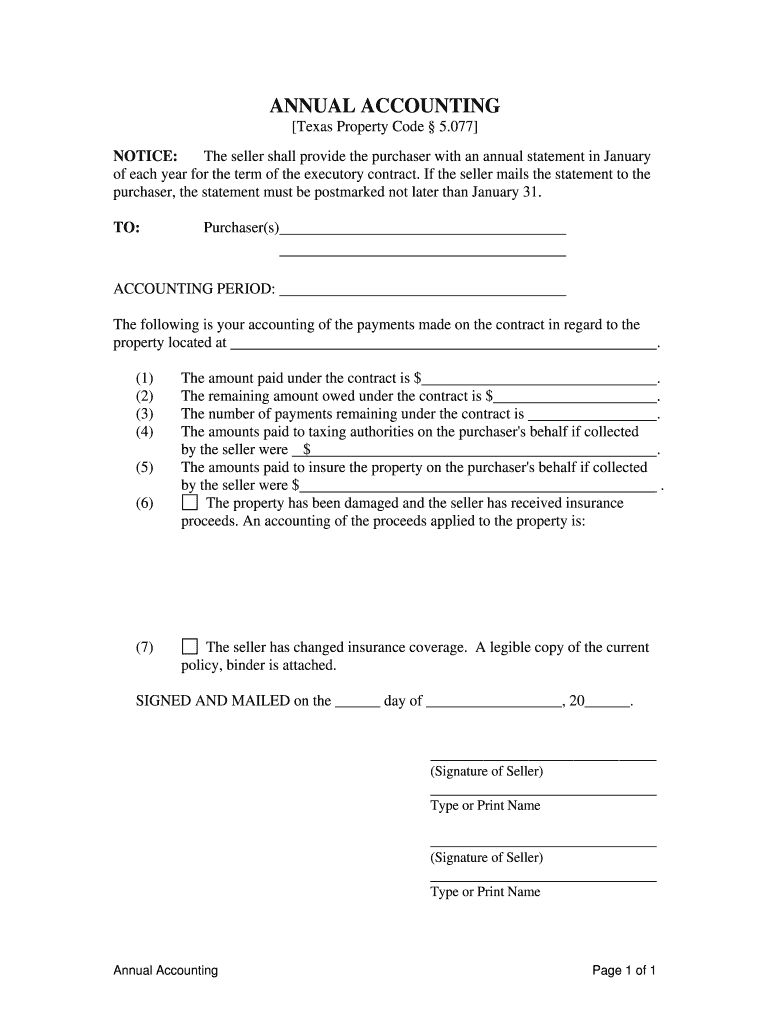

The Texas Contract For Deed Seller's Annual Accounting Statement To Purchaser is a crucial document in real estate transactions involving executory contracts. This statement outlines the financial details related to a residential land contract, providing transparency between the seller and the purchaser. It typically includes information such as the total purchase price, payments made, outstanding balance, and any applicable interest. Understanding this document is essential for both parties to ensure compliance with Texas real estate laws and to maintain clear communication regarding the financial aspects of the agreement.

How to use the Texas Contract For Deed Seller's Annual Accounting Statement To Purchaser Residential Land Contract, Executory Contract

To effectively use the Texas Contract For Deed Seller's Annual Accounting Statement, both the seller and purchaser should carefully review the document. The seller must accurately complete the statement, detailing all financial transactions that have occurred during the year. The purchaser should examine the statement for accuracy and clarity, ensuring that all payments and balances are correctly represented. This statement serves as a record for both parties and is often required for tax purposes, making its accuracy vital for financial reporting and compliance.

Steps to complete the Texas Contract For Deed Seller's Annual Accounting Statement To Purchaser Residential Land Contract, Executory Contract

Completing the Texas Contract For Deed Seller's Annual Accounting Statement involves several key steps:

- Gather all relevant financial records related to the contract, including payment history and any adjustments.

- Fill out the statement with accurate figures, including total payments received, outstanding balance, and any interest accrued.

- Review the completed statement for accuracy, ensuring all calculations are correct.

- Provide the statement to the purchaser, allowing them to verify the information.

- Retain a copy for your records, as it may be needed for future reference or tax filings.

Legal use of the Texas Contract For Deed Seller's Annual Accounting Statement To Purchaser Residential Land Contract, Executory Contract

The legal use of the Texas Contract For Deed Seller's Annual Accounting Statement is governed by state laws regarding real estate transactions. This document must be completed accurately to reflect the true financial status of the contract. It serves as a legal record that can be used in disputes or for tax reporting. Both parties should ensure that they understand their rights and obligations under the contract, as well as the implications of the information provided in the statement.

Key elements of the Texas Contract For Deed Seller's Annual Accounting Statement To Purchaser Residential Land Contract, Executory Contract

Key elements of the Texas Contract For Deed Seller's Annual Accounting Statement include:

- Total Purchase Price: The agreed-upon amount for the property.

- Payments Made: A detailed record of all payments made by the purchaser during the year.

- Outstanding Balance: The remaining amount owed by the purchaser.

- Interest Rate: Any applicable interest charged on the outstanding balance.

- Payment Schedule: An outline of when payments are due and any late fees that may apply.

State-specific rules for the Texas Contract For Deed Seller's Annual Accounting Statement To Purchaser Residential Land Contract, Executory Contract

Texas has specific rules governing the use of the Contract For Deed, including the requirement for sellers to provide an annual accounting statement to purchasers. This statement must be delivered within a certain timeframe and must include all relevant financial details. Failure to comply with these regulations can lead to legal repercussions for the seller. It is essential for both parties to be aware of their rights and responsibilities under Texas law to ensure a smooth transaction.

Quick guide on how to complete texas contract for deed sellers annual accounting statement to purchaser residential land contract executory contract

Easily prepare Texas Contract For Deed Seller's Annual Accounting Statement To Purchaser Residential Land Contract, Executory Contract on any device

The management of documents online has become increasingly popular among businesses and individuals. It serves as an excellent environmentally-friendly alternative to traditional printed and signed paperwork, as you can access the right form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Manage Texas Contract For Deed Seller's Annual Accounting Statement To Purchaser Residential Land Contract, Executory Contract on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related workflow today.

How to edit and electronically sign Texas Contract For Deed Seller's Annual Accounting Statement To Purchaser Residential Land Contract, Executory Contract effortlessly

- Locate Texas Contract For Deed Seller's Annual Accounting Statement To Purchaser Residential Land Contract, Executory Contract and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether it’s via email, SMS, an invitation link, or download it to your PC.

Eliminate the worry of lost or mislaid files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Edit and electronically sign Texas Contract For Deed Seller's Annual Accounting Statement To Purchaser Residential Land Contract, Executory Contract and ensure seamless communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the texas contract for deed sellers annual accounting statement to purchaser residential land contract executory contract

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Texas Contract For Deed Seller's Annual Accounting Statement To Purchaser Residential Land Contract, Executory Contract?

A Texas Contract For Deed Seller's Annual Accounting Statement To Purchaser Residential Land Contract, Executory Contract is a document outlining the financial transactions between the seller and purchaser over the year. This statement ensures that both parties are on the same page regarding payments and remaining balances. It's crucial for maintaining transparency and trust in the transaction.

-

How can airSlate SignNow help in managing a Texas Contract For Deed Seller's Annual Accounting Statement?

airSlate SignNow provides a streamlined platform for creating, sending, and eSigning the Texas Contract For Deed Seller's Annual Accounting Statement To Purchaser Residential Land Contract, Executory Contract. This eliminates the hassle of paper-based processes and enhances efficiency. Our solution allows you to track documents easily and receive notifications when they are signed.

-

What are the pricing options for using airSlate SignNow for Texas Contract For Deed documents?

AirSlate SignNow offers various pricing plans to fit your needs for managing Texas Contract For Deed Seller's Annual Accounting Statement To Purchaser Residential Land Contract, Executory Contract. You can choose from individual, business, or enterprise plans, each designed to provide scalable solutions. Our pricing is cost-effective, ensuring you gain maximum value from our document management services.

-

What features does airSlate SignNow offer for Texas Contract For Deed management?

AirSlate SignNow includes features like customizable templates, document storage, and secure eSigning specifically for Texas Contract For Deed Seller's Annual Accounting Statement To Purchaser Residential Land Contract, Executory Contract. These tools streamline the process and enhance the security of your documents. Additionally, you can integrate with various applications to improve your workflow further.

-

What are the benefits of using airSlate SignNow for Texas Contract For Deed transactions?

Using airSlate SignNow for Texas Contract For Deed Seller's Annual Accounting Statement To Purchaser Residential Land Contract, Executory Contract offers numerous benefits. You can enjoy a paperless process, save time, and improve accuracy in your financial documentation. Furthermore, our platform enhances communication between parties, leading to a smoother transaction experience.

-

Is airSlate SignNow secure for Texas Contract For Deed documentation?

Yes, airSlate SignNow employs industry-standard security measures to protect your Texas Contract For Deed Seller's Annual Accounting Statement To Purchaser Residential Land Contract, Executory Contract. Our platform uses encryption and complies with various regulations to keep your sensitive information safe. You can trust us to handle your documents securely and confidentially.

-

Can I integrate airSlate SignNow with other software for Texas Contract For Deed management?

Absolutely! airSlate SignNow allows seamless integration with various third-party applications, making it simple to manage your Texas Contract For Deed Seller's Annual Accounting Statement To Purchaser Residential Land Contract, Executory Contract alongside other tools. This connectivity helps centralize your operations and enhances your overall workflow efficiency.

Get more for Texas Contract For Deed Seller's Annual Accounting Statement To Purchaser Residential Land Contract, Executory Contract

- Crs 1 form

- Ohio driving privileges letter form

- Lesson 7 homework practice solve systems of equations by graphing form

- Where do you mail a revenue form k 4 to

- Mcculloch fdd210 manual form

- Direct service provider dsp form

- Kamaaina kids administration employment application we are an equal opportunity employer rev form

- Indiana energy assistance program application form

Find out other Texas Contract For Deed Seller's Annual Accounting Statement To Purchaser Residential Land Contract, Executory Contract

- How Can I Sign Alaska Travel Agency Agreement

- How Can I Sign Missouri Travel Agency Agreement

- How Can I Sign Alabama Amendment to an LLC Operating Agreement

- Can I Sign Alabama Amendment to an LLC Operating Agreement

- How To Sign Arizona Amendment to an LLC Operating Agreement

- Sign Florida Amendment to an LLC Operating Agreement Now

- How To Sign Florida Amendment to an LLC Operating Agreement

- How Do I Sign Illinois Amendment to an LLC Operating Agreement

- How Do I Sign New Hampshire Amendment to an LLC Operating Agreement

- How To Sign New York Amendment to an LLC Operating Agreement

- Sign Washington Amendment to an LLC Operating Agreement Now

- Can I Sign Wyoming Amendment to an LLC Operating Agreement

- How To Sign California Stock Certificate

- Sign Louisiana Stock Certificate Free

- Sign Maine Stock Certificate Simple

- Sign Oregon Stock Certificate Myself

- Sign Pennsylvania Stock Certificate Simple

- How Do I Sign South Carolina Stock Certificate

- Sign New Hampshire Terms of Use Agreement Easy

- Sign Wisconsin Terms of Use Agreement Secure