W4101 Form

What is the W-4101?

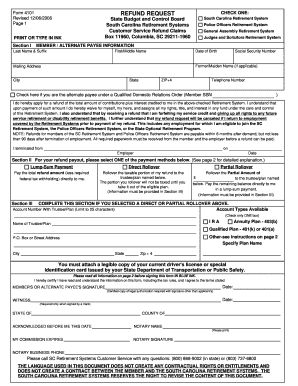

The W-4101 form is a specific document used in the state of South Carolina for retirement refund requests. This form is essential for individuals seeking to withdraw their retirement contributions from the South Carolina Retirement System. Understanding the purpose and requirements of the W-4101 is crucial for ensuring a smooth application process.

How to use the W-4101

Using the W-4101 form involves several steps. First, ensure that you meet the eligibility criteria for a refund. Next, download the form from the appropriate state resources or obtain a physical copy. Fill out the required information accurately, including personal details and retirement account information. Once completed, submit the form according to the provided instructions, either online or via mail.

Steps to complete the W-4101

Completing the W-4101 form requires careful attention to detail. Follow these steps:

- Gather necessary documents, such as identification and retirement account statements.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the reason for the refund request and provide any required supporting documentation.

- Review the form for accuracy and completeness before submission.

Legal use of the W-4101

The W-4101 form must be completed and submitted in compliance with state regulations. It is important to ensure that all information is accurate and that the form is signed where required. Legal validity is maintained when the form adheres to the guidelines set forth by the South Carolina Retirement System, including proper documentation and submission methods.

Required Documents

When submitting the W-4101 form, certain documents are typically required to support your refund request. These may include:

- A copy of your government-issued identification.

- Proof of your retirement account balance.

- Any additional documentation that supports your eligibility for a refund.

Form Submission Methods

The W-4101 form can be submitted through various methods to accommodate different preferences. Options typically include:

- Online submission via the South Carolina Retirement System's website.

- Mailing the completed form to the designated address.

- In-person submission at a local retirement office.

Quick guide on how to complete form 4101

Effortlessly Prepare form 4101 on Any Device

Managing documents online has gained signNow traction among enterprises and individuals alike. It presents an ideal eco-friendly substitute to traditional printed and signed documents, as it allows you to access the appropriate form and securely store it in the cloud. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without any delays. Manage w4101 on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

Effortlessly Edit and eSign w4101 form

- Obtain what is a w4101 form and select Get Form to begin.

- Utilize the tools at your disposal to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using the features that airSlate SignNow provides specifically for such purposes.

- Create your signature using the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign w4101 tax form to ensure seamless communication throughout the document preparation stages with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to w4101

Create this form in 5 minutes!

How to create an eSignature for the w4101 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask w4101 tax form

-

What is the w4101 feature in airSlate SignNow?

The w4101 feature in airSlate SignNow enhances document management by allowing users to automate workflows and manage eSignature processes efficiently. This feature is designed to streamline tasks and improve productivity by providing a user-friendly interface for document handling.

-

How much does airSlate SignNow with w4101 cost?

Pricing for airSlate SignNow featuring the w4101 capability is competitive and varies based on the chosen plan. Businesses can select from different tiers to find an option that fits their budget while benefiting from advanced eSignature solutions provided by w4101.

-

What are the key benefits of using w4101 in airSlate SignNow?

Using the w4101 feature in airSlate SignNow offers several benefits, including increased efficiency in document signing, improved tracking capabilities, and enhanced collaboration among team members. This ensures that businesses can close deals faster and reduce turnaround times on critical documents.

-

Can w4101 integrate with other software applications?

Yes, the w4101 feature in airSlate SignNow seamlessly integrates with various software applications, such as CRM and project management tools. This integration capability allows businesses to streamline their processes and reduce manual data entry while ensuring all documents are handled effectively.

-

Is the w4101 feature secure for handling sensitive documents?

Absolutely, the w4101 feature in airSlate SignNow adheres to industry-leading security standards to protect sensitive documents. With robust encryption and compliance with regulations such as GDPR and HIPAA, businesses can confidently manage their eSigning needs.

-

What types of documents can I use with the w4101 feature?

You can use the w4101 feature in airSlate SignNow for a variety of document types, including contracts, agreements, and consent forms. This versatility makes it a suitable solution for different industries looking to enhance their eSigning processes.

-

How does w4101 enhance the user experience in airSlate SignNow?

The w4101 feature signNowly enhances the user experience by providing intuitive navigation and customizable templates. This makes it easier for users to create, send, and track documents, ultimately leading to a more efficient signing process.

Get more for form 4101

- Agreement goods form

- Equipment bill of sale form

- Confirmation of agreement form

- Notice to buyer repudiating the existence of an oral sales agreement 497331258 form

- Agreement remedies form

- Mediation parties form

- Employment of manager of business that sells and install products form

- Basic construction contract form

Find out other form 4101 south carolina

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast

- Electronic signature Louisiana Land lease agreement Fast

- How Do I eSignature Arizona Attorney Approval

- How Can I eSignature North Carolina Retainer Agreement Template

- Electronic signature New York Land lease agreement Secure

- eSignature Ohio Attorney Approval Now

- eSignature Pennsylvania Retainer Agreement Template Secure

- Electronic signature Texas Land lease agreement Free

- Electronic signature Kentucky Landlord lease agreement Later