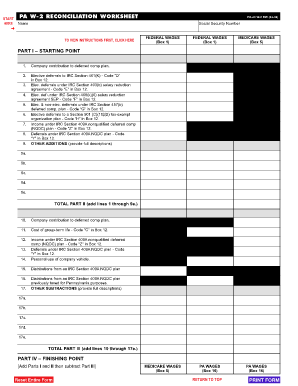

W2 Reconciliation Worksheet Form

What is the W-2 Reconciliation Worksheet

The W-2 reconciliation worksheet is a crucial document used by employers to ensure that the wages reported to the Internal Revenue Service (IRS) match the amounts reported on employees' W-2 forms. This worksheet helps in identifying discrepancies between the total wages, tips, and other compensation reported on the W-2 forms and the amounts reported on the employer's payroll records. By using this worksheet, employers can verify the accuracy of their payroll reporting and ensure compliance with tax regulations.

How to Use the W-2 Reconciliation Worksheet

To effectively use the W-2 reconciliation worksheet, employers should follow these steps:

- Gather all W-2 forms issued to employees for the tax year.

- Collect payroll records that detail total wages and withholdings for the same period.

- Input the total wages from the payroll records into the worksheet.

- Compare the total wages reported on the W-2 forms with the amounts calculated in the worksheet.

- Identify and document any discrepancies for further investigation.

Steps to Complete the W-2 Reconciliation Worksheet

Completing the W-2 reconciliation worksheet involves several key steps:

- Start by entering the employer's information, including the Employer Identification Number (EIN).

- List all employees and their corresponding W-2 amounts, including wages, tips, and other compensation.

- Calculate the total of all reported wages and compare this with the payroll records.

- Document any adjustments or corrections needed to resolve discrepancies.

- Finalize the worksheet by ensuring all calculations are accurate and complete.

Legal Use of the W-2 Reconciliation Worksheet

The W-2 reconciliation worksheet is legally recognized as a tool for ensuring compliance with federal tax regulations. Employers must accurately report wages to the IRS, and discrepancies can lead to audits or penalties. By maintaining thorough records and utilizing the reconciliation worksheet, employers can demonstrate due diligence in their reporting practices. It is essential to keep this document on file for a specified period, as it may be requested during audits or reviews.

Key Elements of the W-2 Reconciliation Worksheet

Several key elements are essential for the effective use of the W-2 reconciliation worksheet:

- Employer Information: Includes the employer's name, address, and EIN.

- Employee Details: Lists each employee's name and Social Security number.

- W-2 Amounts: Captures total wages, tips, and other compensation as reported on W-2 forms.

- Payroll Totals: Summarizes total wages and withholdings from payroll records.

- Discrepancy Notes: Provides space for documenting any differences found during reconciliation.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing W-2 forms and completing the reconciliation worksheet. Typically, W-2 forms must be submitted to the IRS by January thirty-first of the following year. Employers should also provide copies to employees by the same date. It is advisable to complete the W-2 reconciliation worksheet prior to these deadlines to ensure all discrepancies are resolved and accurate filings are made.

Quick guide on how to complete w2 reconciliation worksheet

Effortlessly Prepare W2 Reconciliation Worksheet on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily access the right form and securely store it online. airSlate SignNow offers you all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Handle W2 Reconciliation Worksheet on any device using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The Easiest Way to Modify and Electronically Sign W2 Reconciliation Worksheet with Ease

- Find W2 Reconciliation Worksheet and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign W2 Reconciliation Worksheet and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w2 reconciliation worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a PA W-2 reconciliation worksheet?

The PA W-2 reconciliation worksheet is a tool that helps businesses reconcile their Pennsylvania W-2 forms with state tax filings. It ensures that employee wage and tax information is accurate and in compliance with state regulations. By utilizing the PA W-2 reconciliation worksheet, organizations can avoid potential penalties for discrepancies.

-

How can airSlate SignNow assist with the PA W-2 reconciliation worksheet?

airSlate SignNow offers a streamlined solution for sending and eSigning PA W-2 reconciliation worksheets. With its user-friendly interface, businesses can efficiently manage document workflows and ensure timely compliance with state requirements. This cost-effective solution simplifies the reconciliation process, making it accessible for all users.

-

Is there a cost associated with using airSlate SignNow for the PA W-2 reconciliation worksheet?

Yes, airSlate SignNow offers flexible pricing plans tailored to various business needs. The pricing is designed to cater to different user volumes and feature requirements, providing great value for managing PA W-2 reconciliation worksheets. For specific pricing details, you can visit our pricing page or contact our sales team.

-

What features does airSlate SignNow provide for managing the PA W-2 reconciliation worksheet?

airSlate SignNow provides features like document templates, automated workflows, and secure electronic signatures that streamline the process of managing PA W-2 reconciliation worksheets. Additionally, it integrates with various tools to facilitate data import/export, ensuring a seamless experience for users preparing their reconciliation documents.

-

Can I integrate airSlate SignNow with other software for PA W-2 reconciliation?

Absolutely! airSlate SignNow offers integration capabilities with popular accounting and HR software, allowing for seamless data transfers related to PA W-2 reconciliation worksheets. This interoperability enhances workflow efficiency by reducing manual entry and errors, making tax preparation much easier.

-

What are the benefits of using airSlate SignNow for the PA W-2 reconciliation worksheet?

Using airSlate SignNow for your PA W-2 reconciliation worksheet simplifies the document management process, reduces paperwork, and increases accuracy. The electronic signature feature speeds up approvals and enhances collaboration among team members. Overall, it saves time and resources, enabling businesses to focus on core operations.

-

How secure is the document management process for PA W-2 reconciliation worksheets using airSlate SignNow?

Security is a top priority at airSlate SignNow. The platform employs industry-standard encryption and compliance measures to protect sensitive information in PA W-2 reconciliation worksheets. We ensure all user data is securely stored and transmitted, giving you peace of mind while managing your tax documents.

Get more for W2 Reconciliation Worksheet

- Chicago cubs license form

- Acceptable identification documents illinois secretary of state form

- Reduced fee license plate program cyberdrive illinois form

- Vsd 688 illinois secretary of state form

- Volantes espa ol illinois secretary of state form

- Documentation of non traditional support illinois secretary of state form

- Request to remove suppressed personal information

- Illinois graduated driver licensing program illinois secretary of state form

Find out other W2 Reconciliation Worksheet

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document