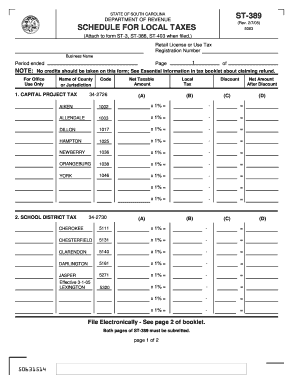

St 389 Form

What is the ST-389?

The ST-389 is a sales tax exemption form used in the United States, specifically for businesses and organizations that qualify for sales tax exemptions. This form allows eligible entities to purchase goods and services without paying sales tax, provided they meet specific criteria set by state regulations. The ST-389 is essential for non-profit organizations, government agencies, and certain educational institutions that are exempt from sales tax under applicable laws.

How to use the ST-389

To utilize the ST-389 form, eligible organizations must complete it accurately and present it to vendors when making purchases. The form typically requires information such as the name of the organization, its tax identification number, and a description of the items being purchased. It is important to ensure that the form is filled out completely to avoid any issues with vendors or tax authorities. Vendors may retain the ST-389 for their records to substantiate the tax-exempt status of the sale.

Steps to complete the ST-389

Completing the ST-389 involves several key steps:

- Gather necessary information, including the organization's name, address, and tax identification number.

- Provide a detailed description of the items or services being purchased under the exemption.

- Sign and date the form, confirming that the information provided is accurate and that the organization qualifies for the exemption.

- Present the completed ST-389 to the vendor at the time of purchase.

Legal use of the ST-389

The legal use of the ST-389 is governed by state tax regulations. Organizations must ensure they are eligible for sales tax exemption and that their purchases align with the allowed categories. Misuse of the ST-389, such as using it for ineligible purchases, can lead to penalties or fines. It is advisable for organizations to familiarize themselves with the specific rules and requirements related to the ST-389 in their state to maintain compliance.

Key elements of the ST-389

Several key elements are essential for the ST-389 form:

- Organization Information: The name and address of the exempt organization.

- Tax Identification Number: A unique identifier assigned to the organization for tax purposes.

- Purchase Description: A clear description of the goods or services being purchased.

- Signature: An authorized representative must sign the form to validate the exemption claim.

Filing Deadlines / Important Dates

While the ST-389 does not typically have specific filing deadlines like tax returns, it is crucial for organizations to present the form at the time of purchase to ensure tax exemption. Organizations should be aware of their local state deadlines for submitting any required annual reports or renewals related to their tax-exempt status. Keeping track of these dates helps maintain compliance and avoid any potential penalties.

Quick guide on how to complete st 389 100057083

Easily Prepare St 389 on Any Device

Digital document management has gained traction among companies and individuals alike. It offers a superb eco-friendly substitute for traditional printed and signed papers, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage St 389 on any device with airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

Effortlessly Edit and eSign St 389

- Locate St 389 and select Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to apply your changes.

- Select how you wish to deliver your form, whether by email, text message (SMS), or a sharing link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, the hassle of searching for forms, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and eSign St 389 and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st 389 100057083

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is st 389 and how does it relate to airSlate SignNow?

ST 389 refers to a specific compliance standard that many businesses follow to ensure secure document management. airSlate SignNow meets the requirements of st 389 by providing an easy-to-use platform for eSigning and managing documents securely.

-

How much does airSlate SignNow cost for users needing st 389 compliance?

airSlate SignNow offers various pricing plans, catering to businesses of all sizes. For users focusing on st 389 compliance, the pricing is competitive and provides essential features that ensure secure document handling.

-

What key features does airSlate SignNow offer to support st 389 compliance?

To comply with st 389, airSlate SignNow includes features such as secure eSigning, document encryption, and customizable workflows. These features help ensure that your documents remain confidential and meet compliance standards.

-

Can I integrate airSlate SignNow with other tools while ensuring st 389 compliance?

Yes, airSlate SignNow can be integrated with various third-party applications, allowing for a seamless workflow while maintaining st 389 compliance. Integration ensures that all documents are handled in a secure manner throughout the process.

-

What benefits can I expect when using airSlate SignNow for st 389 compliance?

Using airSlate SignNow for st 389 compliance offers numerous benefits, including enhanced security, increased efficiency, and simplified document management. This allows businesses to focus on their core activities while ensuring compliance standards are met.

-

Is airSlate SignNow user-friendly for businesses needing st 389 compliance?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for businesses to navigate and comply with st 389. The intuitive interface minimizes the learning curve, enabling users to start eSigning documents quickly.

-

Are there any customer support features available for st 389 users of airSlate SignNow?

Yes, airSlate SignNow provides robust customer support options to assist users focused on st 389 compliance. This includes access to a help center, live chat, and dedicated account managers to ensure that all queries are addressed promptly.

Get more for St 389

- Court of washington county of no courtswagov form

- Superior court of washington county of no order form

- Court of washington county of no firearm courtswagov form

- Order dismissing felony charges and form

- Washington state courts court s instructions doc form

- Oregon constitutional law newsletter oregon state bar yumpu form

- Full text of ampquotan essay towards an indian bibliography form

- Docket codes washington form

Find out other St 389

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure