Schedule E Calculator Form

What is the Schedule E Calculator

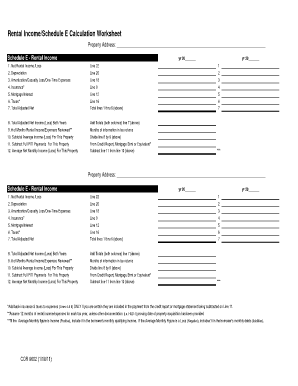

The Schedule E Calculator is a specialized tool designed to assist property owners and investors in accurately calculating their rental income and expenses for tax purposes. This calculator simplifies the process of reporting income from rental properties, royalties, partnerships, S corporations, estates, trusts, and more. By inputting relevant financial data, users can generate a comprehensive overview of their taxable rental income, which is essential for completing their tax returns.

How to use the Schedule E Calculator

Using the Schedule E Calculator is straightforward. Begin by gathering all necessary financial information related to your rental properties, including income received and expenses incurred. Enter these figures into the designated fields of the calculator. The tool will automatically compute your net rental income by subtracting total expenses from total income. This calculated amount can then be used to fill out the Schedule E form accurately.

Steps to complete the Schedule E Calculator

To effectively complete the Schedule E Calculator, follow these steps:

- Gather your rental income details, including monthly rents and any additional income sources.

- Collect all relevant expenses, such as property management fees, repairs, mortgage interest, and utilities.

- Input the total rental income into the calculator.

- Enter the total expenses in the corresponding sections.

- Review the calculated net rental income provided by the calculator.

- Use this figure to complete the Schedule E form for your tax return.

Legal use of the Schedule E Calculator

The Schedule E Calculator is legally recognized for assisting taxpayers in preparing their tax returns. It adheres to IRS guidelines, ensuring that the calculations made are valid and compliant with tax regulations. Utilizing this calculator helps ensure that all income and expenses are reported accurately, which is crucial for avoiding potential penalties associated with misreporting on tax returns.

Required Documents

To use the Schedule E Calculator effectively, certain documents are necessary. These include:

- Rental income statements, such as lease agreements or bank statements.

- Expense receipts for property-related costs, including repairs and maintenance.

- Mortgage statements detailing interest paid.

- Property tax records.

- Any relevant documentation for additional income sources, if applicable.

IRS Guidelines

The IRS provides specific guidelines regarding the reporting of rental income and expenses. It is essential to follow these guidelines to ensure compliance and avoid issues during tax filing. The Schedule E form must be completed accurately, reflecting all income and expenses associated with rental properties. Familiarizing yourself with IRS publications related to rental income can enhance your understanding and ensure that you are meeting all necessary requirements.

Quick guide on how to complete schedule e calculator

Complete Schedule E Calculator effortlessly on any device

Web-based document management has become popular with businesses and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage Schedule E Calculator on any device using airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

How to alter and electronically sign Schedule E Calculator with ease

- Find Schedule E Calculator and click Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or cover sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Schedule E Calculator and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule e calculator

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the airSlate SignNow calculator oline?

The airSlate SignNow calculator oline is an easy-to-use tool that helps you estimate the costs associated with signing and sending documents electronically. With this calculator, users can quickly determine potential savings and efficiencies by utilizing our eSignature services. This tool highlights the affordability and effectiveness of using airSlate SignNow.

-

How does airSlate SignNow's calculator oline improve business efficiency?

By using the airSlate SignNow calculator oline, businesses can streamline their document signing processes, signNowly reducing turnaround times. This platform automates many manual tasks, allowing teams to focus on more important activities. Enhanced efficiency leads to quicker transactions and improved customer satisfaction.

-

What features are included in the calculator oline?

The calculator oline offers various features, including cost estimations, integration options, and the ability to analyze document workflows. It is designed to provide users with clear insights on potential savings and the overall benefits of implementing airSlate SignNow. With its user-friendly interface, navigating these features is straightforward and intuitive.

-

Is airSlate SignNow's calculator oline free to use?

Yes, the airSlate SignNow calculator oline is free to use and available to all prospective customers. It provides organizations with a valuable resource to understand the costs associated with eSigning documents without any financial commitment. Users can explore the calculator oline's benefits before making an investment.

-

What are the pricing plans for airSlate SignNow?

AirSlate SignNow offers competitive pricing plans tailored to different business needs, starting from basic options for small businesses to more advanced plans for larger enterprises. You can easily compare these plans using the calculator oline to help determine which one best fits your budget and requirements. Each plan is designed to maximize value while reducing document processing costs.

-

Can the calculator oline integrate with other software tools?

Yes, the airSlate SignNow calculator oline can seamlessly integrate with various software tools and platforms, enhancing its functionality. This integration capability allows businesses to incorporate airSlate SignNow into existing workflows, which boosts overall productivity. Whether for CRM software or other business applications, integrations make your document management process even more efficient.

-

What benefits does airSlate SignNow provide over traditional signing methods?

Using airSlate SignNow instead of traditional signing methods can greatly reduce the time and cost associated with document management. The calculator oline demonstrates how organizations can save on labor and material costs by switching to eSignatures. Additionally, it enhances security, accessibility, and compliance, making it a superior choice for businesses.

Get more for Schedule E Calculator

- Innovative industrial properties inc form 8 k received 11

- Get the minnesota flood zone statement and authorization form

- Affidavit for service by publication of lawful age being form

- County of state of arizona and described as form

- Arizona last will and testament married adult wadult form

- Free arizona notarial certificate copy certification pdf form

- Portfolio table of contents sample my lisaromanoski form

- Foreign judgment packet educationcenter2000 form

Find out other Schedule E Calculator

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now