Form 5329

What is the Form 5329

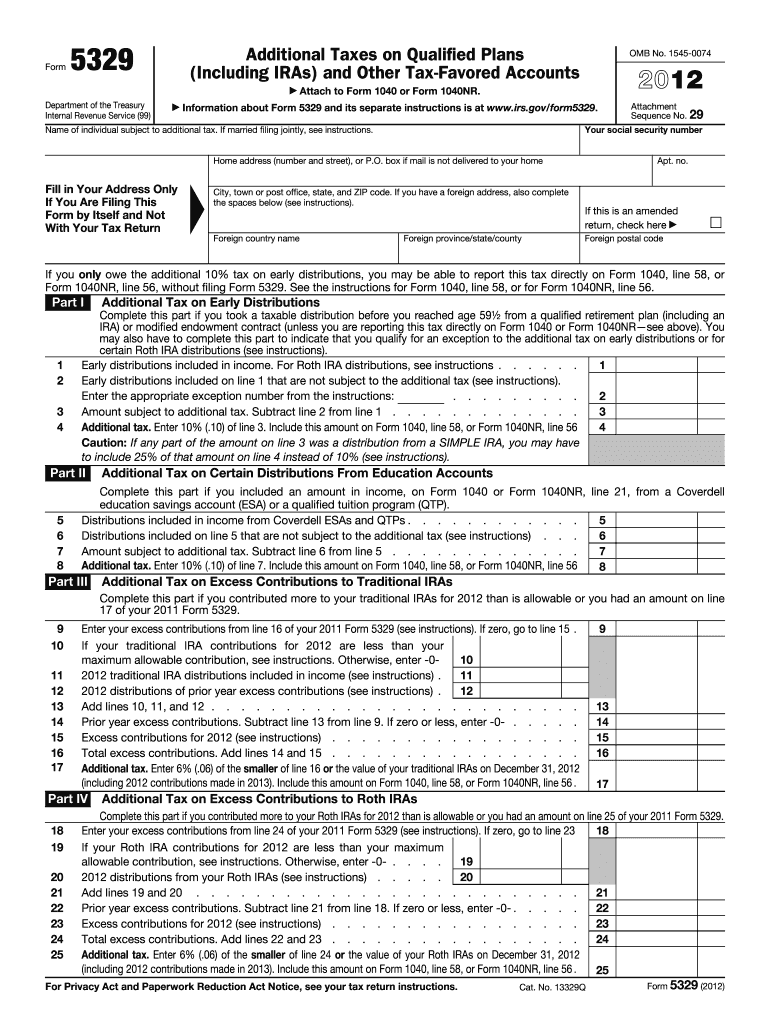

The 2012 Form 5329 is a tax form used by individuals to report additional taxes on qualified retirement plans, including IRAs (Individual Retirement Accounts). This form is essential for taxpayers who have incurred excess contributions, early distributions, or who are subject to certain penalties related to their retirement accounts. Understanding the purpose and requirements of Form 5329 is crucial for ensuring compliance with IRS regulations and avoiding unnecessary penalties.

How to use the Form 5329

To effectively use the 2012 Form 5329, taxpayers must first identify the specific section that applies to their situation. The form includes various parts that address different tax liabilities associated with retirement accounts. For instance, Part I is for reporting additional taxes on early distributions, while Part II deals with excess contributions. It is important to carefully read the instructions provided with the form to determine which sections need to be completed based on individual circumstances.

Steps to complete the Form 5329

Completing the 2012 Form 5329 involves several steps:

- Gather necessary documents, including any records of contributions and distributions from retirement accounts.

- Identify the correct parts of the form based on your tax situation.

- Fill out the form accurately, ensuring that all required information is provided.

- Calculate any additional taxes owed, if applicable.

- Review the completed form for accuracy before submission.

Taking the time to follow these steps can help prevent errors that may lead to penalties or delays in processing.

Legal use of the Form 5329

The legal use of the 2012 Form 5329 is governed by IRS regulations. When filled out correctly, this form serves as a legally binding document that reports any additional taxes owed on retirement accounts. It is important to ensure compliance with the relevant tax laws to avoid penalties. Utilizing a trusted eSignature solution can enhance the legal validity of the form when submitting it electronically, ensuring that all signatures and data are securely captured and verifiable.

Filing Deadlines / Important Dates

For the 2012 Form 5329, the filing deadline generally aligns with the tax return due date, which is typically April 15 of the following year. However, if you are filing for an extension, it is important to ensure that the form is submitted by the extended deadline. Keeping track of these important dates is essential for avoiding late penalties and ensuring compliance with IRS requirements.

Penalties for Non-Compliance

Failure to file the 2012 Form 5329 or inaccuracies in reporting can lead to significant penalties. Taxpayers who do not report additional taxes on early distributions may face a penalty of ten percent of the amount distributed. Additionally, failing to correct excess contributions can result in a penalty of six percent per year on the excess amount. Understanding these potential penalties highlights the importance of accurately completing and submitting the form.

Quick guide on how to complete form 5329

Prepare Form 5329 effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the correct template and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 5329 on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Form 5329 with ease

- Find Form 5329 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

No more worrying about lost or misfiled documents, tedious form searches, or mistakes that require printing additional copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 5329 to ensure excellent communication at every phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 5329

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2012 Form 5329 used for?

The 2012 Form 5329 is used for reporting additional taxes on qualified plans and other tax-favored accounts. This form allows taxpayers to report issues such as excess contributions and early distributions. Understanding how to complete the 2012 Form 5329 can help prevent costly penalties.

-

How can airSlate SignNow help with the 2012 Form 5329?

AirSlate SignNow provides a seamless platform for electronically signing and sending the 2012 Form 5329. With its user-friendly interface, you can quickly gather signatures and keep track of document status. This makes managing your tax documents more efficient and streamlined.

-

Is there a free trial for airSlate SignNow for preparing the 2012 Form 5329?

Yes, airSlate SignNow offers a free trial that allows you to explore its features while preparing forms like the 2012 Form 5329. This trial gives you an opportunity to evaluate how the service can simplify your document signing process. After the trial, you can choose a pricing plan that suits your needs.

-

What are the benefits of using airSlate SignNow for tax forms like the 2012 Form 5329?

Using airSlate SignNow for the 2012 Form 5329 enhances efficiency by eliminating paperwork and reducing turnaround time. The platform also ensures that your documents are securely stored and easily accessible. Additionally, it provides real-time tracking of your document's signing process.

-

Does airSlate SignNow integrate with accounting software for the 2012 Form 5329?

Yes, airSlate SignNow offers integrations with various accounting software, making it easier to manage your tax documents such as the 2012 Form 5329. This integration streamlines your workflow, helping to keep your financial records organized. You can automate processes related to document signing and reduce manual entry errors.

-

What features does airSlate SignNow offer for preparing forms like the 2012 Form 5329?

AirSlate SignNow includes features such as customizable templates, secure electronic signatures, and document storage, tailored for forms like the 2012 Form 5329. These tools ensure that your signing experience is efficient and compliant with legal standards. Furthermore, you can access your forms anytime, anywhere.

-

How secure is airSlate SignNow when handling the 2012 Form 5329?

AirSlate SignNow prioritizes security by using advanced encryption both at rest and in transit for documents like the 2012 Form 5329. This ensures that your sensitive information is protected against unauthorized access. You can confidently send and sign documents with peace of mind.

Get more for Form 5329

Find out other Form 5329

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later