Use Only SURETY BOND INDIVIDUAL Form

What is the Use Only SURETY BOND INDIVIDUAL

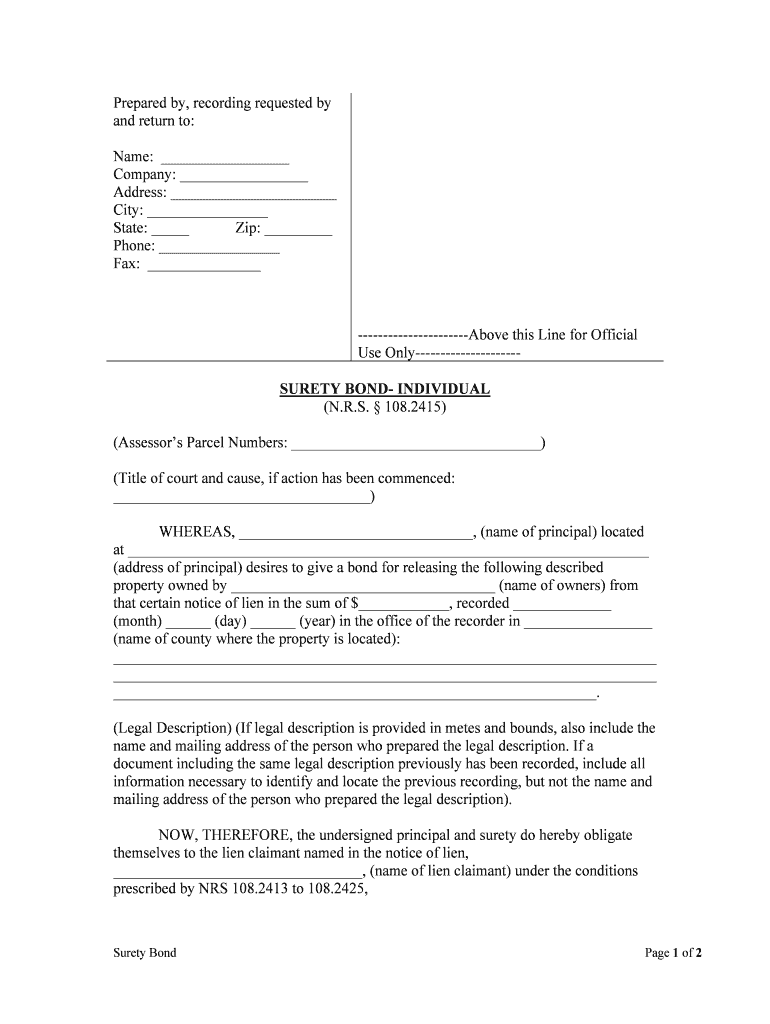

The Use Only SURETY BOND INDIVIDUAL is a legal document that serves as a guarantee for the performance of obligations by an individual. This bond is often required in various situations, such as securing a loan, fulfilling contractual obligations, or ensuring compliance with legal requirements. It acts as a protective measure for the party requiring the bond, ensuring that the individual will meet their commitments. In the context of business and personal transactions, this bond provides assurance and builds trust between parties involved.

How to use the Use Only SURETY BOND INDIVIDUAL

Using the Use Only SURETY BOND INDIVIDUAL involves several steps to ensure that it is executed properly and meets all legal requirements. First, the individual must determine the specific obligations that the bond will cover. Next, they should complete the bond form accurately, providing all necessary information, including the names of the parties involved and the details of the obligations. Once completed, the bond must be signed and may require notarization, depending on state regulations. Finally, it should be submitted to the relevant authority or party requesting the bond.

Steps to complete the Use Only SURETY BOND INDIVIDUAL

Completing the Use Only SURETY BOND INDIVIDUAL involves a systematic approach to ensure accuracy and compliance. Here are the essential steps:

- Identify the purpose of the bond and the obligations it covers.

- Gather all necessary information, including personal details and specifics of the obligations.

- Fill out the bond form, ensuring all fields are completed accurately.

- Review the completed form for any errors or omissions.

- Sign the bond in the presence of a notary if required.

- Submit the bond to the requesting party or authority.

Legal use of the Use Only SURETY BOND INDIVIDUAL

The legal use of the Use Only SURETY BOND INDIVIDUAL is governed by specific regulations that vary by state. It is essential to ensure that the bond complies with local laws to be considered valid. The bond must clearly outline the obligations being guaranteed and the conditions under which the bond will be enforced. Additionally, the bond should be executed properly, including signatures from all parties involved. Failure to adhere to these legal requirements may result in the bond being deemed unenforceable.

Key elements of the Use Only SURETY BOND INDIVIDUAL

Several key elements are critical to the effectiveness of the Use Only SURETY BOND INDIVIDUAL. These include:

- Obligor: The individual who is responsible for fulfilling the obligations outlined in the bond.

- Obligee: The party that requires the bond and is protected by it.

- Surety: The entity that issues the bond and guarantees the performance of the obligor.

- Conditions: Specific terms that outline what obligations are covered and under what circumstances the bond can be enforced.

- Signatures: Required signatures from the obligor, obligee, and surety to validate the bond.

Who Issues the Form

The Use Only SURETY BOND INDIVIDUAL is typically issued by a surety company or a bonding agency. These entities specialize in providing bonds and assessing the risk associated with issuing them. When applying for a bond, the individual must provide relevant information to the surety company, which will evaluate their creditworthiness and ability to fulfill the obligations. Once approved, the surety company will issue the bond, making it legally binding.

Quick guide on how to complete use only surety bond individual

Effortlessly Prepare Use Only SURETY BOND INDIVIDUAL on Any Device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Manage Use Only SURETY BOND INDIVIDUAL on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Modify and eSign Use Only SURETY BOND INDIVIDUAL with Ease

- Find Use Only SURETY BOND INDIVIDUAL and click Obtain Form to begin.

- Utilize our provided tools to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and has the same legal validity as a traditional wet ink signature.

- Review the information and select the Finish button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from your preferred device. Modify and eSign Use Only SURETY BOND INDIVIDUAL to ensure excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a SURETY BOND INDIVIDUAL and how does it work?

A SURETY BOND INDIVIDUAL is a type of bond that provides a financial guarantee to ensure compliance with contracts, laws, or regulations. When you use only SURETY BOND INDIVIDUAL, you are engaging a third party to ensure that the obligations will be fulfilled. This bond protects the obligee against possible losses due to noncompliance or failure by the principal.

-

How can I obtain a SURETY BOND INDIVIDUAL through airSlate SignNow?

Obtaining a SURETY BOND INDIVIDUAL through airSlate SignNow is straightforward. You simply need to sign up for our e-signature services, select the appropriate bond type, and follow the provided steps to complete your application. Once you submit your request, our team will assist you in finalizing the details.

-

What are the pricing options for using a SURETY BOND INDIVIDUAL?

The pricing for a SURETY BOND INDIVIDUAL varies depending on factors like the bond amount and the applicant’s credit score. airSlate SignNow offers competitive pricing and transparent fees for all our services. Additionally, you can easily review pricing options and find the best fit for your business needs.

-

What benefits will I experience by using a SURETY BOND INDIVIDUAL?

Using a SURETY BOND INDIVIDUAL provides peace of mind by ensuring compliance with legal obligations. It enhances your business credibility and builds trust with clients and stakeholders. Furthermore, airSlate SignNow streamlines the process, making it cost-effective and efficient.

-

Are there specific industries that typically require a SURETY BOND INDIVIDUAL?

Yes, various industries, including construction, real estate, and service providers, often require a SURETY BOND INDIVIDUAL. These bonds are essential to protect clients and ensure project completion. By using airSlate SignNow, businesses in these sectors can manage their bonds effectively.

-

What features does airSlate SignNow offer for managing my SURETY BOND INDIVIDUAL?

airSlate SignNow offers various features for managing your SURETY BOND INDIVIDUAL, including easy document tracking, secure e-signature capabilities, and simplified workflows. These features not only enhance productivity but ensure all your bond-related documents are handled with utmost security.

-

Can I integrate airSlate SignNow with other applications for my SURETY BOND INDIVIDUAL?

Yes, airSlate SignNow can integrate with numerous applications, making it easier for you to manage your SURETY BOND INDIVIDUAL. This includes popular business tools like CRM systems and project management software. Integration allows for seamless data flow and enhances overall efficiency.

Get more for Use Only SURETY BOND INDIVIDUAL

- Transcript from grambling state university form

- Hilco eyewear service center form

- Hourly pay timesheet weekly assemblers inc form

- Savannah state university application print out form

- A7 auto sales purchase agreement printlink form

- Hawaii nurse aide registry recertification form prometric

- University of mpumalanga application online form

- Sh9002 new york state department of labor labor ny form

Find out other Use Only SURETY BOND INDIVIDUAL

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later