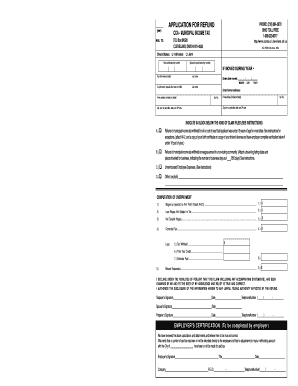

Cca Form 120 16 Ir

What is the CCA Form 120 18?

The CCA Form 120 18 is a specific tax form used in the United States for reporting certain financial information related to the CCA tax. This form is essential for individuals and businesses that need to comply with tax regulations and provide accurate information to the Internal Revenue Service (IRS). Understanding the purpose of this form is crucial for ensuring that you meet your tax obligations effectively.

Steps to Complete the CCA Form 120 18

Completing the CCA Form 120 18 involves several steps to ensure accuracy and compliance. Here is a structured approach to filling out the form:

- Gather all necessary financial documents, including income statements, expense reports, and any relevant tax documents.

- Carefully read the instructions provided with the form to understand the requirements and specific information needed.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Report your income and any deductions or credits applicable to your situation.

- Review the completed form for accuracy, ensuring all numbers are correct and all required fields are filled out.

- Sign and date the form before submission.

Legal Use of the CCA Form 120 18

The CCA Form 120 18 is legally binding when completed and submitted according to IRS guidelines. To ensure its legal validity:

- Use a reliable eSignature platform to sign the form electronically, which provides a certificate of authenticity.

- Ensure compliance with the ESIGN Act and UETA, which govern electronic signatures in the United States.

- Maintain a secure copy of the completed form for your records, as it may be requested by the IRS in the future.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the CCA Form 120 18 to avoid penalties. Typically, the form must be submitted by the federal tax deadline, which is usually April fifteenth for individual taxpayers. Extensions may be available, but they must be requested ahead of time. Always check the IRS website or consult a tax professional for the most current deadlines.

Form Submission Methods

The CCA Form 120 18 can be submitted through various methods, ensuring flexibility for users. These methods include:

- Online Submission: Many taxpayers prefer to file electronically using authorized e-filing software, which can streamline the process.

- Mail: You can print the completed form and send it via postal service to the designated IRS address.

- In-Person: Some individuals may choose to deliver their forms directly to their local IRS office.

Key Elements of the CCA Form 120 18

Understanding the key elements of the CCA Form 120 18 is essential for accurate completion. The form typically includes:

- Taxpayer Information: Personal details such as name, address, and taxpayer identification number.

- Income Reporting: Sections for reporting various types of income, including wages, dividends, and other earnings.

- Deductions and Credits: Areas to claim applicable deductions and tax credits that can reduce overall tax liability.

- Signature Section: A designated area for the taxpayer's signature, affirming the accuracy of the information provided.

Quick guide on how to complete cca form 120 16 ir

Effortlessly prepare Cca Form 120 16 Ir on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can easily locate the appropriate form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without any hiccups. Manage Cca Form 120 16 Ir on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign Cca Form 120 16 Ir seamlessly

- Locate Cca Form 120 16 Ir and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which only takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Cca Form 120 16 Ir to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cca form 120 16 ir

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the cca form 120 18 and how is it used?

The cca form 120 18 is a specific document utilized for electronic signatures within airSlate SignNow. It simplifies the signing process for users, allowing them to complete legal documentation efficiently. Businesses can leverage this form to ensure compliance and streamline their operations.

-

How does airSlate SignNow simplify the process of completing the cca form 120 18?

airSlate SignNow offers a user-friendly interface that makes it easy to fill out and sign the cca form 120 18 electronically. The platform allows users to add signatures, dates, and initials in just a few clicks, enhancing productivity. This signNowly reduces the time taken to process vital documents.

-

What are the pricing options for using airSlate SignNow with the cca form 120 18?

airSlate SignNow provides flexible pricing plans that accommodate various business needs when using the cca form 120 18. You’ll find options that suit individual users, small teams, and larger enterprises, all offering cost-effective solutions by eliminating traditional paper processes. Contact us for a detailed pricing breakdown.

-

What benefits can I expect when using the cca form 120 18 in airSlate SignNow?

Using the cca form 120 18 in airSlate SignNow provides multiple benefits, including faster document turnaround times and improved accuracy. The eSigning feature ensures that your form is legally binding while maintaining security. Moreover, it allows for easier tracking and management of important documents.

-

Can I integrate airSlate SignNow with other applications while using the cca form 120 18?

Yes, airSlate SignNow supports integration with a variety of applications, enhancing the functionality of the cca form 120 18. You can connect the platform with popular tools such as CRM systems, cloud storage solutions, and productivity software. This streamlines your workflow and boosts collaboration among team members.

-

Is my data secure when signing the cca form 120 18 through airSlate SignNow?

Absolutely! airSlate SignNow employs advanced encryption and security protocols to protect your data when signing the cca form 120 18. We prioritize user security and confidentiality, ensuring that your documents remain safe throughout their lifecycle. Regular audits and compliance checks further bolster our security measures.

-

What industries benefit from using the cca form 120 18 with airSlate SignNow?

Various industries can benefit from the cca form 120 18 with airSlate SignNow, including finance, healthcare, real estate, and education. The versatility of the form makes it applicable for any sector requiring legal documentation. Businesses in these fields can signNowly improve their efficiency and compliance through our solution.

Get more for Cca Form 120 16 Ir

Find out other Cca Form 120 16 Ir

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document