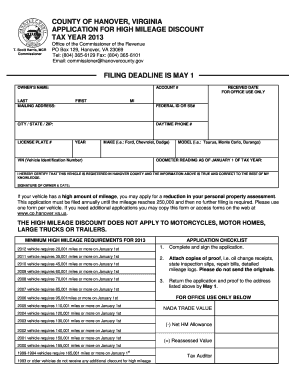

Hanover County High Mileage Form

What is the Hanover County High Mileage Form

The Hanover County High Mileage Form is a document used to report high mileage reimbursement claims for employees or contractors who use their personal vehicles for work-related purposes. This form is essential for accurately tracking and documenting mileage to ensure proper reimbursement in accordance with company policies and IRS guidelines. By providing a clear record of travel, the form helps maintain transparency and accountability in expense reporting.

How to use the Hanover County High Mileage Form

Using the Hanover County High Mileage Form involves several straightforward steps. First, gather all necessary information, including the dates of travel, starting and ending odometer readings, and the purpose of each trip. Next, accurately fill out the form by entering these details in the designated fields. Once completed, review the information for accuracy before submitting it to the appropriate department for processing. Proper use of this form ensures timely reimbursement and compliance with company policies.

Steps to complete the Hanover County High Mileage Form

Completing the Hanover County High Mileage Form requires attention to detail. Follow these steps for successful completion:

- Start by entering your personal information, including your name and contact details.

- Record the date of each trip, along with the starting and ending odometer readings.

- Document the purpose of each trip to provide context for the mileage claimed.

- Calculate the total miles driven for each trip and provide a summary of the total mileage at the end of the form.

- Sign and date the form to certify that the information provided is accurate and complete.

Legal use of the Hanover County High Mileage Form

The Hanover County High Mileage Form is legally valid when completed and submitted in accordance with applicable laws and regulations. To ensure compliance, it is important to adhere to IRS guidelines regarding mileage reimbursement. This includes maintaining accurate records and submitting the form within specified timeframes. Using a reliable electronic signature tool can further enhance the legal standing of the form by providing a digital certificate and maintaining compliance with eSignature laws.

Key elements of the Hanover County High Mileage Form

Several key elements are crucial for the Hanover County High Mileage Form to be effective:

- Personal Information: Includes the name and contact details of the individual submitting the form.

- Trip Details: Requires dates, starting and ending odometer readings, and the purpose of each trip.

- Total Mileage: A summary of total miles driven, which is essential for reimbursement calculations.

- Signature: A signature certifying the accuracy of the information provided is necessary for legal validity.

Form Submission Methods

The Hanover County High Mileage Form can be submitted through various methods to accommodate different preferences. Common submission methods include:

- Online Submission: Many organizations allow electronic submission through secure portals, enabling quick processing.

- Mail: The form can be printed and mailed to the appropriate department for processing.

- In-Person: Some individuals may prefer to submit the form directly to their supervisor or HR department.

Quick guide on how to complete hanover county high mileage form

Complete Hanover County High Mileage Form effortlessly on any device

Digital document management has become increasingly popular with businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed papers, as you can locate the appropriate form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and eSign your documents swiftly without interruptions. Manage Hanover County High Mileage Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to edit and eSign Hanover County High Mileage Form with ease

- Locate Hanover County High Mileage Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or censor sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Edit and eSign Hanover County High Mileage Form and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hanover county high mileage form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Hanover County High Mileage Form?

The Hanover County High Mileage Form is a document required for submitting mileage claims to ensure accurate reimbursements. This form facilitates record-keeping and provides a clear summary of incurred mileage expenses for employees in Hanover County.

-

How can airSlate SignNow help with the Hanover County High Mileage Form?

airSlate SignNow allows you to easily create, send, and eSign the Hanover County High Mileage Form online. Our platform streamlines the signing process to save time and reduce errors, ensuring that your documents are handled efficiently.

-

Is there a cost associated with using airSlate SignNow for the Hanover County High Mileage Form?

Yes, airSlate SignNow offers various pricing plans to fit different business needs, including those requiring the Hanover County High Mileage Form. Our plans are designed to be cost-effective while providing a comprehensive suite of features to simplify document management.

-

What features are included when using airSlate SignNow for the Hanover County High Mileage Form?

With airSlate SignNow, you can enjoy features such as customizable templates, real-time tracking, and secure storage for the Hanover County High Mileage Form. Additionally, our user-friendly interface allows for easy navigation and quick document processing.

-

Can I integrate airSlate SignNow with other applications for managing the Hanover County High Mileage Form?

Yes, airSlate SignNow offers integrations with various applications to enhance your workflow when managing the Hanover County High Mileage Form. You can connect with popular platforms such as Salesforce, Google Drive, and more to centralize your document management.

-

What are the benefits of using airSlate SignNow for my Hanover County High Mileage Form processing?

Using airSlate SignNow for your Hanover County High Mileage Form processing ensures faster approvals and improved accuracy. Our digital solutions eliminate paperwork hassles and streamline the signing process, enhancing your overall efficiency.

-

How secure is the Hanover County High Mileage Form when processed through airSlate SignNow?

The security of your Hanover County High Mileage Form is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your data and ensure compliance with industry standards during the signing and storing of documents.

Get more for Hanover County High Mileage Form

- Warranty deed trust form

- Fl warranty deed 497303478 form

- Florida warranty deed 497303479 form

- Quitclaim deed trust to individual florida form

- Warranty deed one individual to two individuals as joint tenants with the right of survivorship florida form

- Florida deed husband wife 497303482 form

- Husband wife tenants form

- Warranty deed for husband and wife to a trust florida form

Find out other Hanover County High Mileage Form

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online