Property Tax Form PDF

What is the Property Tax Form PDF

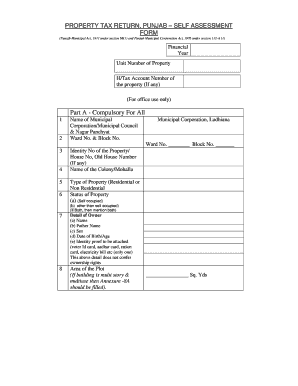

The self assessment form for property tax is a crucial document used by property owners to report their property value to local tax authorities. This form helps determine the amount of property tax owed based on the assessed value of the property. The property tax form PDF is a standardized format that allows users to fill out the necessary information electronically, ensuring accuracy and ease of submission. By using this form, property owners can provide essential details regarding their property, including its location, size, and any improvements made.

Steps to Complete the Property Tax Form PDF

Completing the self assessment property tax form involves several key steps to ensure that all required information is accurately provided. First, gather all necessary documents related to your property, such as previous tax assessments and any receipts for improvements. Next, download the property tax form PDF from your local tax authority's website. Fill in the required fields, including your name, address, and property details. Be sure to double-check for any errors before finalizing the form. Once completed, you can submit the form either online or by mailing it to the appropriate tax office.

Legal Use of the Property Tax Form PDF

The self assessment form for property tax is legally binding when filled out correctly and submitted according to local regulations. Compliance with eSignature laws ensures that electronic submissions are valid and recognized by tax authorities. Utilizing a reliable platform for electronic signatures can enhance the legal standing of your submission. It's essential to keep a copy of the completed form for your records, as it serves as proof of your property tax assessment and can be referenced in case of disputes or audits.

Required Documents

When filling out the self assessment form for property tax, certain documents may be required to support your submission. Commonly needed documents include:

- Previous property tax statements

- Receipts for any property improvements or renovations

- Legal documents proving property ownership

- Any relevant appraisal reports

Having these documents ready can streamline the process and ensure that your form is complete and accurate.

Form Submission Methods

There are various methods to submit the self assessment property tax form, depending on your local tax authority's guidelines. Typically, you can choose from the following options:

- Online Submission: Many jurisdictions allow electronic submission through their official websites, making it convenient to file your form.

- Mail: You can print the completed form and send it via postal service to the designated tax office.

- In-Person: Some tax offices accept submissions in person, providing an opportunity to ask questions or clarify any uncertainties.

Filing Deadlines / Important Dates

Being aware of filing deadlines is crucial for property owners. These dates can vary by state and locality, but generally, property tax self assessment forms must be submitted by a specific date each year to avoid penalties. It is advisable to check with your local tax authority for the exact deadlines applicable to your situation. Missing the deadline may result in late fees or other consequences, so timely submission is essential.

Quick guide on how to complete property tax form pdf

Complete Property Tax Form Pdf effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly and efficiently. Manage Property Tax Form Pdf on any platform with the airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign Property Tax Form Pdf effortlessly

- Find Property Tax Form Pdf and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, a process that takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form: via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Property Tax Form Pdf while ensuring effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the property tax form pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a self assessment form for property tax?

A self assessment form for property tax is a document that allows property owners to report the value of their property for taxation purposes. This form helps local tax authorities determine how much tax you need to pay based on the assessed value. It's crucial for property owners to complete this form accurately to avoid tax discrepancies.

-

How can airSlate SignNow help with the self assessment form for property tax?

airSlate SignNow streamlines the process of filling out and submitting your self assessment form for property tax. With our eSigning solution, you can easily fill, sign, and send your forms securely and quickly. This reduces the risk of errors and ensures compliance with local regulations.

-

What are the benefits of using airSlate SignNow for property tax forms?

Using airSlate SignNow for your self assessment form for property tax offers several benefits, including improved accuracy, faster processing times, and secure document handling. Our platform enables you to track the status of your forms and obtain real-time updates, making the property tax filing process much more efficient.

-

Is airSlate SignNow cost-effective for small property owners?

Yes, airSlate SignNow is designed to be a cost-effective solution for both individuals and businesses, including small property owners managing their self assessment form for property tax. With flexible pricing plans, you can choose the option that best fits your needs while gaining access to essential features that simplify document management.

-

Can I integrate airSlate SignNow with other software for managing property taxes?

Absolutely! airSlate SignNow offers integrations with various accounting and property management software. This ensures you can seamlessly manage your self assessment form for property tax alongside your other financial documents and processes, improving overall efficiency and organization.

-

What features does airSlate SignNow offer for the self assessment form for property tax?

airSlate SignNow includes features such as customizable templates, secure eSigning, and easy form sharing specifically for self assessment form for property tax. Additionally, our platform allows for document tracking and audit trails, ensuring you have all necessary information at your fingertips.

-

How secure is my information when using airSlate SignNow for tax forms?

Security is a top priority for airSlate SignNow. When filling out your self assessment form for property tax, your information is encrypted both in transit and at rest. We adhere to strict security protocols to protect your sensitive data, ensuring that your documents remain confidential and secure.

Get more for Property Tax Form Pdf

Find out other Property Tax Form Pdf

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free