Income and Expense Statement 2005-2026

What is the Income and Expense Statement

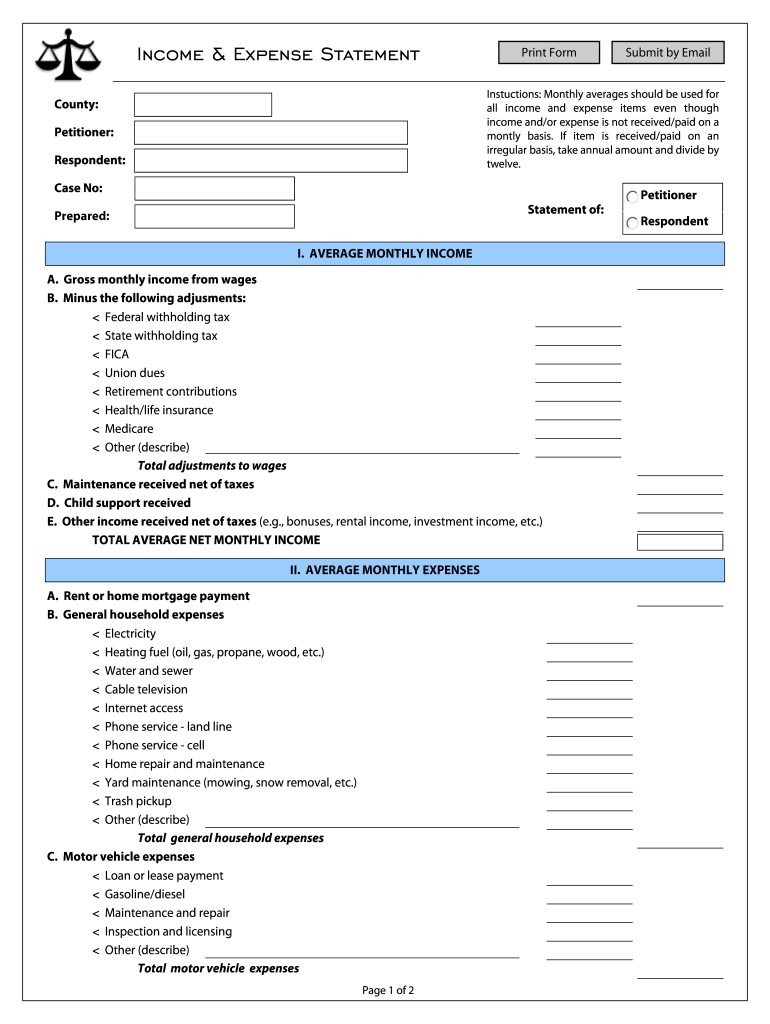

The income and expense statement is a financial document that summarizes an individual's or business's income and expenses over a specific period. This statement is crucial for understanding financial health, as it provides a clear picture of profitability and cash flow. It is also commonly referred to as an income expense form, and it is widely used by self-employed individuals, small businesses, and larger corporations alike. The statement typically includes various income sources, such as sales revenue and other earnings, alongside all expenses incurred, including operational costs, salaries, and overheads.

How to Use the Income and Expense Statement

Using the income and expense statement effectively involves several steps. First, gather all financial records for the period in question, including receipts, invoices, and bank statements. Next, categorize income and expenses into clear sections. Income should be listed first, followed by expenses, which can be further divided into fixed and variable costs. After completing the statement, review the totals to assess profitability. This analysis can inform future financial decisions, such as budgeting and forecasting. Additionally, the completed statement can be beneficial for tax preparation and financial reporting.

Steps to Complete the Income and Expense Statement

Completing the income and expense statement requires careful attention to detail. Follow these steps for accurate completion:

- Collect all relevant financial documents for the reporting period.

- List all sources of income, ensuring to include all revenue streams.

- Detail all expenses, categorizing them into fixed and variable costs.

- Calculate total income and total expenses.

- Determine net income by subtracting total expenses from total income.

- Review the completed statement for accuracy and completeness.

Key Elements of the Income and Expense Statement

Several key elements must be included in an income and expense statement to ensure it is comprehensive and useful:

- Income Section: This includes all forms of income, such as sales revenue, interest income, and other earnings.

- Expense Section: This should detail all expenses incurred, categorized into operational costs, salaries, and miscellaneous expenses.

- Net Income: The difference between total income and total expenses, indicating profitability.

- Time Period: Clearly state the reporting period for which the statement is prepared.

Legal Use of the Income and Expense Statement

The income and expense statement serves not only as a financial tool but also has legal implications. Businesses may be required to present this statement for tax purposes, loan applications, or during audits. It is essential to ensure that the information is accurate and complies with applicable regulations. In the United States, the IRS requires accurate reporting of income and expenses for tax filings, making this statement a vital document for compliance. Failure to provide accurate information can lead to penalties or legal issues.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting an income and expense statement. Taxpayers must report all income earned and all deductible expenses to ensure compliance with federal tax laws. The IRS may require additional documentation to support the figures reported in the income and expense statement. It is advisable to consult IRS publications or a tax professional for detailed guidance on requirements and potential deductions available for various business types.

Quick guide on how to complete income expense statement form

The simplest method to locate and sign Income And Expense Statement

Across the breadth of an entire organization, ineffective workflows surrounding document approval can take up signNow working hours. Signing documents like Income And Expense Statement is an inherent aspect of operations in any company, which is why the efficiency of each agreement’s lifecycle signNowly impacts the organization’s overall productivity. With airSlate SignNow, signing your Income And Expense Statement is as straightforward and rapid as possible. This platform provides you with the latest version of virtually any form. Even better, you can sign it instantly without the need to install any external software on your device or print anything as physical copies.

Steps to obtain and sign your Income And Expense Statement

- Explore our collection by category or utilize the search box to find the form you require.

- Preview the form by clicking Learn more to confirm it is the correct one.

- Select Get form to begin editing immediately.

- Fill out your form and include any necessary details using the toolbar.

- Once completed, click the Sign tool to sign your Income And Expense Statement.

- Choose the signature method that works best for you: Draw, Create initials, or add an image of your handwritten signature.

- Click Done to finalize editing and proceed to document-sharing options as required.

With airSlate SignNow, you have everything necessary to handle your documents efficiently. You can discover, complete, edit, and even send your Income And Expense Statement all in one tab without any difficulty. Enhance your processes with a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How do I fill out the MHT-CET MBA exam application form in detail?

DTE Maharashtra has discharged MHT CET 2018 application form as on January 18 in online mode, can be filled by competitors by following the means said in how to fill MHT CET application frame 2018. Applicants who need to enlist themselves for the selection test should take after the means as given in how to fill MHT CET 2018 application form to maintain a strategic distance from oversights and entire method to go smooth and bother free. The means to fill the application type of MHT CET 2018 incorporates enlistment, filling of required subtle elements, transferring of filtered reports, instalment and affirmation page download. Hopefuls are required to fill the application type of MHT CET 2018 painstakingly to stay away from dismissal by the specialists. It is essential to take the application shape filling methodology of MHT CET genuinely on the grounds that exclusive those hopefuls who will present their structures effectively will get concede cards. Such applicants who will have legitimate MHT CET 2018 concede cards will be permitted to show up in the exam.Competitors must read the means offered underneath to fill and submit MHT CET 2018 application frame in a sorted-out way:Stage 1 – RegistrationApplicants should enrol themselves and give the required details. Candidate should concur whether he or she is an Indian resident or not.Proceeding onward, they will be required to fill the accompanying individual subtle elements:Full name (as showing up on the announcement of characteristics of SSC tenth or proportional exam), Father’s name, Mother’s first name, Last name, Gender, Contact Information, Address for correspondence, House No/Street, Area Name, Town/City , State, District, Pin code, Country, Mobile Number, Primary Email Id (Email will be sent to this email ID), Alternate Email Id (Parent’s Email ID, if accessible), Contact Telephone No. (with STD Code), Permanent Residence in Village/Town/City, Domicile of Maharashtra/Disputed Maharashtra Karnataka Border (MKB)/Outside Maharashtra, Reservation, Category of competitor (Caste perceived in Maharashtra state), Candidates having a place with SC, ST, VJ(A), NT(B), NT(C), NT(D), OBC and SBC classes must have their individual standing authentications, Candidates having a place with Non Creamy Layer (NCL) should create substantial testament upto March 31, 2019, Other DetailsRegardless of whether the candidate has a place with – PWD class or not (competitors qualified who are qualified under this classification ought to have under 40% incapacity), visually impaired, low vision. Orthopedically debilitated and competitors influenced with Cerebral Palsy and Dyslexia, who are not in a situation to compose, can benefit a copyist/author for the MHT-CET 2018 examRegardless of whether the applicant is a J&K vagrant or notReligionOther placement tests that applicant has enrolled for (JEE Main/NEET/None)Add up to Annual Family IncomeAadhaar NumberFinancial balance DetailsName of the record holder according to Bank recordName of the BankName of the Bank BranchKind of Account (Savings/Current)Financial balance NumberIFSC CodePoints of interest of HSC (twelfth/Equivalent Examination)Regardless of whether hopeful has passed/showed up for confirmation in Pharmacy (just for Biology applicants)Place from where hopeful has finished HSC (twelfth)/proportional exam showing up/Passed from school/Jr. School arranged (Maharashtra/Outside Maharashtra)Subtle elements required for MHT-CET 2018Subjects for CET examination (Physics, Chemistry, Mathematics, Biology)Dialect for the exam (English, Marathi, Urdu)Enter secret keyCompetitors should make a secret word (least 8 and most extreme 15 characters and should have one capitalized, one lower case and one numeric)In the wake of entering the secret key, competitors should affirm it. This secret word will be utilized for future logins.Statement by the hopefulApplicants should read the revelation composed and after that tap on “I Agree”Applicants need to enter the security key as gave and after that tap on “Next” catchStage 2 – Confirmation and SubmissionIn the wake of filling the previously mentioned subtle elements, hopefuls will have the capacity to check the data filled and alter certain things in the application frame.Applicants can backpedal and change or alter the accompanying particulars (as noticeable in green shading) before accommodation:Exam focusSubjects pickedDialect of the examIndividual with handicap choiceIn any case, there are particulars (as unmistakable in blue shading) that can’t be altered at this stage once submitted:Father’s nameLast nameDate of birthVersatile numberEmail IDSubsequent to rolling out the improvements, if required, hopefuls should present the shape.Stage 3 – Application number gotApplicants will get a message on the screen in regards to effective enlistment for MHT CET 2018 with their application number. A similar number will be sent to them gave email ID. Competitors can see and check their entered data in this progression.Stage 4 – Edit and Upload photo and markApplicants will have the capacity to alter the points of interest they have filled in the application frame. In any case, regardless they won’t have the capacity to alter their full name, father’s name, last name, date of birth, versatile number and email ID. In the event that candidates would prefer not to alter any points of interest, they can move to the subsequent stage of transferring their photo and mark in the arrangement recommended by the experts.Stage 5 – Uploading photo and markApplicants should transfer their current identification estimate shading photo and mark in the configuration given in the table underneath. On the off chance that, applicants are not ready to transfer the right photographs/marks, they should reload the right records and afterward transfer.Stage 6 – VerificationCompetitors will get a message on their screens with respect to fruitful transferring of photo and mark. They will likewise have the capacity to see a connection saying ” Click here to make payment “. Applicants should tap on the connection to enter the instalment entryway.Stage 7 – Payment gatewayHopefuls will have the capacity to see every one of the subtle elements filled by them alongside their transferred photo and mark on their screens. The application expense sum will likewise be noticeable in this progression, which they should pay in the wake of perusing the revelation. It is to noticed that competitors will have the capacity to change their subjects they are applying for.Applicants will have the capacity to influence application to charge payment through credit/check card, net saving money, plastic (ATM PIN), wallets and then some. They should influence instalment of the application to sum with comfort charge and expense.After instalment of utilisation charge, competitors will have the capacity to see a message on their screen with respect to accomplishment of exchange. Applicants must remove a print from this page.Stage 8 – Acknowledgment pageCompetitors must take a print from the affirmation page and keep it securely for some time later.Hope this Helps!!

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

Can I use broker statements to fill out form 8949 instead of a 1099-B?

Yes you can. Should you? Perhaps, but remember that the 1099 is what the IRS is going to receive. There could be differences.You may receive a 1099 which is missing basis information. You will indicate that, and use your records to fill in the missing information.My suggestion is to use the 1099, cross-referencing to your statements.

-

Do I need to fill out a financial statement form if I get a full tuition waiver and RA/TA?

If that is necessary, the university or the faculty will inform you of that. These things can vary from university to university. Your best option would be to check your university website, financial services office or the Bursar office in your university.

-

How do you fill out an income tax form for a director of a company in India?

There are no special provisions for a director of a company. He should file the return on the basis of his income . If he is just earning salary ten ITR-1.~Sayantan Sen Gupta~

Create this form in 5 minutes!

How to create an eSignature for the income expense statement form

How to generate an electronic signature for the Income Expense Statement Form in the online mode

How to create an eSignature for the Income Expense Statement Form in Google Chrome

How to generate an eSignature for putting it on the Income Expense Statement Form in Gmail

How to generate an eSignature for the Income Expense Statement Form from your smartphone

How to create an eSignature for the Income Expense Statement Form on iOS

How to make an eSignature for the Income Expense Statement Form on Android

People also ask

-

What is an Income And Expense Statement?

An Income And Expense Statement is a financial document that summarizes the revenues and expenses of a business over a specific period. It helps businesses track their financial performance, identify trends, and make informed decisions. Using airSlate SignNow, you can easily create and manage your Income And Expense Statement digitally.

-

How can airSlate SignNow help me create an Income And Expense Statement?

With airSlate SignNow, creating an Income And Expense Statement is simple and efficient. Our platform provides customizable templates that allow you to input your data quickly. You can also eSign your statements, ensuring they are legally binding and professionally presented.

-

What features does airSlate SignNow offer for Income And Expense Statements?

AirSlate SignNow offers features like customizable templates, easy document sharing, and secure eSigning for your Income And Expense Statement. Additionally, our platform allows for real-time collaboration, making it easier for teams to work together on financial reports.

-

Is airSlate SignNow affordable for small businesses needing an Income And Expense Statement?

Yes, airSlate SignNow is a cost-effective solution for small businesses looking to manage their Income And Expense Statement. We offer flexible pricing plans that cater to various business sizes and needs, ensuring you get the best value while maintaining access to essential features.

-

Can I integrate airSlate SignNow with other accounting software for my Income And Expense Statement?

Absolutely! airSlate SignNow can integrate seamlessly with popular accounting software, allowing you to streamline the creation of your Income And Expense Statement. This integration helps you automatically pull in financial data, reducing manual entry and minimizing errors.

-

What are the benefits of using airSlate SignNow for my Income And Expense Statement?

Using airSlate SignNow for your Income And Expense Statement offers numerous benefits, including enhanced security, ease of use, and time savings. The ability to eSign documents digitally also accelerates the approval process, helping you maintain efficient financial operations.

-

How secure is my Income And Expense Statement with airSlate SignNow?

At airSlate SignNow, the security of your Income And Expense Statement is our top priority. We use advanced encryption and secure cloud storage to protect your sensitive financial data from unauthorized access, ensuring compliance with industry standards.

Get more for Income And Expense Statement

- Properties of minerals worksheet form

- Food stamp application form

- 30 day notice for tenant to vacate pdf form

- Cardiology patient intake form

- Div1702 pdf form

- Sample powered industrial truck operator permits michigan form

- Authorization request form ur form

- Letter to an employee who may be eligible for fmla form

Find out other Income And Expense Statement

- Sign Michigan Standard rental agreement Online

- Sign Minnesota Standard residential lease agreement Simple

- How To Sign Minnesota Standard residential lease agreement

- Sign West Virginia Standard residential lease agreement Safe

- Sign Wyoming Standard residential lease agreement Online

- Sign Vermont Apartment lease contract Online

- Sign Rhode Island Tenant lease agreement Myself

- Sign Wyoming Tenant lease agreement Now

- Sign Florida Contract Safe

- Sign Nebraska Contract Safe

- How To Sign North Carolina Contract

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe