Virginia Tax Exempt Form St 12

What is the Virginia Tax Exempt Form ST-12

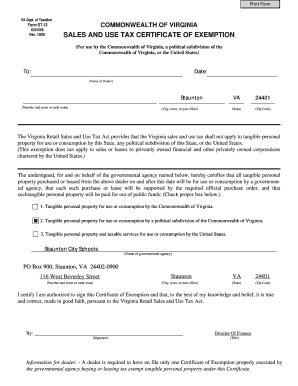

The Virginia Tax Exempt Form ST-12 is a crucial document used by organizations to claim exemption from sales and use tax in Virginia. This form is primarily utilized by non-profit organizations, government entities, and certain other qualifying groups. By submitting the ST-12, these entities can purchase goods and services without incurring sales tax, provided that the purchases are directly related to their exempt activities. Understanding the purpose and requirements of this form is essential for organizations seeking to benefit from tax exemptions.

How to Obtain the Virginia Tax Exempt Form ST-12

Obtaining the Virginia Tax Exempt Form ST-12 is a straightforward process. Organizations can access the form through the Virginia Department of Taxation's official website. It is available in a downloadable format, allowing users to print and fill it out at their convenience. Additionally, organizations may request physical copies from local tax offices if needed. Ensuring that the correct version of the form is used is vital, as outdated forms may not be accepted.

Steps to Complete the Virginia Tax Exempt Form ST-12

Completing the Virginia Tax Exempt Form ST-12 involves several key steps:

- Provide the organization's name, address, and federal employer identification number (EIN).

- Indicate the type of organization and the specific exemption status.

- Detail the purpose of the purchases being made with the exemption.

- Ensure that the form is signed by an authorized representative of the organization.

- Submit the completed form to the vendor from whom the goods or services are being purchased.

It is important to double-check all information for accuracy to avoid delays or complications.

Legal Use of the Virginia Tax Exempt Form ST-12

The legal use of the Virginia Tax Exempt Form ST-12 is governed by specific regulations. Organizations must ensure that their purchases qualify for tax exemption under Virginia law. Misuse of the form, such as using it for personal purchases or for items not related to exempt activities, can result in penalties. Organizations should maintain proper records of all transactions made under this exemption to demonstrate compliance during audits or reviews.

Key Elements of the Virginia Tax Exempt Form ST-12

Several key elements must be included in the Virginia Tax Exempt Form ST-12 to ensure its validity:

- Organization Information: This includes the name, address, and EIN of the organization.

- Exemption Type: Clearly state the type of exemption being claimed.

- Signature: The form must be signed by an authorized individual, confirming the accuracy of the information provided.

- Purpose of Purchase: A description of how the purchased items relate to the organization’s exempt activities.

These elements are essential for the form to be considered complete and legally binding.

Eligibility Criteria for the Virginia Tax Exempt Form ST-12

To be eligible for the Virginia Tax Exempt Form ST-12, organizations must meet specific criteria. Generally, the following types of organizations qualify:

- Non-profit organizations recognized under IRS Section 501(c)(3).

- Government entities at the federal, state, or local level.

- Certain educational institutions and religious organizations.

It is important for organizations to verify their eligibility and ensure compliance with all relevant regulations before submitting the form.

Quick guide on how to complete virginia tax exempt form st 12

Effortlessly Prepare Virginia Tax Exempt Form St 12 on Any Device

The management of online documents has gained signNow traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely save them online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without any delays. Manage Virginia Tax Exempt Form St 12 on any device using the airSlate SignNow applications for Android or iOS and simplify any document-focused procedure today.

How to Edit and Electronically Sign Virginia Tax Exempt Form St 12 with Ease

- Find Virginia Tax Exempt Form St 12 and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as an ordinary handwritten signature.

- Review the information and then click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Edit and electronically sign Virginia Tax Exempt Form St 12 and guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the virginia tax exempt form st 12

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Virginia tax exemption form and who needs it?

The Virginia tax exemption form is a document that allows eligible individuals and businesses to apply for tax exemptions under Virginia state laws. Organizations such as non-profits, certain educational institutions, and government entities may be required to submit this form to qualify for tax-exempt status. By using airSlate SignNow, you can efficiently manage the signing and submission of the Virginia tax exemption form.

-

How can airSlate SignNow help me complete the Virginia tax exemption form?

With airSlate SignNow, you can easily fill out and eSign the Virginia tax exemption form online. Our platform simplifies the process by allowing you to store templates, gather eSignatures, and securely send documents. This streamlines the entire workflow, saving you time and reducing errors.

-

Is there a cost associated with using airSlate SignNow for the Virginia tax exemption form?

airSlate SignNow offers competitive pricing plans that make it cost-effective for businesses of all sizes. You can choose a subscription that best fits your needs, whether you need basic features for occasional use or advanced tools for regular transactions like the Virginia tax exemption form. A free trial is also available to get you started at no cost.

-

What features does airSlate SignNow offer for managing forms like the Virginia tax exemption form?

airSlate SignNow provides a variety of features including document templates, custom workflows, and real-time tracking of your submissions. For the Virginia tax exemption form, its user-friendly interface allows for quick edits, easy sharing with stakeholders, and the ability to collect eSignatures in a secure and compliant manner.

-

Are there integrations available for the Virginia tax exemption form on airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with a variety of applications, including cloud storage services and CRM platforms. This means you can easily access and manage your Virginia tax exemption form alongside other business documents. Such integrations enhance your workflow efficiency and improve collaboration with team members.

-

What benefits can I expect from using airSlate SignNow for the Virginia tax exemption form?

Using airSlate SignNow for the Virginia tax exemption form provides numerous benefits including enhanced security for sensitive information, faster turnaround times, and reduced paperwork. Our solution empowers you to get documents signed quickly, helping you to focus on your core business activities without delays.

-

How secure is airSlate SignNow when dealing with sensitive documents like the Virginia tax exemption form?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and compliance measures to ensure that your Virginia tax exemption form and other sensitive documents are protected from unauthorized access. Our platform also includes authentication features to verify signers and maintain document integrity.

Get more for Virginia Tax Exempt Form St 12

Find out other Virginia Tax Exempt Form St 12

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document