Form 14452

What is the Form 14452

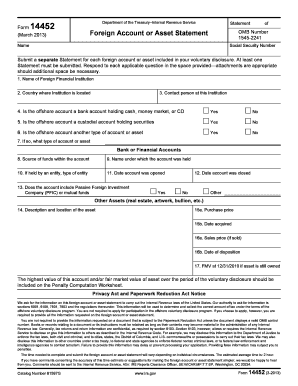

The Form 14452 is a specific document used in the United States, primarily related to tax matters. It serves as a means for taxpayers to report certain information to the Internal Revenue Service (IRS). This form is crucial for individuals and businesses that need to provide detailed financial information for tax assessment and compliance purposes. Understanding the purpose and requirements of Form 14452 is essential for ensuring accurate and timely submissions to the IRS.

How to use the Form 14452

Using Form 14452 involves a few straightforward steps. First, ensure you have the latest version of the form, which can typically be obtained from the IRS website or through authorized tax professionals. Next, carefully read the instructions provided with the form to understand the specific information required. Fill out the form accurately, providing all necessary details, including your personal information and any financial data requested. Once completed, the form can be submitted electronically or via mail, depending on your preference and the instructions provided.

Steps to complete the Form 14452

Completing Form 14452 requires attention to detail. Follow these steps for successful completion:

- Obtain the latest version of Form 14452 from the IRS or a reliable source.

- Read the accompanying instructions thoroughly to understand what information is needed.

- Fill in your personal details, including your name, address, and taxpayer identification number.

- Provide the required financial information accurately, ensuring all figures are correct.

- Review the completed form for any errors or omissions.

- Submit the form as instructed, either online or by mailing it to the appropriate IRS address.

Legal use of the Form 14452

The legal use of Form 14452 is governed by IRS regulations. To ensure that your submission is valid, it is important to comply with all applicable laws and guidelines. This includes providing accurate information, signing the form where required, and adhering to submission deadlines. Failure to comply with these regulations can result in penalties or delays in processing your tax information.

Filing Deadlines / Important Dates

Filing deadlines for Form 14452 can vary based on individual circumstances. It is essential to be aware of these dates to avoid late submissions. Generally, forms must be submitted by the tax filing deadline, which is typically April 15 for most taxpayers. However, specific deadlines may apply depending on whether you are filing as an individual, business, or under special circumstances. Always check the IRS website for the most current information regarding deadlines.

Key elements of the Form 14452

Form 14452 includes several key elements that are crucial for proper completion. These elements typically consist of:

- Taxpayer identification information, including name and address.

- Financial details relevant to the specific reporting requirements.

- Signature and date fields to validate the submission.

- Instructions for any additional documentation that may be required.

Understanding these elements helps ensure that the form is filled out correctly and meets IRS standards.

Quick guide on how to complete form 14452

Effortlessly Prepare Form 14452 on Any Device

Digital document management has become increasingly popular among companies and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Handle Form 14452 on any device using the airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

The Easiest Way to Edit and eSign Form 14452 with Ease

- Find Form 14452 and click Get Form to commence.

- Use our provided tools to complete your form.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, the hassle of searching for forms, or errors that necessitate reprinting new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Edit and eSign Form 14452 to ensure excellent communication at every stage of the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 14452

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 14452 and how can it benefit my business?

Form 14452 is a crucial document used for reporting certain details in business transactions. Utilizing airSlate SignNow to manage and eSign form 14452 can streamline your workflow, reduce paperwork, and enhance efficiency, making it easier to stay organized and compliant.

-

How much does airSlate SignNow cost for managing form 14452?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. By choosing a plan that includes features for managing form 14452, you can maximize your investment with a cost-effective solution that simplifies eSigning and document management.

-

Can I customize the form 14452 using airSlate SignNow?

Yes, airSlate SignNow allows you to customize form 14452 to meet your specific needs. With user-friendly editing tools, you can add fields, set signing order, and ensure all necessary information is collected, resulting in a seamless signing experience.

-

What features does airSlate SignNow offer for eSigning form 14452?

airSlate SignNow provides a range of features for eSigning form 14452, including document templates, automated reminders, and secure signing options. These features enhance the signing process, ensuring that your documents are signed quickly and securely.

-

Is it easy to integrate airSlate SignNow with other tools for form 14452?

Absolutely! airSlate SignNow seamlessly integrates with various third-party applications, making it easy to incorporate form 14452 into your existing workflows. Whether you use CRM tools or cloud storage, you can enhance document management and signing efficiency.

-

How does airSlate SignNow ensure the security of form 14452?

Security is a priority for airSlate SignNow when handling form 14452. The platform employs advanced encryption, user authentication, and secure cloud storage to protect your documents, ensuring that your sensitive information remains confidential.

-

Can I track the status of my form 14452 with airSlate SignNow?

Yes, airSlate SignNow enables you to track the status of your form 14452 in real-time. You'll receive notifications when documents are viewed, signed, or require action, providing you with complete visibility throughout the signing process.

Get more for Form 14452

- Pan example of personal details filled section on psckgoke for an unemployed person form

- Longos online application form

- Spar application form pdf

- Airport jobs in cayman islands form

- Marble slab applicationpdffillercom form

- Application delaware river port authority drpa form

- Short form standard subcontract associated general contractors agc ca

- Bprs scale form

Find out other Form 14452

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document