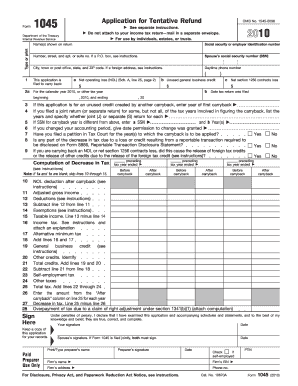

1045 Form

What is the 1045 Form

The 1045 form, officially known as the IRS Form 1045, is a tax document used by individuals and businesses in the United States to apply for a quick refund of overpaid taxes. This form is particularly relevant for those who have experienced a net operating loss (NOL) and wish to carry back the loss to prior tax years to receive a refund. By filing Form 1045, taxpayers can expedite the process of recovering funds that may have been overpaid in previous years, thereby improving their cash flow during financially challenging times.

How to use the 1045 Form

Using the 1045 form involves several key steps. First, individuals must determine their eligibility to file the form, which typically requires having a net operating loss for the current tax year. Once eligibility is confirmed, the taxpayer should gather necessary documentation, including prior year tax returns and any supporting financial statements. After completing the form, it should be submitted to the IRS along with any required attachments. It is important to keep copies of all submitted documents for personal records.

Steps to complete the 1045 Form

Completing the 1045 form requires careful attention to detail. Here are the steps to follow:

- Gather documentation: Collect all relevant tax documents, including previous tax returns and records of income and expenses.

- Determine NOL: Calculate your net operating loss for the current year to ensure you qualify for the refund.

- Fill out the form: Provide accurate information on the form, including your personal details, loss amounts, and any relevant calculations.

- Review for accuracy: Double-check all entries to avoid mistakes that could delay processing.

- Submit the form: Send the completed form to the IRS, ensuring it is submitted within the designated time frame for processing.

Legal use of the 1045 Form

The legal use of the 1045 form is governed by IRS regulations. To ensure compliance, taxpayers must accurately report their net operating losses and adhere to the guidelines set forth by the IRS. This includes understanding the time limits for filing the form and the specific circumstances under which it can be used. Failure to comply with these regulations may result in penalties or delays in receiving refunds. It is advisable to consult with a tax professional if there are any uncertainties regarding the legal aspects of filing Form 1045.

Filing Deadlines / Important Dates

Filing deadlines for the 1045 form are critical to ensure timely processing of refunds. Generally, the form must be filed within twelve months of the end of the tax year in which the net operating loss occurred. For example, if the loss occurred in the 2022 tax year, the form should be submitted by December 31, 2023. Additionally, it is important to stay informed about any changes to IRS deadlines, which may vary based on specific circumstances or legislative updates.

Required Documents

When completing the 1045 form, several documents are necessary to support your application. These typically include:

- Previous year tax returns to establish income and losses.

- Financial statements that detail the nature of the net operating loss.

- Any additional documentation that may be required by the IRS to substantiate claims made on the form.

Having these documents readily available can streamline the process and help ensure that the form is completed accurately.

Quick guide on how to complete 1045 form

Complete 1045 Form effortlessly on any device

Online document handling has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely maintain it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents swiftly without interruptions. Manage 1045 Form on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign 1045 Form with ease

- Find 1045 Form and then click Get Form to initiate the process.

- Utilize the tools available to complete your form.

- Emphasize signNow parts of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all details and then click the Done button to save your modifications.

- Select your preferred delivery method for your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in a few clicks from a device of your choice. Edit and electronically sign 1045 Form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1045 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 1045 and how is it used?

Form 1045 is a tax form used by individuals to apply for a quick refund of overpayments from their federal income tax. By filing form 1045, taxpayers can receive their refund more expediently, allowing them to quickly access their funds for immediate needs.

-

How can airSlate SignNow help with submitting form 1045?

With airSlate SignNow, you can easily create, edit, and eSign form 1045. Our platform simplifies the process, ensuring your form is filled accurately and submitted in a timely manner, signNowly reducing the risk of errors that can delay your refund.

-

Is there a cost associated with using airSlate SignNow for form 1045?

Yes, airSlate SignNow offers various pricing plans suitable for businesses, providing access to features that streamline the eSigning process for form 1045. This cost-effective solution empowers you to manage your documents efficiently without hidden fees.

-

Can I integrate airSlate SignNow with other applications for form 1045 processing?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage form 1045 and other documents within your existing workflows. This integration enhances productivity by providing an all-in-one solution that connects with your favorite tools.

-

What features does airSlate SignNow offer for handling form 1045?

airSlate SignNow offers features such as customizable templates, secure eSigning, and real-time tracking for form 1045. These features ensure that your documentation process is streamlined, secure, and efficient, making submissions hassle-free.

-

Is airSlate SignNow secure for submitting sensitive documents like form 1045?

Yes, airSlate SignNow prioritizes security with advanced encryption protocols for all documents, including form 1045. We take your privacy seriously, ensuring that your sensitive information is protected throughout the eSigning process.

-

What are the benefits of using airSlate SignNow for form 1045 over traditional methods?

Using airSlate SignNow for form 1045 expedites the signing and submission process compared to traditional methods. The digital format eliminates printing and mailing delays, allows for instant access, and helps you manage your documents anytime, anywhere.

Get more for 1045 Form

Find out other 1045 Form

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile