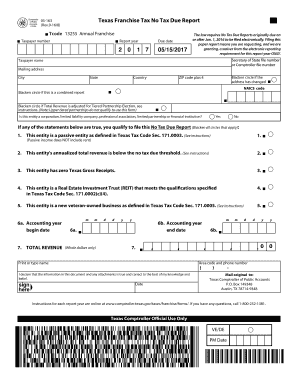

Texas Franchise Tax Form

What is the Texas Franchise Tax

The Texas Franchise Tax is a state tax imposed on businesses operating within Texas. It is primarily a privilege tax, meaning it is charged for the privilege of doing business in the state. The tax applies to various business entities, including corporations and limited liability companies (LLCs). The amount owed is calculated based on the entity's revenue, with different rates and thresholds depending on the type of business. Understanding the Texas Franchise Tax is essential for compliance and financial planning for businesses in the state.

Steps to complete the Texas Franchise Tax

Completing the Texas Franchise Tax involves several key steps to ensure compliance with state regulations. First, businesses must determine their eligibility and whether they meet the revenue thresholds that require them to file. Next, they should gather the necessary financial documents, including income statements and balance sheets. Once the required information is collected, businesses can calculate their tax liability based on the applicable rates. Finally, they can complete the Texas Franchise Tax report, which can be submitted online or via mail, depending on their preference.

Required Documents

To file the Texas Franchise Tax, businesses need to prepare specific documents that provide a clear picture of their financial status. Key documents include:

- Income statements for the reporting period

- Balance sheets that reflect the company's assets and liabilities

- Prior year tax returns for reference

- Any additional documentation that supports revenue calculations or deductions

Having these documents ready will facilitate a smoother filing process and help ensure accuracy in reporting.

Filing Deadlines / Important Dates

Staying informed about filing deadlines is crucial for businesses to avoid penalties. The Texas Franchise Tax report is typically due on May 15 of each year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Additionally, businesses should be aware of any extensions that may be available, as well as specific deadlines for estimated tax payments throughout the year.

Penalties for Non-Compliance

Failing to comply with the Texas Franchise Tax requirements can lead to significant penalties. Businesses that do not file their reports on time may incur late fees, which can accumulate over time. Additionally, failure to pay the owed tax can result in interest charges and potential legal action by the state. It is essential for businesses to understand these consequences and prioritize timely filing and payment to maintain good standing with the state.

Digital vs. Paper Version

Businesses have the option to file the Texas Franchise Tax report either digitally or via paper forms. Filing online is often more efficient, allowing for quicker processing and confirmation of submission. Digital filing also reduces the risk of errors that can occur with manual entry. However, some businesses may prefer the traditional paper method for record-keeping purposes. Understanding the pros and cons of each method can help businesses choose the best option for their needs.

Quick guide on how to complete texas franchise tax 395565170

Complete Texas Franchise Tax effortlessly on any device

Internet-based document management has become popular among companies and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Texas Franchise Tax on any device with airSlate SignNow Android or iOS applications and streamline any document-oriented task today.

How to modify and eSign Texas Franchise Tax with ease

- Locate Texas Franchise Tax and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, bothersome form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Adjust and eSign Texas Franchise Tax and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the texas franchise tax 395565170

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Texas franchise tax?

The Texas franchise tax is a business tax imposed on entities operating in Texas. It is calculated based on the company's revenue, and understanding how to navigate this tax is crucial for business compliance. Using tools like airSlate SignNow can simplify the document signing process when dealing with Texas franchise tax filings.

-

How can airSlate SignNow help with Texas franchise tax documents?

airSlate SignNow provides an efficient way to eSign all necessary documents related to the Texas franchise tax. Its user-friendly interface allows businesses to quicken the workflow and ensure that all signatures are captured securely. This efficiency helps you stay compliant with Texas franchise tax requirements without delay.

-

Is airSlate SignNow cost-effective for handling Texas franchise tax filings?

Yes, airSlate SignNow is a highly cost-effective solution for signing documents related to the Texas franchise tax. With flexible pricing plans, businesses can choose options that fit their budget and needs. This affordability, combined with essential features, makes it a popular choice among Texas businesses.

-

What features does airSlate SignNow offer for Texas franchise tax compliance?

airSlate SignNow includes features designed to streamline the Texas franchise tax compliance process. Key features such as document templates, in-app chat, and comprehensive audit trails allow users to manage and track their submissions efficiently. These tools help ensure all necessary documentation is in order and compliant with Texas franchise tax laws.

-

Can I integrate airSlate SignNow with other tools for managing Texas franchise tax?

Absolutely! airSlate SignNow provides various integrations with popular accounting and business management tools that are vital for managing Texas franchise tax. By connecting your existing software with airSlate SignNow, you can enhance productivity and streamline your tax processes effortlessly.

-

What are the benefits of using airSlate SignNow for Texas franchise tax-related paperwork?

Using airSlate SignNow for Texas franchise tax paperwork offers numerous benefits, such as increased efficiency, enhanced security, and reduced paper usage. It simplifies the eSignature process, allowing for faster approvals and compliance. These advantages ultimately save time and reduce costs for Texas businesses.

-

How secure is airSlate SignNow for handling Texas franchise tax documents?

airSlate SignNow is built with top-notch security measures to protect your sensitive documents, including those related to the Texas franchise tax. With strong encryption protocols and secure cloud storage, businesses can trust that their important tax documents are safe from unauthorized access. This focus on security ensures compliance and peace of mind.

Get more for Texas Franchise Tax

- Sample gis map request forms

- Nhisp form

- General information for buyers and sellers of residential real property

- Wage payment election and consent form

- Nbcrfli leave payout form

- Mv2941 form

- Missoula property managment form

- Bcia 8020 request for applicant name check by the federal bureau of investigation fbi form

Find out other Texas Franchise Tax

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation