Form 1042 S Foreign Person's U S Source Income Subject to Withholding 2025-2026

What is the Form 1042-S?

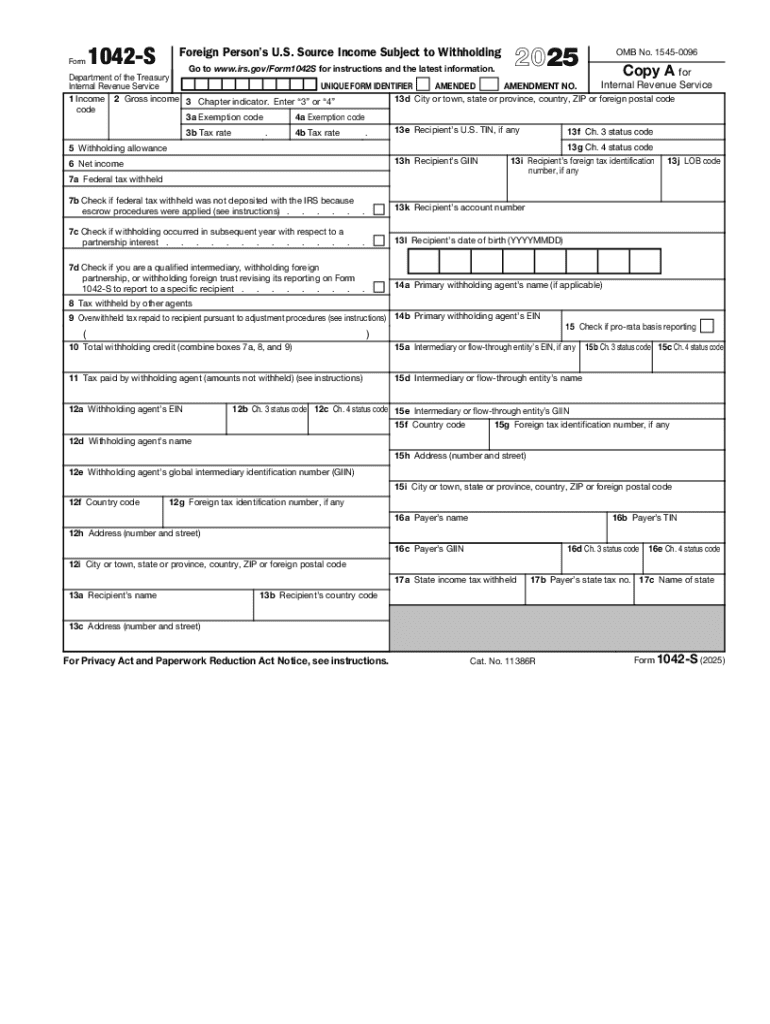

The Form 1042-S, officially known as the Foreign Person's U.S. Source Income Subject to Withholding, is a tax document used by withholding agents to report income paid to foreign persons. This form is essential for reporting various types of income, including interest, dividends, rents, and royalties, that are subject to U.S. tax withholding. The IRS requires this form to ensure that foreign entities comply with U.S. tax obligations on income derived from U.S. sources.

Key Elements of the Form 1042-S

The Form 1042-S includes several critical components that must be accurately completed for proper reporting. Key elements include:

- Recipient Information: Name, address, and taxpayer identification number (TIN) of the foreign person receiving the income.

- Income Type: Specific type of income being reported, such as interest or dividends.

- Withholding Tax Rate: The applicable withholding tax rate based on the income type and any tax treaties.

- Gross Income Amount: Total amount of income paid to the foreign recipient.

- Withholding Amount: Total amount of tax withheld from the income.

Steps to Complete the Form 1042-S

Completing the Form 1042-S involves several steps to ensure accuracy and compliance with IRS regulations. Here are the steps to follow:

- Gather Information: Collect all necessary information about the foreign recipient and the income being reported.

- Fill Out the Form: Complete the form with the required details, ensuring all information is accurate.

- Calculate Withholding: Determine the appropriate withholding tax rate and calculate the total amount withheld.

- Review for Accuracy: Double-check all entries for correctness before submission.

- File the Form: Submit the completed Form 1042-S to the IRS and provide copies to the foreign recipient.

IRS Guidelines for Form 1042-S

The IRS provides specific guidelines for completing and filing the Form 1042-S. These guidelines include instructions on eligibility, deadlines for submission, and the required documentation. It is crucial for withholding agents to familiarize themselves with these guidelines to avoid penalties and ensure compliance. The IRS also specifies the format for electronic filing and the conditions under which paper forms may be submitted.

Filing Deadlines for Form 1042-S

Filing deadlines for the Form 1042-S are critical to avoid penalties. Generally, the form must be filed with the IRS by March 15 of the year following the payment of income. Additionally, copies of the form must be provided to the foreign recipients by the same date. It is important to keep track of these deadlines to ensure timely compliance with IRS requirements.

Penalties for Non-Compliance

Failure to file the Form 1042-S accurately and on time can result in significant penalties. The IRS imposes fines for late filings, incorrect information, and failure to provide copies to recipients. Understanding these penalties is essential for withholding agents to mitigate risks and ensure compliance with U.S. tax laws.

Handy tips for filling out Form 1042 S Foreign Person's U S Source Income Subject To Withholding online

Quick steps to complete and e-sign Form 1042 S Foreign Person's U S Source Income Subject To Withholding online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Get access to a HIPAA and GDPR compliant solution for optimum simpleness. Use signNow to electronically sign and send out Form 1042 S Foreign Person's U S Source Income Subject To Withholding for e-signing.

Create this form in 5 minutes or less

Find and fill out the correct form 1042 s foreign persons u s source income subject to withholding

Create this form in 5 minutes!

How to create an eSignature for the form 1042 s foreign persons u s source income subject to withholding

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1042 S form and who needs it?

The 1042 S form is used to report income paid to non-resident aliens and foreign entities. If you are a business that pays U.S. source income to foreign individuals or entities, you will need to file this form to comply with IRS regulations.

-

How can airSlate SignNow help with the 1042 S form?

airSlate SignNow provides an efficient platform for electronically signing and sending the 1042 S form. Our solution simplifies the process, ensuring that you can manage your documents securely and in compliance with tax regulations.

-

Is there a cost associated with using airSlate SignNow for the 1042 S form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solution allows you to manage the 1042 S form and other documents without breaking the bank.

-

What features does airSlate SignNow offer for managing the 1042 S form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking. These tools make it easy to prepare, send, and manage your 1042 S form efficiently.

-

Can I integrate airSlate SignNow with other software for the 1042 S form?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to streamline your workflow when handling the 1042 S form. This integration helps you maintain consistency and efficiency across your business processes.

-

What are the benefits of using airSlate SignNow for the 1042 S form?

Using airSlate SignNow for the 1042 S form offers numerous benefits, including enhanced security, reduced processing time, and improved compliance. Our platform ensures that your documents are handled with care and efficiency.

-

How secure is airSlate SignNow when handling the 1042 S form?

airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect your documents, including the 1042 S form. You can trust that your sensitive information is safe with us.

Get more for Form 1042 S Foreign Person's U S Source Income Subject To Withholding

- Yookoso workbook answers form

- Presbyterian mileage reimbursement form

- Functional pain scale pdf form

- Australian standardised spelling age test answer sheet form

- Tuition remission form for undergraduategraduate courses hr lr

- Career coach contract template form

- Caregiver caregiver contract template form

Find out other Form 1042 S Foreign Person's U S Source Income Subject To Withholding

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure