Pit 1 Fillable Form

What is the Pit 1 Fillable Form

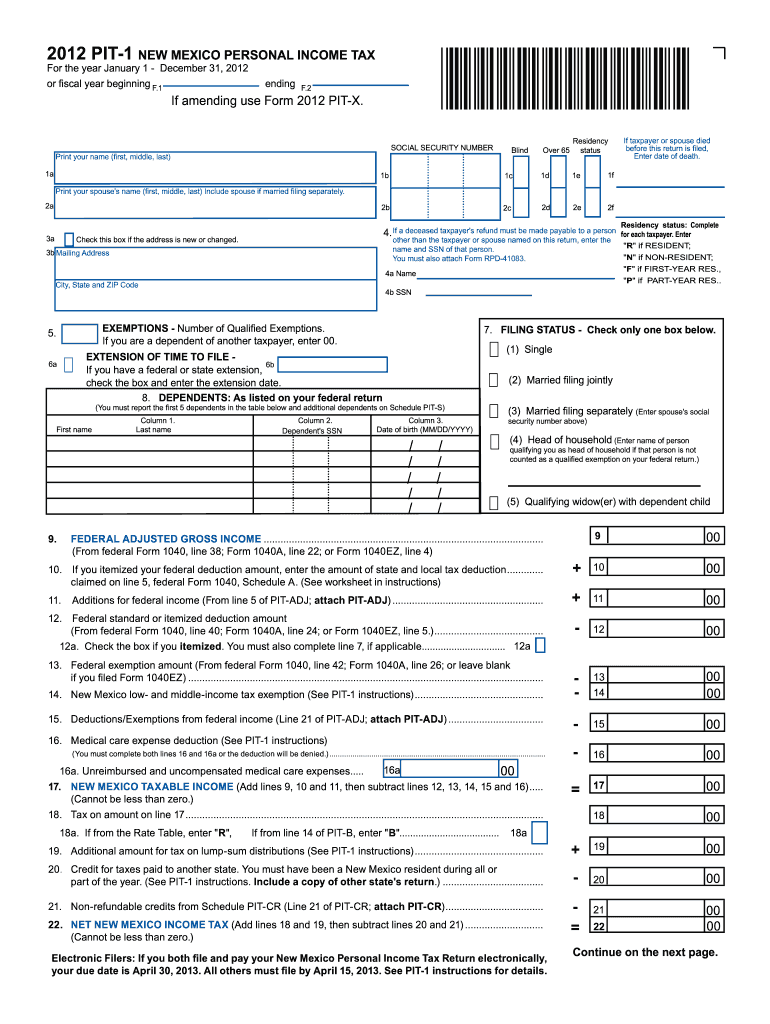

The Pit 1 form is a crucial document used in New Mexico for reporting personal income tax. This form is essential for individuals who need to report their income and calculate their tax obligations. The Pit 1 form allows taxpayers to provide detailed information about their income, deductions, and credits, ensuring accurate tax calculations. It is specifically designed for residents of New Mexico and aligns with state tax regulations.

How to use the Pit 1 Fillable Form

Using the Pit 1 fillable form is straightforward. Taxpayers can access the form online and fill it out digitally. This method allows for easy corrections and adjustments before submission. Once completed, the form can be printed or submitted electronically, depending on the submission method chosen. It is essential to ensure that all required fields are filled accurately to avoid delays in processing.

Steps to complete the Pit 1 Fillable Form

Completing the Pit 1 fillable form involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Access the Pit 1 form through a reliable source, ensuring it is the correct version for the tax year.

- Fill in personal information, including name, address, and Social Security number.

- Report all sources of income accurately, including wages, self-employment income, and any other taxable income.

- Calculate deductions and credits applicable to your situation, ensuring to follow New Mexico tax guidelines.

- Review the completed form for accuracy and completeness.

- Submit the form either electronically or by mail, following the instructions provided.

Legal use of the Pit 1 Fillable Form

The Pit 1 fillable form is legally recognized for tax reporting in New Mexico. To ensure its validity, taxpayers must adhere to state regulations regarding eSignature and document submission. The form must be signed and dated appropriately to confirm the accuracy of the information provided. Compliance with these legal requirements helps avoid issues with tax authorities and ensures that the form is processed efficiently.

Filing Deadlines / Important Dates

Filing deadlines for the Pit 1 form are critical for taxpayers to observe. Typically, the deadline for submitting the form is April 15 of the following year after the tax year ends. However, it is advisable to check for any changes or extensions that may apply. Filing on time helps avoid penalties and interest on unpaid taxes, ensuring compliance with New Mexico tax laws.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Pit 1 form. The form can be submitted electronically through the New Mexico Taxation and Revenue Department's website, which is often the fastest method. Alternatively, taxpayers may choose to print the completed form and mail it to the appropriate address. In-person submission is also an option at designated tax offices, providing assistance if needed.

Quick guide on how to complete pit 1 fillable form

Effortlessly prepare Pit 1 Fillable Form on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly and without delays. Manage Pit 1 Fillable Form on any device using the airSlate SignNow apps for Android or iOS, and enhance any document-centered process today.

How to edit and electronically sign Pit 1 Fillable Form with ease

- Locate Pit 1 Fillable Form and click on Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Highlight relevant sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which only takes a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Pit 1 Fillable Form and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

I'm trying to fill out a free fillable tax form. It won't let me click "done with this form" or "efile" which?

From https://www.irs.gov/pub/irs-utl/... (emphasis mine):DONE WITH THIS FORM — Select this button to save and close the form you are currently viewing and return to your 1040 form. This button is disabled when you are in your 1040 formSo, it appears, and without them mentioning it while you're working on it, that button is for all forms except 1040. Thank you to the other response to this question. I would never have thought of just clicking the Step 2 tab.

-

How do I make a PDF a fillable form?

1. Open it with Foxit PhantomPDF and choose Form > Form Recognition > Run Form Field Recognition . All fillable fields in the document will be recognized and highlighted.2. Add form fields from Form > Form Fields > click a type of form field button and the cursor changes to crosshair . And the Designer Assistant is selected automatically.3. All the corresponding type of form fields will be automatically named with the text near the form fields (Take the text fields for an example as below).4. Click the place you want to add the form field. To edit the form field further, please refer to the properties of different buttons from “Buttons”.

-

Is there a service that will allow me to create a fillable form on a webpage, and then email a PDF copy of each form filled out?

You can use Fill which is has a free forever plan.You can use Fill to turn your PDF document into an online document which can be completed, signed and saved as a PDF, online.You will end up with a online fillable PDF like this:w9 || FillWhich can be embedded in your website should you wish.InstructionsStep 1: Open an account at Fill and clickStep 2: Check that all the form fields are mapped correctly, if not drag on the text fields.Step 3: Save it as a templateStep 4: Goto your templates and find the correct form. Then click on the embed settings to grab your form URL.

-

How do I transfer data from Google Sheets cells to a PDF fillable form?

I refer you a amazing pdf editor, her name is Puspita, She work in fiverr, She is just amazing, Several time I am use her services. You can contact with her.puspitasaha : I will create fillable pdf form or edit pdf file for $5 on www.fiverr.com

-

How do I fill out a fillable PDF on an iPad?

there is an app for that !signNow Fill & Sign on the App Store

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How do I create a fillable HTML form online that can be downloaded as a PDF? I have made a framework for problem solving and would like to give people access to an online unfilled form that can be filled out and downloaded filled out.

Create PDF Form that will be used for download and convert it to HTML Form for viewing on your website.However there’s a lot of PDF to HTML converters not many can properly convert PDF Form including form fields. If you plan to use some calculations or validations it’s even harder to find one. Try PDFix Form Converter which works fine to me.

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

Create this form in 5 minutes!

How to create an eSignature for the pit 1 fillable form

How to generate an electronic signature for the Pit 1 Fillable Form online

How to create an electronic signature for the Pit 1 Fillable Form in Google Chrome

How to make an eSignature for putting it on the Pit 1 Fillable Form in Gmail

How to make an electronic signature for the Pit 1 Fillable Form straight from your smart phone

How to make an eSignature for the Pit 1 Fillable Form on iOS

How to make an electronic signature for the Pit 1 Fillable Form on Android

People also ask

-

What are nm pit 1 tax rate tables 2020 used for?

The nm pit 1 tax rate tables 2020 provide a detailed breakdown of tax rates applicable in New Mexico for personal income taxation. They help businesses and individuals easily determine their tax obligations for the year 2020, ensuring compliance with state tax laws.

-

How can airSlate SignNow assist with nm pit 1 tax rate tables 2020?

airSlate SignNow allows users to create, send, and eSign tax documents associated with nm pit 1 tax rate tables 2020 quickly and securely. This streamlines the tax preparation process, helping both individuals and businesses manage their tax-related documents more efficiently.

-

Are the nm pit 1 tax rate tables 2020 updated regularly?

Yes, the nm pit 1 tax rate tables 2020 are updated based on changes in tax legislation and policy. It's important to refer to the latest tables annually to ensure accurate tax calculations and compliance.

-

What features does airSlate SignNow offer for handling tax documents?

airSlate SignNow offers features like document templates, eSignature capabilities, and secure storage, making it easy to manage tax documents, including forms related to nm pit 1 tax rate tables 2020. This functionality enhances the overall efficiency of the tax filing process.

-

Is airSlate SignNow cost-effective for small businesses managing tax documents?

Absolutely! airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. By using our service, small businesses can save on printing and mailing costs associated with tax documents, such as those involving nm pit 1 tax rate tables 2020.

-

Can I integrate airSlate SignNow with other accounting software for tax management?

Yes, airSlate SignNow offers integrations with popular accounting software, allowing for a seamless workflow when managing tax documents. This ensures you can easily incorporate nm pit 1 tax rate tables 2020 into your accounting processes.

-

How does airSlate SignNow ensure the security of tax documents?

airSlate SignNow adheres to strict security protocols to protect sensitive tax documents, including those related to nm pit 1 tax rate tables 2020. Our platform utilizes encrypted connections and secure data storage to maintain confidentiality.

Get more for Pit 1 Fillable Form

Find out other Pit 1 Fillable Form

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement