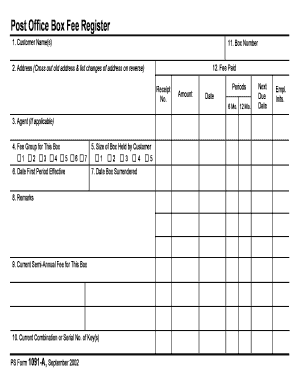

Ps Form 1091

What is the Ps Form 1091

The Ps Form 1091 is a tax-related document used primarily by individuals and businesses in the United States. It serves as a declaration for specific tax situations, allowing taxpayers to report income, deductions, and credits accurately. This form is essential for ensuring compliance with federal tax regulations and is often required during the tax filing process. Understanding the purpose and requirements of the 1091 form is crucial for maintaining proper tax records and avoiding potential penalties.

How to use the Ps Form 1091

Using the Ps Form 1091 involves several steps that ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and deduction records. Next, carefully fill out the form, ensuring that all information is accurate and complete. It is important to follow the specific instructions provided with the form to avoid common mistakes. Once completed, the form can be submitted electronically or via mail, depending on the filing preferences and requirements of the IRS.

Steps to complete the Ps Form 1091

Completing the Ps Form 1091 involves a systematic approach to ensure accuracy. Begin by downloading the latest version of the form from a reliable source. Next, fill in your personal information, including your name, address, and Social Security number. Proceed to report your income, detailing all sources and amounts. After that, include any applicable deductions and credits. Review the completed form for any errors or omissions before signing and dating it. Finally, submit the form according to the guidelines specified by the IRS.

Legal use of the Ps Form 1091

The legal use of the Ps Form 1091 is governed by federal tax laws, which dictate how the form should be filled out and submitted. To be considered valid, the form must be completed accurately and submitted by the appropriate deadlines. Additionally, electronic signatures are legally accepted, provided that the eSignature complies with the Electronic Signatures in Global and National Commerce (ESIGN) Act. Understanding these legal requirements is essential for ensuring that the form is recognized by the IRS and other relevant authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Ps Form 1091 are critical to avoid penalties and interest charges. Generally, the form must be submitted by April fifteenth of the tax year, unless an extension has been granted. It is important to stay informed about any changes to deadlines, as they can vary based on specific circumstances, such as natural disasters or legislative changes. Marking these dates on a calendar can help ensure timely submission and compliance with tax obligations.

Required Documents

To complete the Ps Form 1091, several documents are typically required. These may include income statements, such as W-2s or 1099s, receipts for deductible expenses, and any relevant tax credits documentation. Having these documents readily available streamlines the process and helps ensure that all information reported on the form is accurate. It is advisable to keep copies of all submitted documents for personal records and future reference.

Who Issues the Form

The Ps Form 1091 is issued by the Internal Revenue Service (IRS), which is responsible for overseeing tax collection and enforcement in the United States. The IRS provides the form along with instructions on how to complete it accurately. It is essential for taxpayers to use the official version of the form to ensure compliance with federal tax regulations and to avoid any issues with their tax filings.

Quick guide on how to complete ps form 1091

Complete Ps Form 1091 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the resources you require to create, modify, and eSign your documents quickly without delays. Manage Ps Form 1091 on any platform with the airSlate SignNow Android or iOS applications and simplify any document-centric process today.

The most efficient way to modify and eSign Ps Form 1091 with ease

- Locate Ps Form 1091 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, burdensome form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your requirements in document management in just a few clicks from any device you prefer. Edit and eSign Ps Form 1091 and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ps form 1091

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 1091 form and who needs it?

The 1091 form is a document used to report income from certain sources, primarily related to business and investments. Businesses and individuals who have specific financial transactions throughout the tax year may need to complete this form. It's essential to understand its requirements to ensure compliance with IRS regulations.

-

How can airSlate SignNow help me with the 1091 form?

airSlate SignNow streamlines the process of sending and eSigning the 1091 form, making it quicker and more efficient. Our platform allows you to easily upload the form, send it for signatures, and track its progress in real-time. This ensures that your documentation is handled securely and complies with necessary regulations.

-

What features does airSlate SignNow offer for eSigning documents like the 1091 form?

airSlate SignNow provides various features such as customizable templates, secure document storage, and automatic reminders for pending signatures. These tools enhance the efficiency of managing documents like the 1091 form, allowing for seamless collaboration and reducing the risk of delays or errors.

-

Is there a cost to use airSlate SignNow for signing the 1091 form?

Yes, airSlate SignNow offers different pricing plans depending on your needs, starting from a cost-effective option for small businesses. Each plan includes features designed to facilitate document management, including eSigning the 1091 form. It's advisable to review our pricing page to find the best fit for your requirements.

-

Can I integrate airSlate SignNow with other software tools for handling the 1091 form?

Absolutely! airSlate SignNow integrates seamlessly with numerous third-party tools such as CRM systems, cloud storage services, and productivity applications. This enables you to efficiently manage the 1091 form and other documents within the workflows and systems you already use.

-

What are the benefits of using airSlate SignNow for the 1091 form eSigning?

Using airSlate SignNow for the 1091 form eSigning offers numerous benefits, including enhanced security, ease of use, and quick turnaround times. Our platform ensures that your documents are signed legally and securely, saving you time and resources on paper-based processes. This efficiency allows you to focus more on your business operations.

-

How secure is airSlate SignNow when handling sensitive documents like the 1091 form?

AirSlate SignNow employs top-tier security measures, including encryption and compliance with data protection regulations, to safeguard documents like the 1091 form. We prioritize the confidentiality and integrity of your information, providing a secure environment for eSigning and document management.

Get more for Ps Form 1091

- Services agreement form

- License merchandising form

- Advertising agreement web advertising agreement between mpath interactive inc and euniverse regarding sale of advertising on form

- Settlement agreement form sample

- Stock tender form

- Stock transfer agreement form

- Royalty agreement form

- Sample corporate agreement 497336794 form

Find out other Ps Form 1091

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later